Can NRI send money from India to USA

It can be done through your banking channel only either using online services or via demand drafts or cheques. You cannot use the services of money transfer agents. NRIs will not have a resident Indian bank account.

How much can you transfer internationally

While the IRS does not place any limits on the amount of money you can send or receive internationally to and from the US, they do have reporting requirements. For payments of USD 10,000 or more, or multiple smaller payments in a short space of time that add to USD 10,000, these must be reported to the IRS.

How NRI can transfer money from India

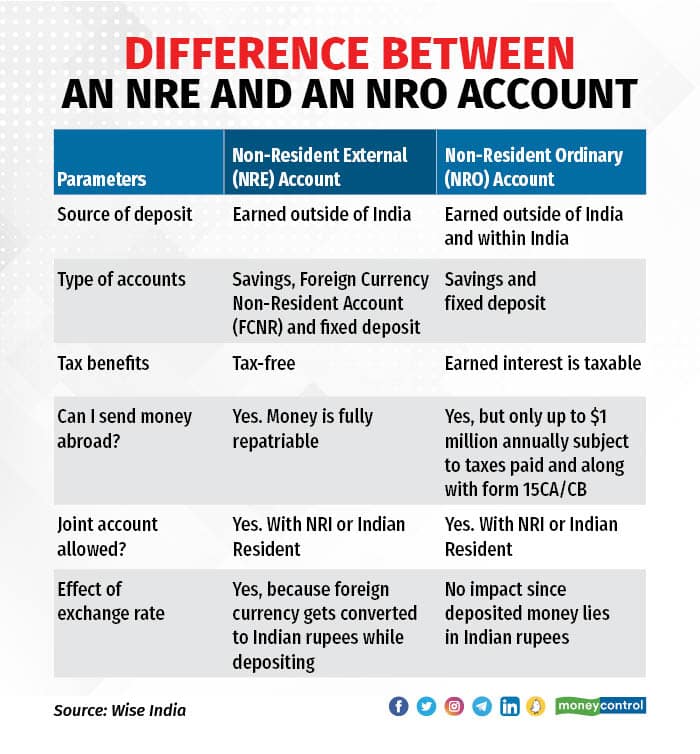

There are several ways in which NRIs can transfer funds to or from India:Wire Transfer. NRIs can use wire transfer to transfer funds between their bank accounts in India and abroad.Demand Draft.Online Money Transfer Services.NRE and NRO Accounts.

How much money can be remitted out of India

Liberalised Remittance Scheme (LRS) was brought into effect by the Reserve Bank of India in 2004. According to it, residents of India can remit a maximum of $250,000 within a given financial year to individuals living overseas. This includes both capital and current account transactions.

How many dollars can NRI carry from India

Export: Currency Regulations in India

There is no limit to carry foreign exchange to the US. However, amounts exceeding USD 5,000 or equivalent and foreign exchange in the form of currency notes, bank notes or traveller's cheques in exceeding USD 10,000 or its equivalent must be declared to the customs.

How much tax I have to pay if I transfer money from India to USA

No, the money transferred to US from India is not taxable. But, if it exceeds US $100,000 for any current year, you must report it to the IRS by filing Form 3520. This is just an informational form with no taxes payable.

What happens if you transfer more than $10000

Financial institutions must file a Currency Transaction Report (CTR) for any transaction over $10,000. The CTR includes information about the person initiating the transaction, the recipient, and the nature of the transaction.

How can I transfer a large amount of money internationally

Both Western Union and PayPal are popular choices for sending large sums of money overseas.

How much money can NRI remit out of India

Repatriation from an NRO account is possible after taxes have been deducted from the income. The current income in NRO accounts is from earnings in India and is liable to be taxed. There is a repatriation limit of USD 1 million in a financial year on income from the sale of any moveable or immovable assets in India.

How much can NRI remit out of India

However, a non-resident is allowed to remit upto 10 lakh USD every year from his NRO account every year. So you can remit back upto this limit every year in case the aggregate value of your investments exceeds 10 lakh USD.

How much money can I transfer without being flagged India

The income tax department will be looking at high-value transactions, i.e., transactions above Rs 2.5 lakh by an individual, and may investigate these. The taxmen or bank officials may question anyone receiving high-value funds in his account, even if it is through an electronic transaction.

How many dollars can I carry from India to Vietnam

If you bring over $5,000 US Dollars, other foreign currencies of the same value (or 15,000,000 Vietnamese Dong, you're going to have to declare it at customs when you get here.

Do I have to pay tax on money transferred from India to overseas

Taxation of India's Outbound Remittances: LRS Scheme and Increased Tax Rate from October 1. Effective from October 1, 2023, the tax rate on outbound remittances from India will rise from five percent to 20 percent. This increase will impact funds sent abroad for purposes such as vacations, investments, and gifts.

Do I need to pay tax if I get money from India

The money sent from India to the US is not taxable. However, you must declare it to the IRS by submitting Form 3520 if it exceeds US $100,000 for any given year. There are no taxes due on this form; it is merely informational. However, gift taxes in the US can be imposed if the funds are given as a gift.

Can I transfer $100000 from one bank to another

Wire transfers also have limits, but in general they are higher than ACH transfers. As with an ACH transfer, many major banks impose a per-day or per-transaction wire transfer limit. For example, Chase Bank sets the limit at $100,000 for individuals, but offers higher limits to businesses on request.

What happens if we transfer more than 50000

The required details are account number, account name, IFSC Code, branch name, bank name, and account type of both persons. If the transaction exceeds Rs. 50,000, the remitter will have to provide his/her PAN card at the time of commencing the transaction.

What is the maximum amount you can transfer from bank to bank

Bank transfer limits

| Type of transfer | Transfer limit |

|---|---|

| ACH Same Day transfer | Up to $1,000,000 |

| Bank of America Corp. | $3,500 per day or $10,000 per week |

| JPMorgan Chase & Co. | Up to $25,000 per day |

| Citigroup Inc. Standard ACH | Up to $10,000 per day |

What is the limit for outward remittance from NRE account

There is no limit to repatriate funds from NRE accounts as it is fully and freely repatriable from India. NRE Deposits are tax-free in India as NRE Accounts are meant to maintain the income earned outside India.

How much money can you transfer without paying taxes in India

An amount over Rs 50,000 per year is subject to taxation in the hands of the receiver.

How much money NRI can send to India without tax

As an NRI, there will be no tax applicable on your remittance since the remittance is not being made under LRS. How is tax cut currently on remittances and since when did it apply From October 1, 2020, remittances of up to Rs700,000 (Dh33,103) in a financial year are free from tax liability.

What happens if you transfer $10000

Financial institutions must file a Currency Transaction Report (CTR) for any transaction over $10,000. The CTR includes information about the person initiating the transaction, the recipient, and the nature of the transaction.

How much money can you bring outside of Vietnam

US$ 5,000

There are no restrictions on the amount of currency, gold, precious metals and stones; however, you have to declare on the customs forms provided that your luggage includes: Foreign currency: in excess of US$ 5,000. Vietnam Dong: in excess of VND15. 000.000.

Can I carry 10000 usd from India

How much forex can you carry when going abroad While going abroad, Indian residents can carry an unlimited amount of foreign currency subject to filing of declaration form in case of condition of $5000 or $10000 prescribed and also it has to be purchased/issued by RBI approved foreign exchange dealers as per norms.

Is remittance received in India is taxable for NRI

If an NRI receives income in India, such income is taxable in India,i.e. India as a source state has the right to tax such income. However, the country where such NRI is a resident will also have a right to tax such income as it is the residence state.

How much money can you repatriate from India

There are no limitations on repatriating the amount of money if the seller inherits the property from their parents. However, the seller is subject to a limit of USD 1 million per year on the repatriation of money.