Is it better to use the credit card exchange rate

Credit cards

Credit card issuers typically charge fees for international transactions and you may get the best exchange rate and fees lower than those associated with exchanging cash. However, you should not use your credit card to withdraw money from an ATM, because the fees and interest charges are usually very high.

What gives you the best exchange rate

Best: Use a debit card at an ATM

Your best chance to get money at a great exchange rate, with no extra fees, is to draw cash from your account through an ATM operated by your own bank or its partners. For example, Citibank allows customers fee-free use of its ATMs in 20 countries.

Is it better to use credit card or cash overseas

Credit cards typically provide better exchange rates than what you'll get from ATM machines and currency stands. Depending on your card issuer, your purchases might automatically qualify for insurance. This coverage doesn't simply apply to consumer goods — it also covers travel delays and lost luggage.

What is exchange rate when paying with credit card

A foreign transaction (FX) fee is a surcharge on your credit card bill that appears when you make a purchase that either passes through a foreign bank or is in a currency other than the U.S. dollar (USD). This fee is charged by many credit card issuers, typically ranging from 1% to 3% of the transaction.

Do you get a better exchange rate from ATM

It depends on your destination, their policies, and how commonly accepted your home currency is in that country. It depends on your bank, its charges, its exchange rates and its compatibility with financial institutions in your destination. It depends on the availability of these options in your destination.

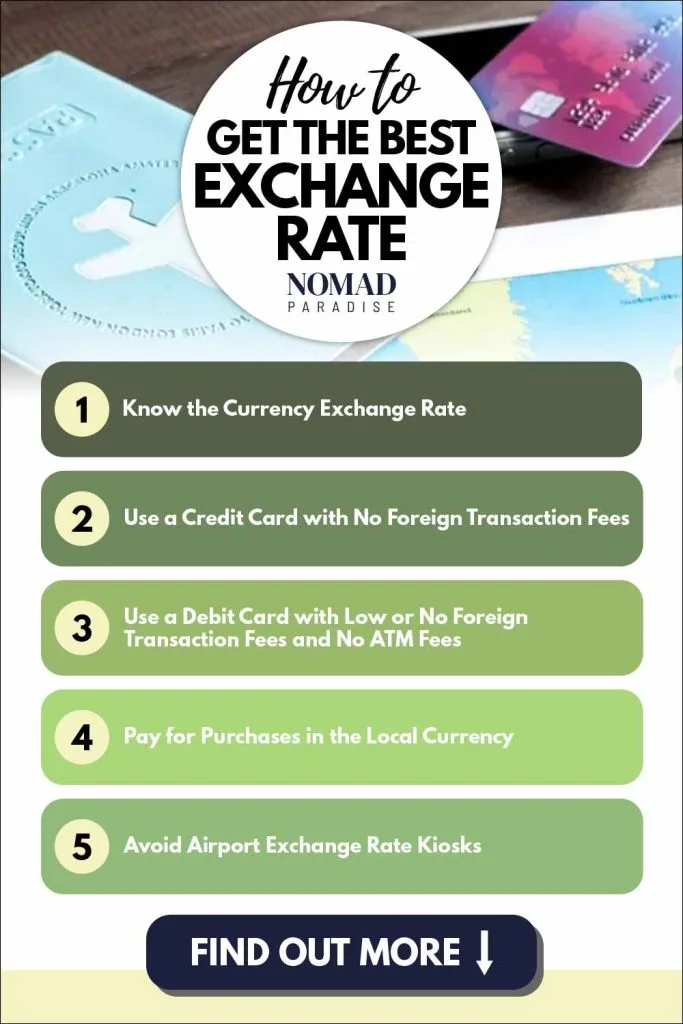

How do you avoid exchange rate fees

Many international travelers encounter foreign transaction fees while making purchases or withdrawing cash from an ATM in a foreign country. The easiest way to avoid a foreign transaction fee is to use a debit or credit card that waives foreign transaction fees while traveling abroad.

How do I get the best exchange rate abroad

Taking some currency as cash when you travel abroad can be a wise move. You can search for the best exchange rates in advance before the trip. Comparing online is usually the fastest way and you'll see competitive rates – often much cheaper than at the airport.

Who gives best rate for euros

Travel FX, an FX specialist, usually provides their most competitive currency exchange rates. A multiple award-winning company, free delivery (over £700.00), no commission, pay by Debit Card or Bank Transfer and typically offering the best rates here.

Why credit cards are better than cash

Credit Cards:

Enhanced security: Credit cards can be easily canceled or blocked if lost or stolen. Rewards and incentives: Credit cards often offer rewards such as cash back or points. Convenience for large purchases: Credit cards allow you to make large purchases without the need for physical cash.

Why is paying credit card better than cash

Convenience. Credit cards are often more convenient and secure than carrying cash. As long as you can pay your bill in full each month, using a credit card is typically more advantageous than using cash for in-person purchases. You need to use a credit card for online transactions as you can't pay in cash.

Is credit card exchange rate better than PayPal

No, as a rule of thumb, PayPal's exchange rate is usually worse than the bank's. Of course, this can differ from bank to bank, and sometime the bank can offer the worse rate. However, according to our analyses, PayPal is usually the more expensive option.

How can I avoid exchange rate fees

Exchange cash before leaving the United States

You can avoid all transaction fees by paying for your purchases in cash while you're abroad. Banks and currency exchange stores will exchange U.S. dollars for most major currencies, and you can do this before you leave.

Do banks have the best exchange rate

Exchanging Currency at Home and Overseas

Local banks and credit unions usually offer the best rates. Major banks, such as Chase or Bank of America, often offer the added benefit of having ATMs overseas.

Do you get a better exchange rate the more you exchange

5. Negotiate discount rates. Exchange rates are not set in stone and it's possible to negotiate a discount with specialist bureaus, especially if you are exchanging a large sum of cash. As a guide, you can often get an extra 0.5% on the advertised rate if you have a large amount to exchange (it makes a difference!).

Do you get charged for using credit card abroad

You may be charged for using your debit or credit card abroad to buy something or when you withdraw cash in a foreign currency. What you'll pay depends on the transaction you make and the card you use. You can also compare EEA currency conversion charges while travelling.

What is the Amex exchange rate

American Express charges a currency conversion fee of 2.99% of the converted value of the transaction for each foreign currency purchase you make.

Should I get euros or use debit card

If you've got a top overseas card, ALWAYS choose the local currency, as your card does the exchange and it's unbeatable. If you're using a bog-standard credit or debit card, it's touch and go. Sometimes the card machine will show you the 'non-sterling cash fee'.

What country has the strongest exchange rate

1. Kuwaiti dinar (KWD) The Kuwaiti dinar is the strongest currency in the world with 1 Kuwaiti dinar buying 3.26 US dollars (or, put another way, US$1 equals 0.31 Kuwaiti dinars). Kuwait is located between Saudi Arabia and Iraq, earning much of its wealth from being a leading global exporter of oil.

Is it best to pay in euros on card

Research shows that in most cases you can save by opting to spend in the local currency. For example, that would mean choosing euros in Spain or dollars in the US. When you choose to pay in the currency of the region or country you're visiting, Visa or Mastercard will set the exchange rate.

What is the cheapest way to pay in Euro

There are five main forms of payment to choose from:Travel credit cards – near-perfect exchange rates and purchase protection.Travel debit cards – near-perfect exchange rates and no 'hard' credit check.Prepaid travel cards – lock in a rate before you go.Cash – good as a backup where card is not accepted.

What is the biggest advantage of a credit card

Building credit, earning cash back and benefiting from fraud protection are just a few of the many advantages of using credit cards.

What is a disadvantage to using a credit card instead of cash

ConsInterest charges. Perhaps the most obvious drawback of using a credit card is paying interest.Temptation to overspend. Credit cards make it easy to spend money — maybe too easy for some people.Late fees.Potential for credit damage.

What are the pros and cons of cash vs credit cards

Credit cards offer conveniences that cash just can't, such as making purchases online and booking flights, hotels and rental cars. Your cash savings may not cover certain expenses. You may not have enough cash to cover unexpected costs. Life is unpredictable, and so are certain expenses.

How to avoid credit card currency conversion fees

1. Use a Credit Card With No Foreign Transaction Fee. Before you depart, check your credit and debit card agreements to see if they include such fees. If they do, then apply for a credit card with no foreign transaction fee, as well as for a debit card that does not charge extra for ATM withdrawals in other countries.

Why use PayPal and not a credit card

The payment platform offers security measures to help protect your data from merchants and scammers. Plus, you'll have access to purchase protection through PayPal for eligible stolen or damaged items — a feature that many, but not all, credit cards offer.