Which income sources are tax free in India

Top 11 Tax Free Income Sources in India in 2023Agricultural Income.Gifts Received.Money received from Insurance.Gratuity.Receipts from Hindu Undivided Family (HUFs)Receipts from a Partnership Firm or Limited Liability Partnership (LLP) as Profit Share.Income from Provident Funds.Income from Pension.

What is the tax free limit in India

The Budget 2023 has hiked the basic exemption limit to Rs 3 lakh from Rs 2.5 lakh currently. Thus, an individual's income becomes taxable if it exceeds Rs 3 lakh in a financial year.

What is the tax rate for 24 lakhs salary in India

What are the income tax rates

| Tax Slabs | Tax Rates |

|---|---|

| Income up to Rs.3 lakhs | NIL |

| Income between Rs.3 lakhs and Rs.5 lakhs | 10% of amount exceeding Rs.3 lakhs |

| Income between Rs.5 lakhs to Rs.10 lakhs | 20% of amount exceeding Rs.5 lakhs |

| Income above Rs.10 lakhs | 30% of amount exceeding Rs.10 lakhs |

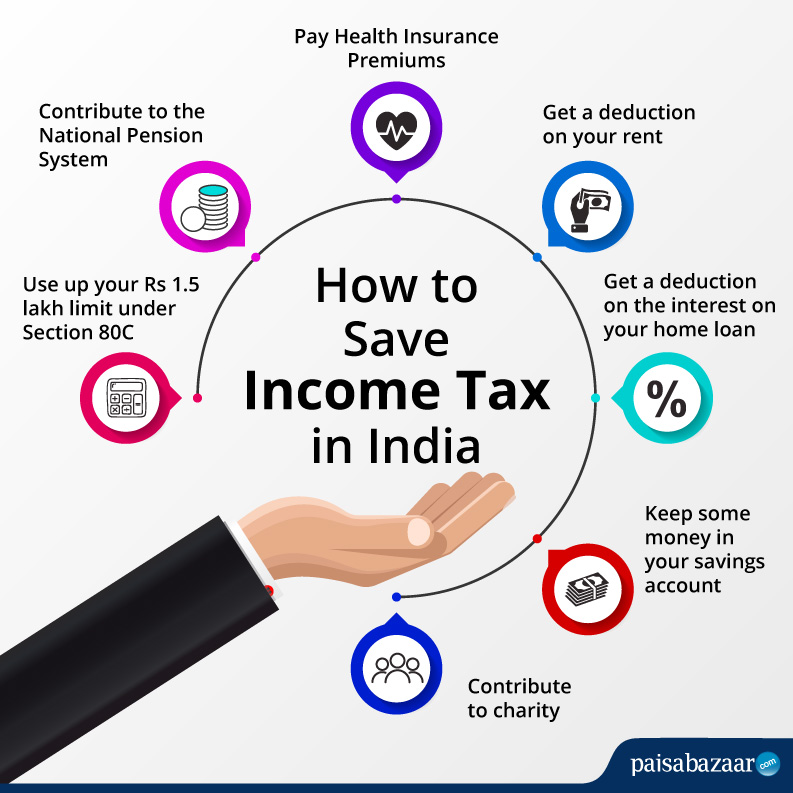

How can we save tax in India

Here are some examples of tax-saving instruments.Public Provident Fund.National Pension Scheme.Premium Paid for Life Insurance policy.National Savings Certificate.Equity Linked Savings Scheme.Home loan's principal amount.Fixed deposit for five years.Sukanya Samariddhi account.

Is passive income taxable in India

Introduction. Passive income comprises of earnings which are derived via a rental property, limited partnership, or any other enterprise in which any individual is not involved in active participation. Usually, passive income is taxable.

What is the maximum tax free cash

Under the pension legislation introduced on 6 April 2006 the general rule for the provision of tax-free cash from a registered pension scheme is that the maximum tax free cash (TFC) an individual can take in their lifetime may not exceed 25% of the individual's lifetime allowance.

How much tax will I pay if my salary is 1000000 in India

If you make ₹ 1,000,000 a year living in India, you will be taxed ₹ 238,335. That means that your net pay will be ₹ 761,665 per year, or ₹ 63,472 per month. Your average tax rate is 23.8% and your marginal tax rate is 36.8%.

How much tax do I have to pay in India for 1 crore

| Range of Income | ||

|---|---|---|

| Rs. 50 Lakhs to Rs. 1 Crore | Rs. 1 Crore to Rs. 2 Crores | Exceeding Rs. 2 crores |

| 10% | 15% | 25% |

How can I avoid high taxes

Invest in Municipal Bonds.Take Long-Term Capital Gains.Start a Business.Max Out Retirement Accounts.Use a Health Savings Account.Claim Tax Credits.

How can I save tax in India if my income is above 20 lakhs

There are various ways to save tax for those earning above ₹20 lakhs, including investing in tax-saving mutual funds, PPF, NPS, health insurance, donations to charity, home loan, rent paid, education loan, and offsetting expenses incurred on generating income from investments.

Which passive income is not taxed in India

Dividends received from your shares or equity mutual funds

You receive dividends from your stocks or equity mutual funds (dividend option). This dividend money you get is also tax-free in your hand.

What is the best source of passive income in India

Passive Income OptionsReal Estate Investments. Real estate has always been a popular investment option for generating passive income.Dividend Stocks.Peer-to-Peer (P2P) Lending.Systematic Investment Plans (SIPs)Fixed Deposits and Bonds.Royalties from Intellectual Property.Real Estate Investment Trust (REIT)

Can I take tax free cash after 75

After reaching age 75

At age 75, any uncrystallised funds become referred to as 'unused funds', but they still have to be tested against the LTA. When the member eventually decides to take their tax free cash, the amount available will be the lower of: 25% of the remaining unused fund coming into payment, or.

Can you take tax free cash

Take less than the tax-free allowance – if you don't need all your tax-free cash, you don't have to take it all at once. Just withdraw as much as you want and whatever is left can be taken later. If your savings rise in value, this could mean you could take a larger total amount tax-free.

What is the tax on 1 crore in India

A surcharge of 15% is levied if the total income exceeds Rs. 1 Crore.

What is the income tax on 3000000 salary in India

If you make ₹ 3,000,000 a year living in India, you will be taxed ₹ 1,101,000. That means that your net pay will be ₹ 1,899,000 per year, or ₹ 158,250 per month. Your average tax rate is 36.7% and your marginal tax rate is 43.2%.

Is 1 crore a good salary in India

Mint spoke to several 'crorepatis' aged between 27 years and 37 years about their lifestyles. Most of them believe that ₹1crore doesn't make them wealthy enough but unanimously agreed that the income gives them ample financial freedom.

How much tax for 50 lakh rupees in India

How to calculate income tax on salary above 50 lakhs Tax calculation example

| Gross Salary | 50,00,000 |

|---|---|

| Net Taxable Income | 42,47,600 |

| Tax on the above income | 10,86,780 |

| Rebate u/s 87A | NA |

| Total Tax | 10,86,780 + 4% cess |

Which income bracket pays the most taxes

The highest-earning Americans pay the most in combined federal, state and local taxes, the Tax Foundation noted. As a group, the top quintile — those earning $130,001 or more annually — paid $3.23 trillion in taxes, compared with $142 billion for the bottom quintile, or those earning less than $25,000.

How can I avoid taxes on a large sum of money in India

Best Ways to Save Tax for Income Tax

Public Provident Fund (PPF): A 15-year lock-in period applies to these government-backed investments. After 7 years, you can partially withdraw your funds and earn 8% interest. Employee Provident Fund (EPF): Employees with salaries participate in this retirement plan.

How can I save tax on salary above 1 crore in India

Standard deduction of Rs.50,000.Conveyance allowance.Transport allowance for specially-abled people.Investment in notified pension scheme.Perquisites.Interest on home loan.

Which income of non resident is not taxable in India

In case of resident taxpayer all his income would be taxable in India, irrespective of the fact that income is earned or has accrued to taxpayer outside India. However, in case of non-resident all income which accrues or arises outside India would not be taxable in India.

Is passive income legal in India

Yes, except for certain passive income sources, others are taxable as per the Income Tax Act 1961.

What are the 7 sources of income in India

7 Different Income Streams For Investors In IndiaSalary Income. You already know what a salary is but, let's define it anyway!Interest Income.Dividend Income.Capital Gains Income.Rental Income.Profit Income.Royalty Income.

Which is no 1 income source in India

Rental Properties

One of the best passive income streams in India commonly used by the older generation is owning and renting out properties. If you have the capital, you can invest in residential or commercial properties and earn monthly rental income while you continue earning your regular income.