How to get the lowest interest rate on a credit card

Want a lower credit card interest rate Just askFind competitive offers.Call your card issuer and ask.Improve your credit score.If denied, apply for a balance transfer card.

How to beat interest rates on credit cards

How to get a lower rateSwitch to a zero percent credit card offer. “Even if you have a lesser credit score, zero percent balance transfer offers are still abundant, some with up to 21 months with no interest,” Rossman says.Consider a fixed-term personal loan.Improve your credit score.Ask for a lower rate.

Can I negotiate a better interest rate on my credit card

Customers can negotiate with credit card companies for lower interest rates. Seeking to negotiate a credit card rate can be a good solution in a variety of situations. Requesting a lower rate should not affect your credit score or credit account.

What makes credit card rates go up

Factors that increase your APR may include federal rate increases or a drop in your credit score. By identifying changes to your APR and understanding the actions that led to your increased rate, you can take steps that may help reduce your interest charges in the future.

Is 20% interest on a credit card bad

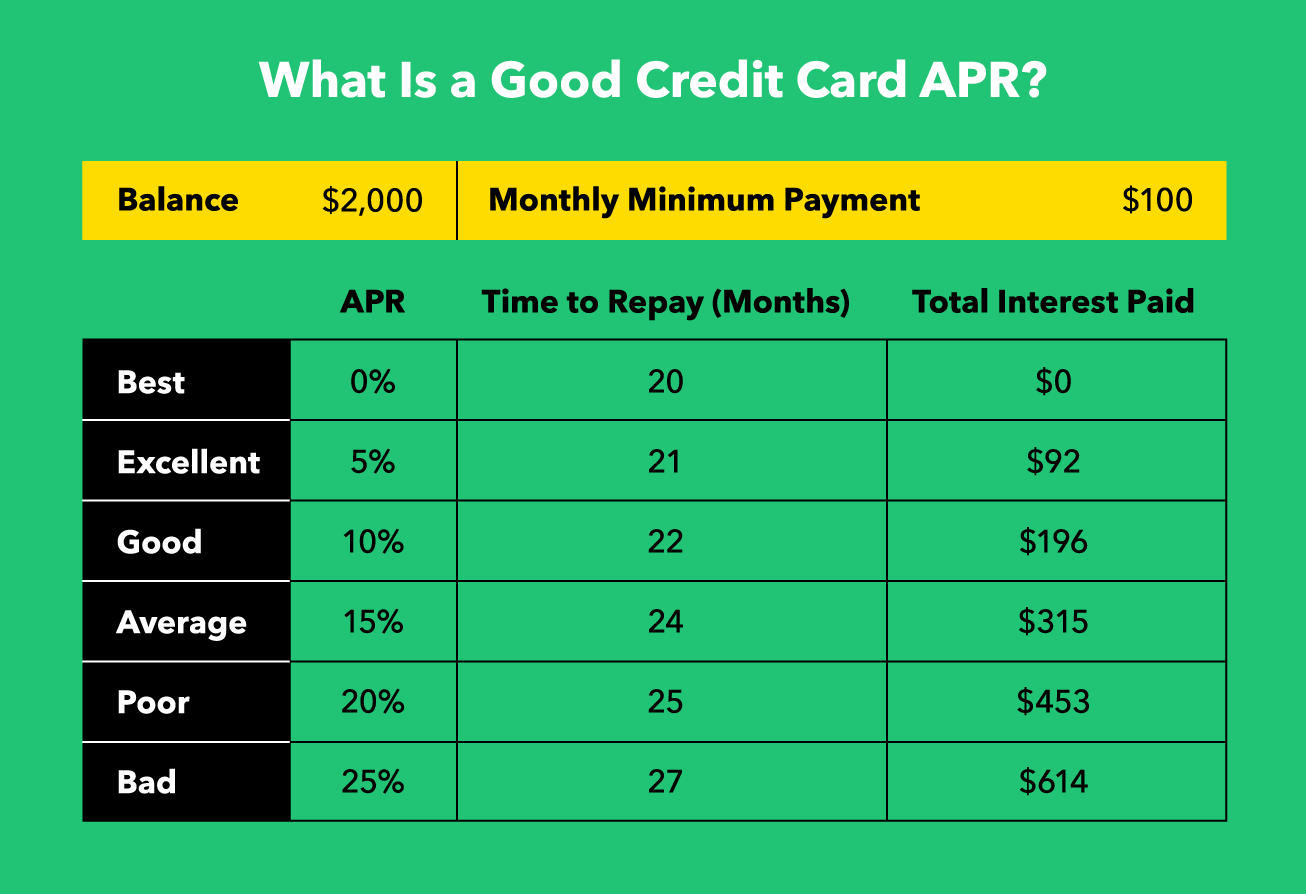

A good APR for a first credit card is anything below 20%. Most first-timers have no credit history, so they need to prove themselves as responsible borrowers before getting a really low APR. But there are some exceptions. Student cards also give lower rates, but you have to be a student to get one.

Is 10% a good credit card interest rate

A good APR for a credit card is anything below 14% — if you have good credit. If you have excellent credit, you could qualify for an even better rate, like 10%. If you have bad credit, though, the best credit card APR available to you could be above 20%.

How do you beat high interest rate

There are many ways to keep your repayments at a manageable level, and these include asking your bank for a lower interest rate, refinancing your home loan, making use of an offset facility to reduce the amount you pay on the interest portion of your home loan and fixing your home loan for a set period of time.

Why is my credit card interest rate so high when I have good credit

Card rates are high because they carry more risk to issuers than secured loans. With average credit card interest rates climbing to above 20 percent, the best thing consumers can do is strategically manage their debt.

Does it hurt your credit to ask for a lower interest rate

Asking for a lower interest rate will not directly impact your credit score. However, if the card company has to do a hard inquiry into your credit history to determine whether you qualify, that will drop your credit score by a few points for up to a year.

What are two ways you can get a lower interest rate on your credit card

There are a number of different ways someone might be able to get a lower credit card interest rate:Work on improving your credit scores.Ask your credit card company for a lower interest rate.Shop around for the best offers.Consider a credit card balance transfer.Keep an eye out for interest rate scams.

Who determines credit card rates

What determines a credit card's interest rate As the CFPB explains, “The credit card company may decide which interest rate to charge you based on your application and your credit history.” Generally, the higher your credit score, the lower your interest rate might be.

Is it better to pay your credit card in full or leave a balance

Carrying a balance does not help your credit score, so it's always best to pay your balance in full each month. The impact of not paying in full each month depends on how large of a balance you're carrying compared to your credit limit.

Is 24% interest high for a credit card

Is a 24% APR high for a credit card Yes, a 24% APR is high for a credit card. While many credit cards offer a range of interest rates, you'll qualify for lower rates with a higher credit score. Improving your credit score is a simple path to getting lower rates on your credit card.

Is 17% interest on a credit card high

A good interest rate is 17%, the average is 19.49% and a bad interest rate is 24% (or higher). Learn more about credit card APR and interest rates to help you better manage and maintain your debt, finances and credit score.

What is the best way to get the lowest interest rate

Here are seven ways you may be able to lower your interest rate and reduce mortgage payments, both at signing and during your loan term.Shop for mortgage rates.Improve your credit score.Choose your loan term carefully.Make a larger down payment.Buy mortgage points.Lock in your mortgage rate.Refinance your mortgage.

Is there any way I can lower my interest rate

If you maintain good credit and a clean payment history you can often be granted a lower interest rate. Even if you don't, don't give up. Continue to make payments on time, reduce outstanding debt and make a plan to try again in three to six months. Improving your credit health will help you make your case next time.

Is 12% interest high on a credit card

Yes, an APR of 12% is a good credit card interest rate. However, you should still pay off your balance in full each month to avoid paying interest.

Is 30 percent interest high

A 30% APR is high for personal loans, too, but it's still fair for people with bad credit. You shouldn't settle for a rate this high if you can help it, though. A 30% APR means the annual percentage rate on the account is 30%, and your annual interest charges will amount to roughly 30% of your balance.

What credit score will give you the lowest interest rate

Generally speaking, borrowers with credit scores of 760 or higher get charged the lowest interest rates. On conventional conforming loans, which must adhere to Fannie Mae and Freddie Mac guidelines, a 780 may qualify you for a slightly lower rate—though it depends on your down payment amount.

Can you negotiate interest rates

Yes, mortgage rates are often negotiable. Borrowers can shop around, compare rates from different lenders, and use these as bargaining tools to negotiate for a lower rate from their preferred lender.

What do credit card rates depend on

Most credit card issuers charge cardholders a variable interest rate based on the prime rate, which is linked to the Fed's key benchmark policy tool, the federal funds rate. Credit card interest rates are priced off the prime rate, the rate that banks charge creditworthy corporate customers.

How are credit card rates set

Most credit card issuers offer a variable annual percentage rate (APR), which means that the interest rates fluctuate with market conditions. They are often set by looking at the Federal Reserve's benchmark prime rate, plus adding on a specific number of percentage points depending on the borrower's credit.

What’s the 15 3 rule

The Takeaway

The 15/3 credit card payment rule is a strategy that involves making two payments each month to your credit card company. You make one payment 15 days before your statement is due and another payment three days before the due date.

What happens if I pay off my credit card early

Paying your credit card early can save money, free up your available credit for other purchases and provide peace of mind that your bill is paid well before your due date. If you can afford to do it, paying your credit card bills early helps establish good financial habits and may even improve your credit score.

Is 24% interest bad

Is a 24% APR high for a credit card Yes, a 24% APR is high for a credit card. While many credit cards offer a range of interest rates, you'll qualify for lower rates with a higher credit score. Improving your credit score is a simple path to getting lower rates on your credit card.