What is the formula for risk analysis

Risk is the combination of the probability of an event and its consequence. In general, this can be explained as: Risk = Likelihood × Impact.

What are the 3 steps of risk analysis

In doing so, we'll break risk assessment down into three separate steps: risk identification, risk analysis, and risk evaluation.

How risks are calculated

Determine risk by conducting a risk versus reward calculation. A risk calculation is a great place to start as you determine whether a risk is worth it. Risk is calculated by dividing the net profit that you estimate would result from the decision by the maximum price that could occur if the risk doesn't pan out.

How is risk analysis done

To carry out a Risk Analysis, you must first identify the possible threats that you face, then estimate their likely impacts if they were to happen, and finally estimate the likelihood that these threats will materialize.

How to calculate risk in Excel

And I get the variance of the market portfolio.

How do you calculate risk and return analysis

Remember, to calculate risk/reward, you divide your net profit (the reward) by the price of your maximum risk. Using the XYZ example above, if your stock went up to $29 per share, you would make $4 for each of your 20 shares for a total of $80. You paid $500 for it, so you would divide 80 by 500 which gives you 0.16.

What are the 4 types of risk assessment

Including qualitative, quantitative, generic, site-specific and dynamic risk assessments. Not all risk assessments are the same. You can use each different type of risk assessment for different situations. And we will cover each one in this post.

What are the 4 main stages of a risk assessment

Step 1) Hazard Identification. After determining an area to study, IDEM samples the affected environment, analyzes the samples, and identifies chemicals that may contribute to increased risk.Step 2) Exposure Assessment.Step 3) Dose-Response Assessment.Step 4) Risk Characterization.

How do you calculate quantitative risk analysis

Quantitative Risk Analysis Formula

The industry-standard formula for quantitative risk analysis is: (ALE = SLE × ARO). That is, Annualized Loss Expectancy (ALE) = Single Loss Exposure (SLE) × Annualized Rate of Occurrence (ARO).

What is risk analysis with example

This process is done in order to help organizations avoid or mitigate those risks. Performing a risk analysis includes considering the possibility of adverse events caused by either natural processes, like severe storms, earthquakes or floods, or adverse events caused by malicious or inadvertent human activities.

How do you calculate risk in a project

Probability * highest impact

Probability x highest impact: this is a very common qualitative risk scoring calculation in which the highest impact score for all of the impact is used to calculate the risk score. For example, if you had a risk that had been assessed: Probability: Very High (5) Schedule: High (4)

Why do we calculate risk and return

The concept of risk and return in finance is an analysis of the likelihood of challenges involved in investing while measuring the returns from the same investment. The underlying principle is that high-risk investments give better returns to investors and vice-versa.

What are the 4 components of risk analysis

Risk assessment is the scientific foundation of risk analysis and has four components:hazard analysis — which includes identification and evaluation.hazard characterization — what the hazard actually is.exposure assessment — how much exposure the food has to the risk.risk characterization — the potential degree of risk.

What are the 6 methods of risk assessment

Each methodology can evaluate an organization's risk posture, but they all require tradeoffs.Quantitative. Quantitative methods bring analytical rigor to the process.Qualitative.Semi-Quantitative.Asset-Based.Vulnerability-Based.Threat-Based.

What are the 5 pillars of risk assessment

The pillars of risk are effective reporting, communication, business process improvement, proactive design, and contingency planning. These pillars can make it easier for companies to successfully mitigate risks associated with their projects.

What is example of quantitative risk analysis

It is performed to understand the probability and impact of risks on project objectives. For instance, in a construction project, quantitative risk analysis helps us to calculate the impact of a project delay such as obtaining a permit late causes a twenty-day delay with a cost of $80,000.

What are common risk analysis methods

There are two main risk analysis methods. The easier and more convenient method is qualitative risk analysis. Qualitative risk analysis rates or scores risk based on the perception of the severity and likelihood of its consequences. Quantitative risk analysis, on the other hand, calculates risk based on available data.

What is basic risk analysis

The term risk analysis refers to the assessment process that identifies the potential for any adverse events that may negatively affect organizations and the environment.

How do you calculate risk vs return

To calculate the risk/return ratio (also known as the risk-reward ratio), you need to divide the amount you stand to lose if your investment does not perform as expected (the risk) by the amount you stand to gain if it does (the reward).

How do you measure risk vs return

The Sharpe ratio measures investment performance by considering associated risks. To calculate the Sharpe ratio, the risk-free rate of return is removed from the overall expected return of an investment. The remaining return is then divided by the associated investment's standard deviation.

What are the 5 parts of a risk assessment

2. Steps needed to manage riskIdentify hazards.Assess the risks.Control the risks.Record your findings.Review the controls.

What are the 7 steps of a risk assessment

Seven Steps for Risk AssessmentPreparation of the risk assessment,Determination of the hazards,Assessment of the hazards,Determination of specific occupational safety and health measures,Performance of the measures,Review of the performance and efficiency of the measures, and.Updating of the risk assessment.

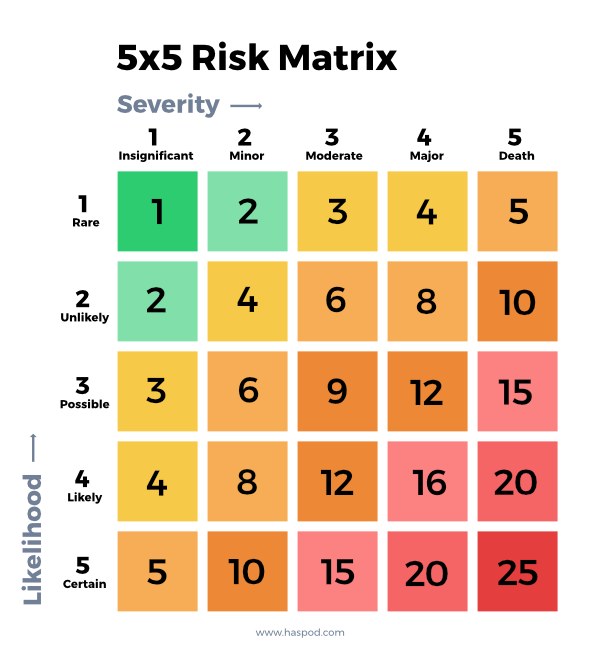

How do you calculate qualitative risk analysis

Rate probability and impact on a scale such as 1 to 5 where 5 is the highest probability and impact. Then we multiply probability times the impact to calculate our risk score. For example, we could rate a risk as a probability of 4 and an impact of 3. The risk score would be 4 x 3 = 12.

Which tool is best for risk analysis

Best Risk Analysis ToolsDelphi Technique. The Delphi Technique is a form of brainstorming for risk identification.SWIFT Analysis.Decision Tree Analysis.Bow-tie Analysis.Probability/Consequence Matrix.Cyber Risk Quantification.

What is the best way to measure risk

Some common measurements of risk include standard deviation, Sharpe ratio, beta, value at risk (VaR), conditional value at risk (CVaR), and R-squared.