What are the ways of managing exchange rates

3 Ways to Manage Foreign Exchange RiskEstablish a forward contract with a bank or foreign exchange service provider.The exporter accepts foreign currency payments only with cash in advance.Match foreign currency receipts with expenditures.

Who manages exchange rates

Central banks manage currency by issuing new currency, setting interest rates, and managing foreign currency reserves. Monetary authorities also manage currencies on the open market to weaken or strengthen the exchange rate if the market price rises or falls too rapidly.

How can a company manage exchange rate risk

These risks can be reduced or even avoided by using hedging contracts such as options, money market hedges, forward contracts, swap contracts or by setting up a foreign exchange policy.

What is managed exchange rate in economics

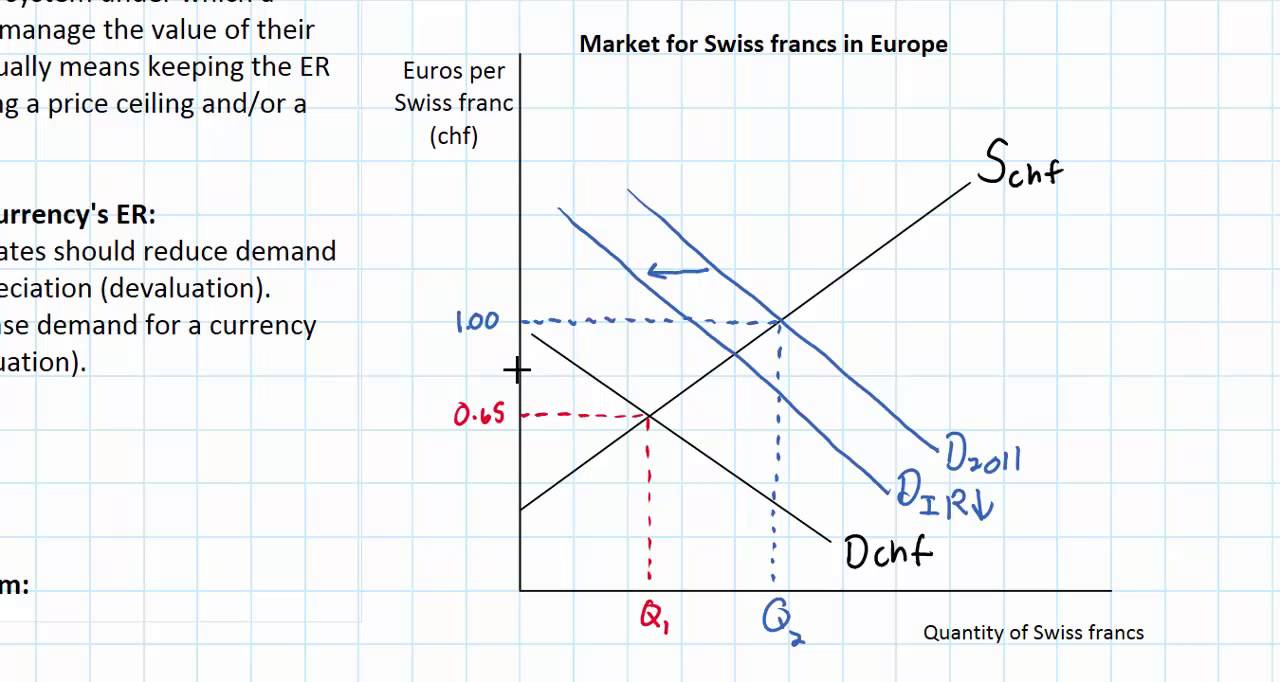

Managed Floating Exchange Rates. A managed floating exchange rate is an exchange rate system that allows a nation's central bank to intervene regularly in foreign exchange markets to change the direction of the currency's float and/or reduce the amount of currency volatility.

What are the three methods of exchange rate

They are: Multiplier method. Divisor method. Triangulation and No inverse method.

Can exchange rates be controlled

Exchange controls are government-imposed limitations on the purchase and/or sale of currencies. These controls allow countries to better stabilize their economies by limiting in-flows and out-flows of currency, which can create exchange rate volatility.

How do central banks manage exchange rates

Regulating the market

Although central banks do not directly control the foreign currency market, they can directly impact inflation and exchange rates by raising or reducing the main interest rate. This is the instrument used to renew banks' liquidity, and it is the primary measure of an economy's credit cost.

How do firms manage their foreign exchange exposure

Financial hedging

The ones most commonly used are: foreign exchange forward contracts, currency options and swaps. Forward contracts allow a company to set the exchange rate at which it will buy or sell a given quantity of foreign currency in the future (on either a fixed date or during a fixed period of time).

How do you manage exchange rate volatility

Hedging Arrangements Through Financial Instruments

In addition to natural hedging, you can use financial instruments like futures, options, cross-currency swaps, and foreign currency forwards to hedge exposure. Futures contracts can be used to create a hedge position.

How is a managed exchange rate different to a fixed exchange rate

A fixed exchange rate denotes a nominal exchange rate that is set firmly by the monetary authority with respect to a foreign currency or a basket of foreign currencies. By contrast, a floating exchange rate is determined in foreign exchange markets depending on demand and supply, and it generally fluctuates constantly.

What are the 4 exchange rate systems

There are four main types of exchange rate regimes: freely floating, fixed, pegged (also known as adjustable peg, crawling peg, basket peg, or target zone or bands ), and managed float.

What are the 2 main types of exchange rates

Exchange rates of a currency can be either fixed or floating. Fixed exchange rate is determined by the central bank of the country while the floating rate is determined by the dynamics of market demand and supply.

How do you control floating exchange rates

In floating exchange rate systems, central banks buy or sell their local currencies to adjust the exchange rate. This can be aimed at stabilizing a volatile market or achieving a major change in the rate.

What causes exchange rates to change

Inflation and interest rates are closely related, and both affect exchange rates. Some inflation – rising prices of goods and services – is healthy for an economy, as it shows increasing demand versus supply.

How central bank can stabilize the foreign exchange

Central banks will often buy foreign currency and sell local currency if the local currency appreciates to a level that renders domestic exports more expensive to foreign nations. Therefore, central banks purposely alter the exchange rate to benefit the local economy.

How do MNCs manage exchange rate risk

MNCs can use forward contracts or futures contracts to hedge transla- tion exposure. They can sell the currency that their subsidiaries receive as earnings, forward. Thus, they create a cash outflow in the currency to off- set the earnings received in that currency.

Why manage foreign exchange risk

Foreign exchange (FX) risk management is important for any organisation that's doing international business. The values of major currencies constantly fluctuate against each other, creating income uncertainty for your business. Many businesses like to eliminate this uncertainty by locking in future exchange rates.

How can we prevent exchange rate crisis

How To PreventThe government should maintain a low inflation rate by providing employment and a favorable monetary policy.Through investors friendly policies, the country can prevent a currency crisis.Maintaining fair monetary policies.Maintaining good trade relations with other countries.

How do companies hedge against exchange rate risk

Hedging is a way for a company to minimize or eliminate foreign exchange risk. Two common hedges are forward contracts and options. A forward contract will lock in an exchange rate today at which the currency transaction will occur at the future date.

What is a managed exchange rate simple definition

A managed floating exchange rate (also known as dirty float') is an exchange rate regime in which the exchange rate is neither entirely free (or floating) nor fixed. Rather, the value of the currency is kept in a range against another currency (or against a basket of currencies) by central bank intervention.

Can exchange rates be manipulated or fixed by governments

The government indirectly regulates exchange rates, because most currency exchange rates are set on the open foreign exchange market (forex). In some countries, like China, the exchange rate is fixed, and the government directly controls it. This control of the yuan, in turn, affects the U.S. dollar.

What are the 5 determinants of exchange rate

Factors that influence exchange ratesInflation.Interest rates.Speculation.Change in competitiveness.Relative strength of other currencies.Balance of payments.Government debt.Government intervention.

What is managed fixed exchange rate

A fixed exchange rate is a regime applied by a government or central bank that ties the country's official currency exchange rate to another country's currency or the price of gold.

Can exchange rates be fixed or floating

A fixed exchange rate denotes a nominal exchange rate that is set firmly by the monetary authority with respect to a foreign currency or a basket of foreign currencies. By contrast, a floating exchange rate is determined in foreign exchange markets depending on demand and supply, and it generally fluctuates constantly.

What are the three factors that affect exchange rates

10 Factors that influence currency exchange rates:Inflation >Interest rates >Government Debt/Public >Political Stability >Economic Recession >Terms of Trade >Current account deficit >Confidence and speculation >