Is Baba a good buy now

BABA Stock Forecast FAQ

Alibaba has 53.90% upside potential, based on the analysts' average price target. Alibaba has a conensus rating of Strong Buy which is based on 13 buy ratings, 1 hold ratings and 0 sell ratings. The average price target for Alibaba is $142.71.

Will Alibaba stock go up

Stock Price Forecast

The 51 analysts offering 12-month price forecasts for Alibaba Group Holding Ltd have a median target of 138.93, with a high estimate of 184.84 and a low estimate of 72.22. The median estimate represents a +51.50% increase from the last price of 91.70.

Will Alibaba recover

If Alibaba meets those analysts' expectations and continues to grow its revenue and net income at a relatively modest CAGR of 10% from fiscal 2025 to fiscal 2028, it could potentially generate about 1.37 trillion yuan ($190 billion) in revenue and 165 billion yuan ($23 billion) in net income by the final year.

Why has Alibaba stock gone down

A media report about possible export restrictions from the U.S., which could potentially stunt the tech giant's growth in a hot segment, helped push the share price down. By the end of the trading day, Alibaba's stock was down by nearly 3%.

Can BABA reach $1,000

Drawing a straightforward trend line price chart, BABA shares could reach $1,000 sometime in the first quarter of 2027 if it crawls along with the support level. Alibaba's P/E ratio would compress to a mere 11 times on a forward basis (FY2026) and this is based on the current depressed environment.

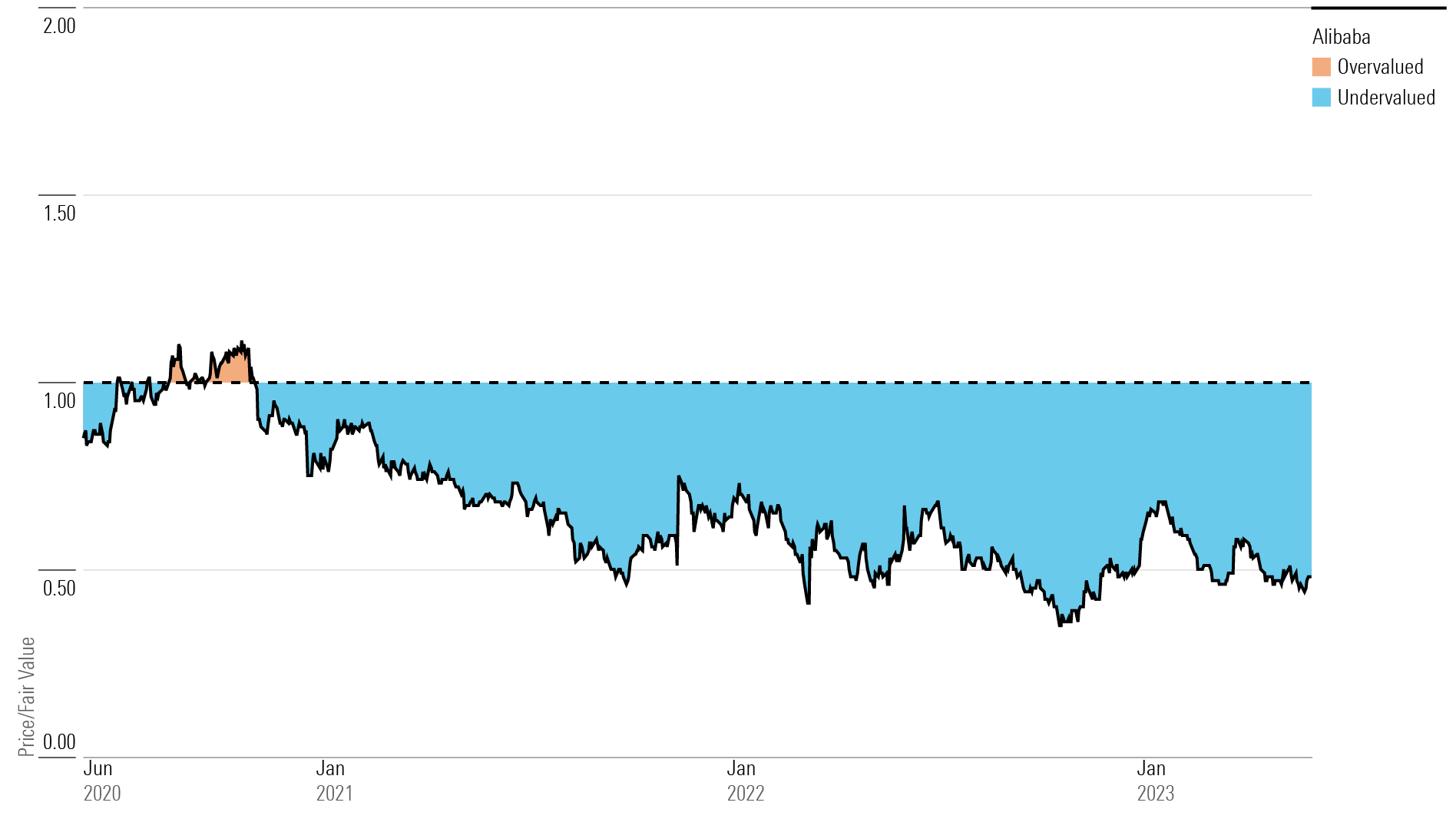

Is Alibaba undervalued

Fair Value Estimate for Alibaba Stock

With its 5-star rating, we believe Alibaba's stock is undervalued.

Can Alibaba reach 1000

Drawing a straightforward trend line price chart, BABA shares could reach $1,000 sometime in the first quarter of 2027 if it crawls along with the support level. Alibaba's P/E ratio would compress to a mere 11 times on a forward basis (FY2026) and this is based on the current depressed environment.

Is Alibaba overvalued

With its 5-star rating, we believe Alibaba's stock is undervalued.

Is BABA stock undervalued

Valuation & Word on Wall Street

Alibaba stock is relatively cheap, trading at 21.34x P/E TTM basis as of today, trading well below the peer group; we believe the stock is undervalued for the growth prospects present.

Why Alibaba will beat Amazon

Alibaba has both a cheaper valuation and faster revenue growth than Amazon, which would theoretically make it a better buy. However, Amazon faces less political risk than Alibaba does, which justifies some sort of a premium.

What is the future growth of Alibaba

Alibaba Group Holding is forecasted to grow earnings and revenue by 16.5% and 7.6% per annum respectively. EPS is expected to grow by 19%. Return on equity is forecast to be 11.1% in 3 years.

What will BABA price be in 2023

The forecasted Alibaba price at the end of 2023 is $108.42 – and the year to year change +23%. The rise from today to year-end: +20%. In the first half of 2024, the Alibaba price will climb to $128.77; in the second half, the price would add $12.14 and close the year at $140.91, which is +56% to the current price.

Can Alibaba be a trillion dollar company

The value is there, and it's remarkable. Alibaba achieved a GMV of $1.2 trillion in fiscal 2021, doubling Amazon. Yet, Alibaba gets no respect, commanding a market cap of 1/6 of the American retail giants'.

Is Alibaba losing

Alibaba Group Holding Ltd.'s biggest selloff in three months is underscoring investor concern that China's consumer recovery may fail to meet lofty expectations. The ecommerce giant's 9.1% slump this week has wiped out $28 billion in the tech giant's market value.

Why is Alibaba PE so high

As we suspected, our examination of Alibaba Group Holding's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio.

What will Alibaba be worth 2025

If its price-to-sales ratio holds steady, it could be worth about $750 billion by the beginning of 2025. But if the regulatory headwinds fade and Alibaba commands higher valuations again, its market cap could exceed $1 trillion by 2025.

Who invested $20 million in Alibaba

Masayoshi Son

Masayoshi Son is one of the earliest backers of Alibaba

SoftBank was the first major outside investor in Alibaba when it was just a tiny startup based out of an apartment building in Hangzhou, Jack Ma's hometown. Son invested $20 million in the company in 2000 despite Ma's lack of experience in sales or management.

Will Alibaba stock hit 1000

Drawing a straightforward trend line price chart, BABA shares could reach $1,000 sometime in the first quarter of 2027 if it crawls along with the support level. Alibaba's P/E ratio would compress to a mere 11 times on a forward basis (FY2026) and this is based on the current depressed environment.

Why Alibaba is a risky investment

Some of the key risks to consider when investing in Alibaba include the regulatory environment in China, economic and political instability in the country, and currency fluctuations. The regulatory environment in China can change rapidly and can have a significant impact on businesses operating in the country.

What are the risks of Alibaba

Risks and Challenges for Sellers

1. Payment Risks: Payment risks are a challenge for sellers on Alibaba.com, as buyers may dispute payments or request chargebacks after receiving their products. 2. Competition: Competition among sellers is high on Alibaba.com, which can drive down prices and reduce profit margins.

Will Alibaba reach $1 000

Drawing a straightforward trend line price chart, BABA shares could reach $1,000 sometime in the first quarter of 2027 if it crawls along with the support level. Alibaba's P/E ratio would compress to a mere 11 times on a forward basis (FY2026) and this is based on the current depressed environment.

What will Alibaba stock be in 2025

Alibaba stock price stood at $92.17

| Year | Mid-Year | Tod/End,% |

|---|---|---|

| 2024 | $129.51 | +54% |

| 2025 | $173.61 | +102% |

| 2026 | $207.89 | +133% |

| 2027 | $238.81 | +185% |

What will Baba stock be in 2030

According to the Traders Union long-term price forecast Alibaba (BABA) can reach $117.14 by 2025, $164.85 by 2030, $216.67 by 2034.

Can Baba reach $1,000

Drawing a straightforward trend line price chart, BABA shares could reach $1,000 sometime in the first quarter of 2027 if it crawls along with the support level. Alibaba's P/E ratio would compress to a mere 11 times on a forward basis (FY2026) and this is based on the current depressed environment.

Is Alibaba a buy sell or hold

Alibaba Group has received a consensus rating of Buy. The company's average rating score is 3.00, and is based on 11 buy ratings, 1 hold rating, and no sell ratings.