Is it bad to have multiple current accounts

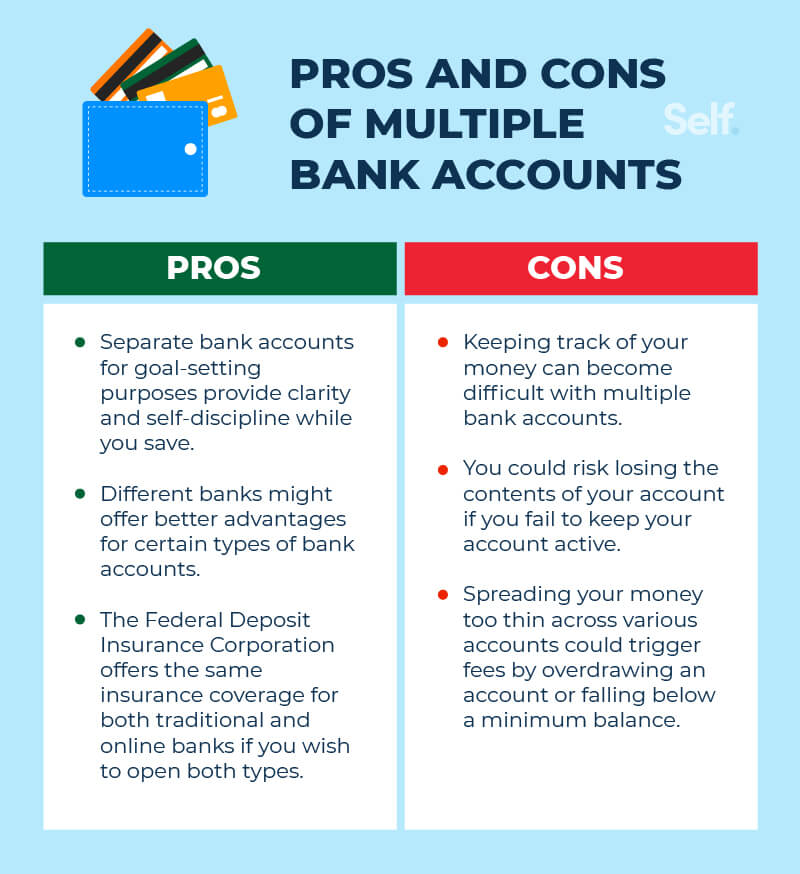

Higher risk of fraud: Every extra account gives fraudsters one more avenue to target. Could affect your credit score: Multiple account applications in a short space of time could mean a temporary dip in your credit score. If you go overdrawn on different current accounts that could also negatively affect your score.

How many current accounts should you have

An expert recommends having four bank accounts for budgeting and building wealth. Open two checking accounts, one for bills and one for spending money.

Is it bad to have too many bank accounts

There is no limit to the number of checking accounts that you can have. But it's a good idea to limit the number of accounts to an amount that you can reasonably and sustainably manage. Too many checking accounts can make it harder to track deposits and withdrawals.

How many current bank accounts can a person have

How many bank accounts can you have You can have as many bank accounts as you like, from any bank that's willing to let you open one. Keeping track of multiple accounts can involve extra legwork, but there are definite benefits. You may already have more than one bank account.

Can a person have 2 current accounts

Having multiple current accounts can help you efficiently manage your cash flow by segregating funds based on priority. For instance, you can have a separate account for immediate expenses and another account for long-term savings or investments.

Is it okay to have 3 bank accounts

Many consumers assume they only need one savings account to meet their needs, but that isn't always the case. Having multiple accounts — at the same bank or different banks — can be useful for managing different savings goals, and there's little harm in doing so, since it doesn't impact your credit.

Is it OK to have 5 bank accounts

Depending on your financial goals, you may find that having more than one bank account makes sense. But there's no correct number of bank accounts to have. The key is figuring out which combination of accounts makes for the ideal match between your financial goals and your lifestyle.

Is it OK to have 4 bank accounts

There is no limit set to how many bank accounts you should have. However, it is advisable to have less than four bank accounts per person because it becomes difficult to manage money in multiple bank accounts.

Is it bad to have 10 bank accounts

Cons. Multiple accounts can be more challenging to keep up with when tracking deposits or withdrawals. You may run the risk of incurring overdraft or other fees if you're not tracking each account closely. Monthly maintenance fees can easily add up for multiple checking accounts.

Is it OK to have 3 bank accounts

Many consumers assume they only need one savings account to meet their needs, but that isn't always the case. Having multiple accounts — at the same bank or different banks — can be useful for managing different savings goals, and there's little harm in doing so, since it doesn't impact your credit.

Can I have 4 bank accounts

Yes, there is no limit on how many savings accounts you can have. But, if the bank detects no activity in your account for a while, it can be marked dormant.

How many times can you switch current accounts

Each current account has its own rules. So if you like to switch frequently to make the most of the freebies, always read the terms and conditions. Although there's no official limit on how often you can switch, switching accounts goes on your credit file and frequent switching could affect your credit score.

Is it good to have 4 bank accounts

Some experts suggest you should have four bank accounts — two checking and two savings. You'll use one checking account to pay bills and the other for spending money.

Should I have 5 bank accounts

Budgeting expert Ellyce Fulmore, who runs a life and money coaching website, says the ideal number of bank accounts you should have is four. This is made up of a bill paying account, daily spending account, short-term savings account and a long-term investment account.

Can a person open two current accounts

Banks are, however, mandating retaining only one account. Some businesses have branches in multiple locations, while banks do not permit them to have multiple current accounts in different cities. Banks are also not allowing businesses to open collection accounts in other banks where they do not have branches.

How many bank accounts is too much

You can have as many as there are banks that will give them to you. Just keep in mind that having too many can be confusing and expose you to additional risk. On top of having multiple accounts, there are upsides to having accounts with multiple banks.

What are the rules for bank current account

There is no restriction on the number and amount of deposits. There is also no restriction on the number and amount of withdrawals made, as long as the current account holder has funds in his bank account. Generally, bank does not pay any interest on current account.

Is it bad to have 4 bank accounts

Having multiple accounts — at the same bank or different banks — can be useful for managing different savings goals, and there's little harm in doing so, since it doesn't impact your credit.

Is it good to keep money in current account

A savings account is most suitable for people who are salaried employees or have a monthly income, whereas, Current Accounts work best for traders and entrepreneurs who need to access their accounts frequently. Savings accounts earn interest at a rate of around 4%, while there is no such earning from a Current Account.

What are the disadvantages of current account in bank

Disadvantages of a Current AccountCurrent bank accounts are usually interest-free accounts; therefore, customers will not get the advantage of a monetary benefit on their money in a current account.Due to rendering additional services with current accounts, most banks charge high fees from customers.

Is it bad to have 5 bank accounts

Having multiple accounts — at the same bank or different banks — can be useful for managing different savings goals, and there's little harm in doing so, since it doesn't impact your credit.

Where do millionaires keep their money

Cash equivalents are financial instruments that are almost as liquid as cash and are popular investments for millionaires. Examples of cash equivalents are money market mutual funds, certificates of deposit, commercial paper and Treasury bills. Some millionaires keep their cash in Treasury bills.

Is it better to keep money in savings or current account

Savings accounts earn interest at a rate of around 4%, while there is no such earning from a Current Account. A Current Account is actually a no interest-bearing deposit account. When you withdraw more money from the account, than is actually there, then your account is said to be overdrawn.

Is it safe to keep savings in current account

A current account and savings account are both secure places to store your money. However, they both have many differences and are suitable for different situations. Current accounts are generally used for day-to-day transactions, whereas a savings account is a place to store extra cash.

Is 300 million a lot of money

According to Global Rich List, $300M would instantly make the recipient the 5,393rd wealthiest person on Earth. Among the top 0.0001% richest people alive, anywhere.