Is S&P 500 the biggest

The S&P 500 index consists of most but not all of the largest companies in the United States. The S&P market cap is 70 to 80% of the total US stock market capitalization. It is a commonly used benchmark for stock portfolio performance in America and abroad.

Is the S&P 500 the 500 largest companies

The Bottom Line

The S&P 500 is one of the most widely-watched and tracked indexes in the global financial markets. It is made up of 500 of the largest companies in the country.

Which is bigger Dow Jones or S&P 500

The Bottom Line

While both the DJIA and S&P 500 are used by investors to determine the general trend of the U.S. stock market, the S&P 500 is more encompassing, as it is based on a larger sample of total U.S. stocks.

Is S&P 500 a large-cap index

The Standard & Poor's 500 Index (S&P 500) and the Russell 1000 Index both track stocks of publicly traded companies and are both considered large-cap stock indices.

What are the Big 7 stocks

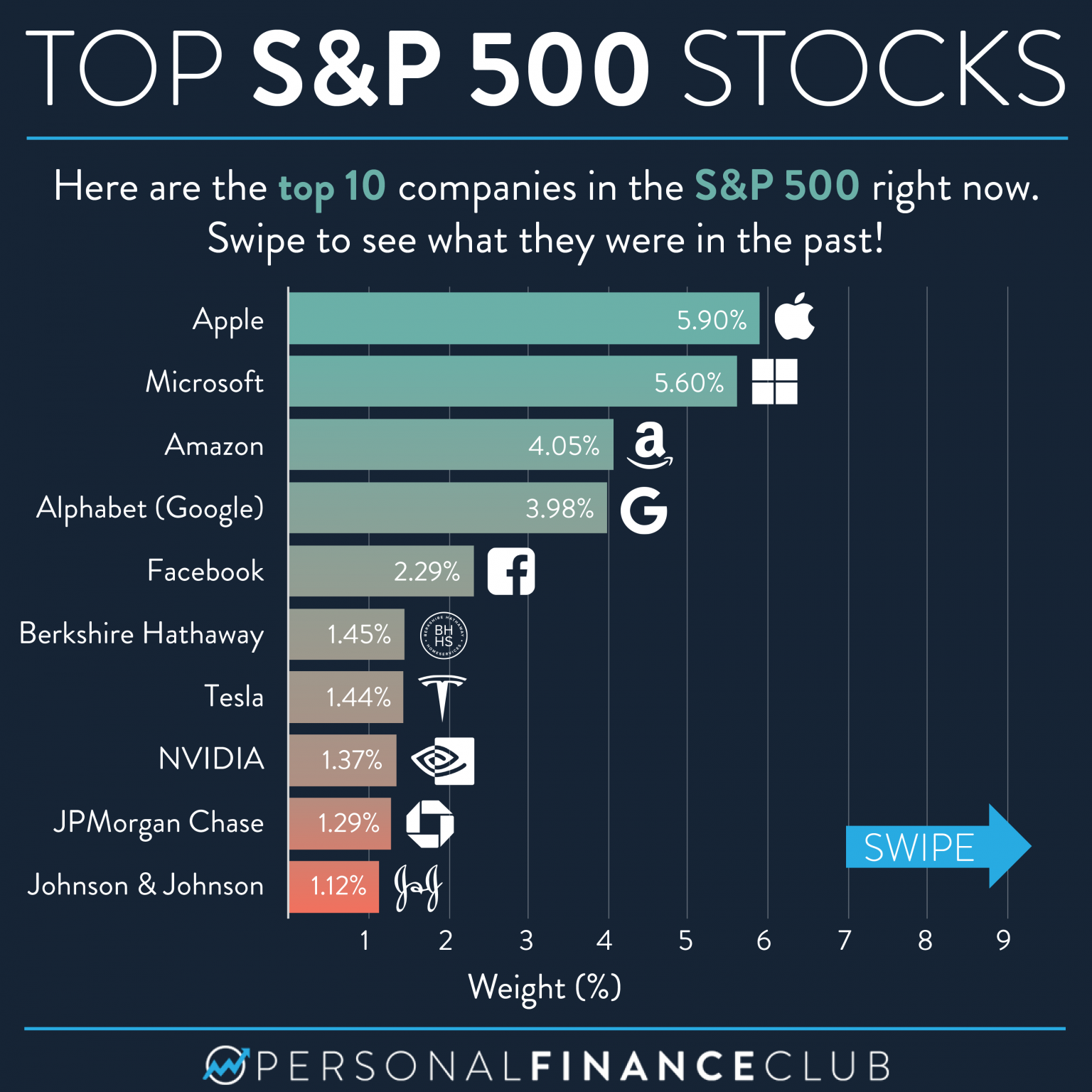

CNBC's Jim Cramer opined Tuesday about the value of sticking with his “Magnificent Seven,” the seven tech stocks currently leading the market: Apple , Amazon , Alphabet , Meta , Microsoft , Nvidia and Tesla .

Why is the S and P 500 so popular

The key advantage of using the S&P 500 as a benchmark is the wide market breadth of the large-cap companies included in the index. The index can provide a broad view of the economic health of the U.S. because it covers so many companies in so many different sectors.

Why is S&P 500 so popular

The key advantage of using the S&P 500 as a benchmark is the wide market breadth of the large-cap companies included in the index. The index can provide a broad view of the economic health of the U.S. because it covers so many companies in so many different sectors.

What index tracks 500 of the largest companies

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices.

Is S&P 500 better than Nasdaq

S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has significantly outperformed S&P 500 in terms of performance. Over the past 15 years, Nasdaq 100 has delivered a CAGR of around 16%, while S&P 500 has returned about 8%.

Is it better to invest in Dow Jones or S&P 500

However, by 1956, when the S&P 500 was launched, technology had advanced to the point that S&P could base its new market metric on companies' total stock market values rather than on their share prices. That's why the S&P 500 is a much better, much broader market indicator than the Dow.

What is the biggest market cap index

The New York Stock Exchange is the largest stock exchange in the world, with an equity market capitalization of nearly 24.3 trillion U.S. dollars as of May 2023. The following three exchanges were the NASDAQ, the Shanghai Stock Exchange, and the Euronext.

Do small caps outperform S&P 500

As I mentioned above, though small cap stocks generally outperformed the S&P 500 in every decade from 1930-1979, they generally underperformed the S&P 500 in every decade from 1980 onward.

What are the 3 main stocks

The most widely followed indexes in the U.S. are the Standard & Poor's 500, Dow Jones Industrial Average, and Nasdaq Composite. The Wilshire 5000 includes all stocks listed on the U.S. stock market.

What are the 4 essential stocks

Types of Stock

There are four basic kinds of stock/fond: white stock (Fond Blanc), brown stock (Fond Brun), vegetable or neutral stock (Fond Maigre) and Fish Stock (Fume de Poisson). The classifications refer to the contents and method used to prepare the stock, not necessarily to color.

Can anyone beat the S&P 500

Yes, you may be able to beat the market, but with investment fees, taxes, and human emotion working against you, you're more likely to do so through luck than skill. If you can merely match the S&P 500, minus a small fee, you'll be doing better than most investors.

Is S&P 500 the best benchmark

The S&P 500 has generally become the leading stock index due to its broader scope, and investors and analysts use its performance to judge the overall economy. Additionally, many hedge funds compare their annual performance to the S&P 500, seeking to realize alpha in excess of the index's returns.

Is the S and P 500 the best investment

Is Investing in the S&P 500 Less Risky Than Buying a Single Stock Generally, yes. The S&P 500 is considered well-diversified by sector, which means it includes stocks in all major areas, including technology and consumer discretionary—meaning declines in some sectors may be offset by gains in other sectors.

What are the three biggest indexes

The S&P 500. The Standard & Poor's 500 Index, commonly known as the S&P 500, is an index with 500 of the top companies in the U.S. Stocks chosen by market capitalization.The Dow Jones Industrial Average.The Nasdaq Composite Index.

What is the best S and P 500 index fund

Compare the best S&P 500 index funds

| Fund ticker | Expense ratio | 10-year annualized rate |

|---|---|---|

| FXAIX | 0.015% | 12.85% |

| VFIAX | 0.04% | 12.82% |

| SWPPX | 0.02% | 12.80% |

| SVSPX | 0.16% | 12.72% |

Has the Nasdaq outperformed the S&P 500

The Nasdaq-100 is heavily allocated towards top performing industries such as Technology, Consumer Discretionary, and Health Care, which have helped the Nasdaq-100 outperform the S&P 500 by a wide margin between December 31, 2007 and December 30, 2022.

Does the S&P 100 outperform the S&P 500

In the 502 month sample period, the S&P 100 has only outperformed in 156 of 502 months (31%). On average, the S&P 100 has trailed the S&P 500 by the 2.3% we see on the first graph in the article. The largest rolling 1-yr outperformance was 11.9% in December 1999 as the tech bubble was hitting its peak.

Do most investors beat the S&P 500

Commonly called the S&P 500, it's one of the most popular benchmarks of the overall U.S. stock market performance. Everybody tries to beat it, but few succeed.

Who has the largest market caps by industry

What Are the Biggest Market SectorsCommunication services – $5.42 trillion.Consumer discretionary – $7.39 trillion.Consumer staples – $4.05 trillion.Energy – $1.71 trillion.Financials – $5.78 trillion.Healthcare – $6.70 trillion.Industrials – $4.44 trillion.Information technology – $12.02 trillion.

What is the market cap of the S&P 500

$37.823 trillion dollars

Data Details. The S&P 500 has a market capitalization of $37.823 trillion dollars. The total market cap is calculated by summing the market capitalization of every company in the index. Each company's calculated market cap is based on the outstanding float share count.

Why is it so hard to beat the S&P 500

The Barriers

Investment fees are one major barrier to beating the market. If you take the popular advice to invest in an S&P 500 index fund rather than on individual stocks, your fund's performance should be identical to the performance of the S&P 500, for better or worse.