Who came up with the 50 30 20 rule

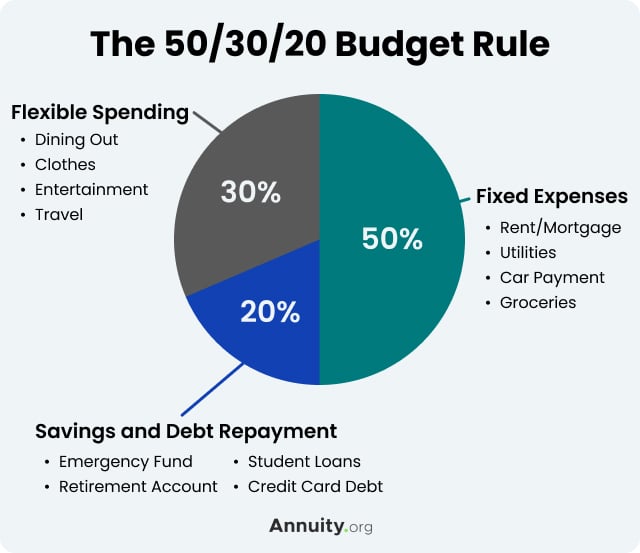

Developed by Elizabeth Warren, a senior U.S. Senator from Massachusetts and renowned expert in bankruptcy law, the 50/30/20 rule states that your after-tax income should be roughly divided three ways: 50% to needs. 30% to wants. 20% to long-term savings.

What is the 40 30 30 budget

30/30/40. Thirty percent of your income goes toward housing expenses, 30% toward other living costs like food and transportation, and 40% toward discretionary spending and savings.

What is the easiest budget method

Pay-yourself-first budget

Simply put, you set aside a specific amount every time you get paid for savings and debt payments, then spend the rest of your money however you see fit. By doing this, you can prioritize your savings and debt repayment goals and make do with whatever is left over.

Why is the 50 20 30 rule easy to follow

This method allocates 50% of your after-tax income toward essentials, 20% toward financial goals, like savings or reducing debt, and 30% toward things you want. This allows you to plan for every dollar you earn and create a budget you can follow easily.

What is the disadvantage of 50 30 20 budget

Drawbacks of the 50/30/20 rule:Lacks detail.May not help individuals isolate specific areas of overspending.Doesn't fit everyone's needs, particularly those with aggressive savings or debt-repayment goals.May not be a good fit for those with more complex financial situations.

What is the 10 10 30 rule

Spend Less Money

So, if you get a thousand dollars, you live by the “10-10-30-50” rule. The first 10% you tithe, the next 10% you save, 30% is cash in your pocket for incidentals (food, groceries, hair, etc.), and the remaining 50% saved in your checking account for your bills.

What is the 70 20 10 rule money

The biggest chunk, 70%, goes towards living expenses while 20% goes towards repaying any debt, or to savings if all your debt is covered. The remaining 10% is your 'fun bucket', money set aside for the things you want after your essentials, debt and savings goals are taken care of.

What is the smartest way to budget

The 50/30/20 rule is an easy budgeting method that can help you to manage your money effectively, simply and sustainably. The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt.

Why is investing a better option than saving

Saving provides a safety net and a way to achieve short-term goals, while investing has the potential for higher long-term returns and can help achieve long-term financial goals.

What are the benefits of the 50 30 20 rule

The 50-20-30 rule helps you allot funds in your monthly budget for specific purposes. Following this template can help you increase your savings and prioritize your budget to afford your most important needs. This method puts a focus on reducing debt and ensuring you set aside money to find personal fulfillment.

What are the flaws of 50 30 20

Drawbacks of the 50/30/20 rule: Lacks detail. May not help individuals isolate specific areas of overspending. Doesn't fit everyone's needs, particularly those with aggressive savings or debt-repayment goals.

What are the flaws with the 50 30 20 rule

Some Experts Say the 50/30/20 Is Not a Good Rule at All. “This budget is restrictive and does not take into consideration your values, lifestyle and money goals. For example, 50% for needs is not enough for those in high-cost-of-living areas.

What is the 5 5 5 rule

Follow the 5/5/5 rule

To keep your audience from feeling overwhelmed, you should keep the text on each slide short and to the point. Some experts suggest using the 5/5/5 rule: no more than five words per line of text, five lines of text per slide, or five text-heavy slides in a row.

What is 10 5 3 rule of investment

The 10, 5, 3 rule. This is the expected long-term return from equities 10%, bonds 5%, and cash 3%. It hasn't quite worked out like that since 2008, but it's a long term view over 20 years. It can be combined with the rule of 72, so we can see how long it takes for each asset class to approximately double in value.

What is the 75 15 10 rule

for anybody with any amount of money. so for every dollar you make, you can spend 75 cents. then 15 cents is the minimum that you can invest, and 10 cents is the minimum that you save. this allows you to allocate 25 of your income. towards wealth building activities.

What is the 40 rule money

40% of income should go towards necessities (such as rent/mortgage, utilities, and groceries) 30% should go towards discretionary spending (such as dining out, entertainment, and shopping) – Hubble Spending Money Account is just for this. 20% should go towards savings or paying off debt.

Which budgeting method is best

5 budgeting methods to consider

| Budgeting method | Good for |

|---|---|

| 1. Zero-based budget | Tracking consistent income and expenses |

| 2. Pay-yourself-first budget | Prioritizing savings and debt repayment |

| 3. Envelope system budget | Making your spending more disciplined |

| 4. 50/30/20 budget | Categorizing “needs” over “wants” |

Is it smarter to save or invest

Is it better to save or invest It's a good rule of thumb to prioritize saving over investing if you don't have an emergency fund or if you'll need the cash within the next few years. If there are funds you won't need for at least five years, that money may be a good candidate for investing.

Am I better off saving or investing

Savings are ideal for short-term or unexpected expenses such as holidays or the boiler breaking down. But if you're looking to build your wealth for the future, it's worth considering investing because stock markets tend to perform better than cash over the longer-term.

What are the pros and cons for the 50 30 20 budget

Here are the pros and cons of the 50-30-20 budget method:PRO: It's simple.PRO: You learn where your money goes each month.PRO: It's doesn't feel like a diet.PRO: It pushes you to reduce your fixed costs.PRO: You don't need to monitor every single purchase.CON: It doesn't take into account your circumstances.

What is the disadvantage of 50-30-20 budget

Drawbacks of the 50/30/20 rule:Lacks detail.May not help individuals isolate specific areas of overspending.Doesn't fit everyone's needs, particularly those with aggressive savings or debt-repayment goals.May not be a good fit for those with more complex financial situations.

Is 50-30-20 impossible

Inflation and Wage Stagnation Make the 50/30/20 Unaffordable

“A recent poll we conducted with our visitor base concluded that most people are nowadays spending upward of 70% of their whole income on basic necessities, which leaves a very small percent to be split between debt, investments and unnecessary expenses.”

Is 50 30 20 wrong

Some Experts Say the 50/30/20 Is Not a Good Rule at All. “This budget is restrictive and does not take into consideration your values, lifestyle and money goals. For example, 50% for needs is not enough for those in high-cost-of-living areas.

What is the 1 6 6 rule

The 1-6-6 Rule: Quite simply, each PowerPoint slide should have one main idea, a maximum of six bullet points, and a maximum of six words per bullet point. 9. Sketch out the story: Simple, but crucial. Before you open up PowerPoint, know exactly what you want to say, then break up that story into slides.

What is the 10 20 30 rule of PowerPoint

The idea of the 10/20/30 rule is easy to understand, which is summed up in three points. Your presentation should consist of no more than 10 slides. Your presentation should last no longer than 20 minutes. The text on each slide should be no lower than 30 points in size.