Is 20% bad for a credit card

The APR you receive is based on your credit score – the higher your score, the lower your APR. A good APR is around 20%, which is the current average for credit cards. People with bad credit may only have options for higher APR credit cards around 30%.

How much of your credit card should you use

Most credit experts advise keeping your credit utilization below 30 percent, especially if you want to maintain a good credit score. This means if you have $10,000 in available credit, your outstanding balances should not exceed $3,000.

Is it bad to use your credit card too much

You might even see your credit score drop due to the increased balance on your card. If you make too many over-limit charges, your credit card issuer could close your credit account. Here are the most common consequences associated with spending over your credit limit: Your credit card could be declined.

How much should you spend on a $1000 credit limit

How much should I spend if my credit limit is $1,000 The Consumer Financial Protection Bureau recommends keeping your credit utilization under 30%. If you have a card with a credit limit of $1,000, try to keep your balance below $300.

Is it OK to use 50% of credit card

In general, it's considered a good rule of thumb to keep your utilization ratio below 30%, with the ideal rate being below 10%. By going over 50%, I set off that little "Danger, Danger!" robot from, well, every sci-fi movie ever. The result My credit score dropped a whopping 25 points.

Should you only use 20% of your credit limit

Experts generally recommend maintaining a credit utilization rate below 30%, with some suggesting that you should aim for a single-digit utilization rate (under 10%) to get the best credit score.

Is it good to use 2% of my credit cards

More cards could give you an indirect boost

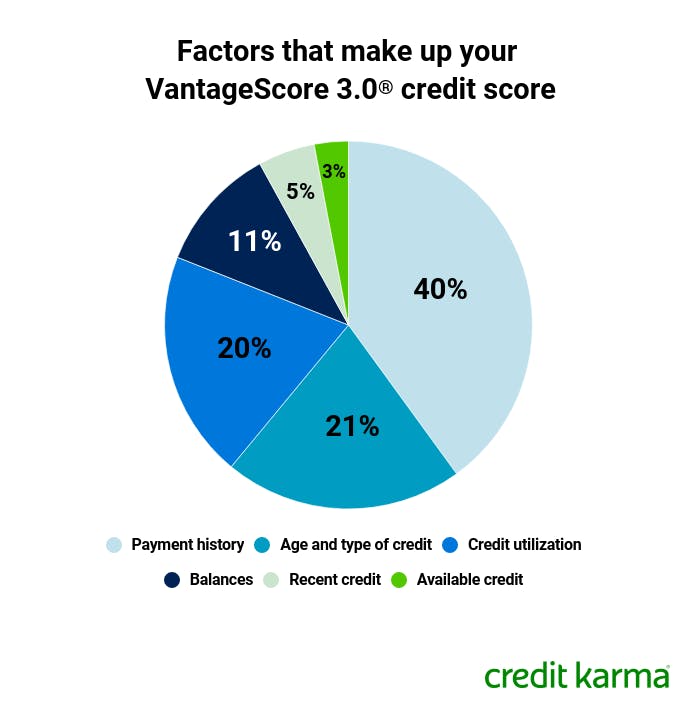

Utilization is simply the amount you owe on your cards divided by your available credit. It plays a major role in the 30% of your FICO score that's determined by amounts owed. The lower your utilization, the better — below 30% is preferable, and below 10% is ideal.

How much of credit card is OK

To improve your credit score, most credit experts recommend that you should avoid using more than 30% of your available credit per card at any given time.

Is it okay to use 40% of credit card

Your credit utilization rate — the amount of revolving credit you're currently using divided by the total amount of revolving credit you have available — is one of the most important factors that influence your credit scores. So it's a good idea to try to keep it under 30%, which is what's generally recommended.

Is using 40% of credit card bad

Even if you pay your credit card balances in full every month, simply using your card is enough to show activity. While experts recommend keeping your credit card utilization below 30%, it's important to note that creditors also care about the total dollar amount of your available credit.

Why should you only use 10% of your credit card

To maintain a healthy credit score, it's important to keep your credit utilization rate (CUR) low. The general rule of thumb has been that you don't want your CUR to exceed 30%, but increasingly financial experts are recommending that you don't want to go above 10% if you really want an excellent credit score.

What is 30% of $300 credit limit

$90

You should try to spend $90 or less on a credit card with a $300 limit, then pay the bill in full by the due date. The rule of thumb is to keep your credit utilization ratio below 30%, and credit utilization is calculated by dividing your statement balance by your credit limit and multiplying by 100.

Should I use 10% of my credit card

Traditional wisdom suggests credit scores benefit most when credit utilization remains below 30%. Those who can keep credit utilization below 10% may see even better results. In general, the lower the ratio, the better. The higher the ratio, the worse the negative impact on your credit score.

Can I use 30% of my credit limit

Using no more than 30% of your credit limits is a guideline, not a rule — and using less is better for your score. NerdWallet writers and editors are experts in their field and come from a range of backgrounds in journalism and finance.

Should I use 50 of my credit card

Experts traditionally recommend not using more than 30% of your available credit in a given month, and ideally keeping it closer to 10% or below. That's because to lenders, seeing a borrower put a lot of money on their credit card can be a red flag that they won't be able to pay back what they owe.

Is it good to leave a little balance on your credit card

In general, it's always better to pay your credit card bill in full rather than carrying a balance. There's no meaningful benefit to your credit score to carry a balance of any size. With that in mind, it's suggested to keep your balances below 30% of your overall credit limit.

Is 30% credit usage good

What is a good credit utilization ratio According to the Consumer Financial Protection Bureau, experts recommend keeping your credit utilization below 30% of your available credit. So if your only line of credit is a credit card with a $2,000 limit, that would mean keeping your balance below $600.

Is 15% credit card utilization good

Many experts will tell you to stay below 30 percent, but I suggest keeping it below 25 percent. That's because once you hit 30 percent, your score is going to be more severely affected. Keeping that 5 percent in reserve will help to keep from ever getting to the point of affecting your score in a negative way.

What happens if you use 30% of your credit

To further help your score, try paying your balance more than once per billing cycle to keep your utilization consistently low. Using more than 30% of your available credit on your cards can hurt your credit score. The lower you can get your balance relative to your limit, the better for your score.

Is it okay to use 50% of your credit limit

In general, it's considered a good rule of thumb to keep your utilization ratio below 30%, with the ideal rate being below 10%.

Should you only use 25 on your credit card

This often looks best to lenders, as it shows you can borrow credit, but you're not heavily reliant on it. So, for a healthy credit score, try to use no more than 25% of your credit limit each month.

How much credit card balance is OK

A good rule of thumb is to keep your credit utilization under 30 percent. This means that if you have $10,000 in available credit, you don't ever want your balances to go over $3,000. If your balance exceeds the 30 percent ratio, try to pay it off as soon as possible; otherwise, your credit score may suffer.

What’s the 15 3 rule

The Takeaway

The 15/3 credit card payment rule is a strategy that involves making two payments each month to your credit card company. You make one payment 15 days before your statement is due and another payment three days before the due date.

Is 25% credit utilization good

Your credit utilization ratio should be 30% or less, and the lower you can get it, the better it is for your credit score. Your credit utilization ratio is one of the most important factors of your credit score—and keeping it low is key to top scores.

Is 75% credit usage bad

50% to 75%: This utilization percentage looks very risky to a lender. Under 50%: If you have high revolving credit balances, your first goal should be to get your utilization under 50%, which is where your risk starts looking more reasonable to a lender.