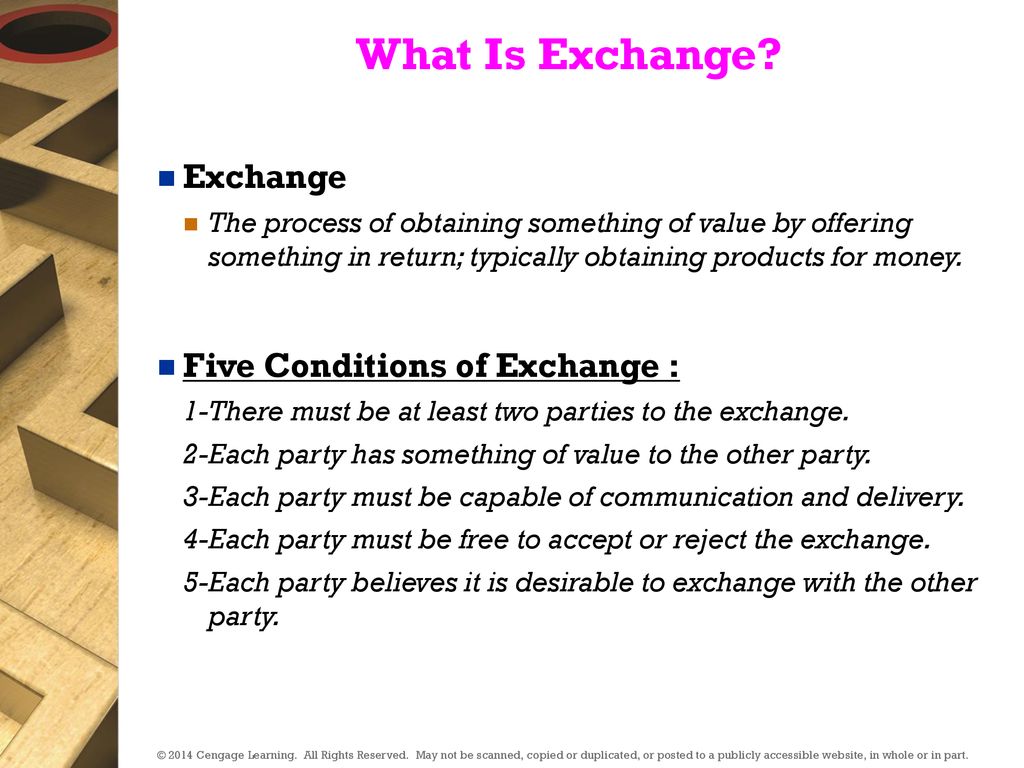

What are the 5 conditions for exchange to take place

For an exchange to take place certain conditions must be met:There must be at least two parties.Each must have something that might be of value to the other.Each can communicate and deliver what they are offering.Each is free to accept or reject what is on offer.

Who are the main participants in the international money market

The major participants in the money market are commercial banks, governments, corporations, government-sponsored enterprises, money market mutual funds, futures market exchanges, brokers and dealers, and the Federal Reserve. Commercial Banks Banks play three important roles in the money market.

What is the requirement of exchange

Exchange Requirements means the Rules; other requirements implemented by the Exchange pursuant to the Rules; each term of a Contract; and the participant documentation and other contractual obligations between a Participant (including its Authorized Users) and the Exchange.

What is the rule of exchange

Exchange Rule means a rule of the National Securities Exchange on which the Common Shares or other securities of the Company are listed for trading. Exchange Rule means any rules of any exchange or other trading environment in which the securities of a party are publicly traded.

What are the four different levels of participants in foreign exchange markets

4 Main Participants of Foreign Exchange MarketParticipant # 1. Commercial Banks or Market Makers:Participant # 2. Foreign Exchange Brokers:Participant # 3. Central Banks or Reserve Bank of India:Participant # 4. Corporates and Entrepreneurs:

What are the role of participants in the foreign exchange market

The participants engaged in this market are able to buy, sell, exchange, and speculate on the currencies. These foreign exchange markets are consisting of banks, forex dealers, commercial companies, central banks, investment management firms, hedge funds, retail forex dealers, and investors.

What are the 3 basic types of exchange

An exchange rate regime is closely related to that country's monetary policy. There are three basic types of exchange regimes: floating exchange, fixed exchange, and pegged float exchange.

What are the three principles of exchange

Later, Marshall Sahlins used the work of Karl Polanyi to develop the idea of three modes of exchange, which could be identified throughout more specific cultures than just Capitalist and non-capitalist. These are reciprocity, redistribution, and market exchange.

What are the 3 types of exchange

Later, Marshall Sahlins used the work of Karl Polanyi to develop the idea of three modes of exchange, which could be identified throughout more specific cultures than just Capitalist and non-capitalist. These are reciprocity, redistribution, and market exchange.

What are the four major functions of the foreign exchange market

The following are the important functions of a foreign exchange market:To transfer finance, purchasing power from one nation to another.To provide credit for international trade.To make provision for hedging facilities, i.e., to facilitate buying and selling spot or forward foreign exchange.

What is the basic of foreign exchange

The foreign exchange market is a decentralized worldwide market. The participants in the foreign exchange market include central banks, commercial banks, brokers etc. The central banks monitor market movements and sentiments and intervene according to government policy.

What are the factors affecting the foreign exchange market

7 factors affecting exchange ratesInterest and inflation rates. Inflation is the rate at which the cost of goods and services rises over time.Current account deficits.Government debt.Terms of trade.Economic performance.Recession.Speculation.

What are the 2 main types of exchange rates

Exchange rates of a currency can be either fixed or floating. Fixed exchange rate is determined by the central bank of the country while the floating rate is determined by the dynamics of market demand and supply.

What are 3 examples of medium of exchange

Most forms of money are categorised as mediums of exchange, including commodity money, representative money, cryptocurrency, and most commonly fiat money. Representative and fiat money most widely exist in digital form as well as physical tokens, for example coins and notes.

What are the 3 components of exchange rate risk

Three types of foreign exchange risk are transaction, translation, and economic risk.

What is the principle of exchange

'Locard's Exchange Principle' in forensic science holds that the perpetrator of a crime will bring something to the crime scene and will leave with something from it;1 it was originally devised by the 'Sherlock Holmes of Lyon', France, Dr Edmond Locard (1877–1966), a criminologist.

What are the three functions of exchange

Functions of Foreign Exchange MarketTransfer Function: It is the primary function of the foreign exchange market.Credit Function: Just like domestic trade, foreign trade also depends on credit.Hedging Function: It implies to protection against risk related to fluctuations in the foreign exchange rate.

What are the 3 main functions of foreign exchange market

The main functions of the market are to (1) facilitate currency conversion, (2) provide instruments to manage foreign exchange risk (such as forward exchange), and (3) allow investors to speculate in the market for profit.

What are 3 features of the foreign exchange market

Features of Foreign Exchange MarketHigh Liquidity: The foreign exchange market is the most easily liquefiable financial market in the whole world.Dynamic Market: In foreign exchange market is highly dynamic in nature.Market Transparency: The foreign exchange market is highly transparent.

What are the 4 factors that impact the exchange rate

Exchange rates are determined by factors, such as interest rates, confidence, the current account on balance of payments, economic growth and relative inflation rates.

What are the 8 factors that affect foreign exchange rate

10 Factors that influence currency exchange rates:Inflation >Interest rates >Government Debt/Public >Political Stability >Economic Recession >Terms of Trade >Current account deficit >Confidence and speculation >

What are the 4 exchange rate systems

There are four main types of exchange rate regimes: freely floating, fixed, pegged (also known as adjustable peg, crawling peg, basket peg, or target zone or bands ), and managed float.

What are the 4 factors for exchange rate determination

This paper focuses on an accounting framework that is useful for distinguishing between the effects on exchange rates of four separate factors: relative price levels, balances of payments, interest rates and risk.

Why is the exchange principle important

The fundamental principle formulated by him – Locard's Exchange Principle – is essential for today's law enforcement. This basic principle is that “every contact leaves a trace”. Thus NO perpetrator can leave the scene without leaving a trace.

What are the main principles of social exchange theory

According to social exchange theory, a person will weigh the cost of a social interaction (negative outcome) against the reward of that social interaction (positive outcome). These costs and rewards can be material, like money, time or a service.