What are the best ways to evaluate a stock

Evaluating StocksHow does the company make moneyAre its products or services in demand, and whyHow has the company performed in the pastAre talented, experienced managers in chargeIs the company positioned for growth and profitabilityHow much debt does the company have

What are the types of stock valuation

Stock valuation can be classified into two categories: absolute valuation and relative valuation.

What is the formula for common stock valuation

How is common stock calculated The formula for calculating common stock is Common Stock = Total Equity – Preferred Stock – Additional Paid-in Capital – Retained Earnings + Treasury Stock.

What is stock valuation in finance

Stock valuation is the process of calculating how much a company stock is worth using methods that consider economic factors such as past prices and forecast data. This can help you predict future market prices.

What are the 4 qualities used to evaluate stock

Investing has a set of four basic elements that investors use to break down a stock's value. In this article, we will look at four commonly used financial ratios—price-to-book (P/B) ratio, price-to-earnings (P/E) ratio, price-to-earnings growth (PEG) ratio, and dividend yield—and what they can tell you about a stock.

What are 2 ways to analyze stocks

Investors may use technical and fundamental analysis before buying a stock. Fundamental analysis can tell you about a company's financial health, competitive situation, and exposure to economic trends. Technical analysis means learning the simple steps behind reading a stock chart, plus some common terms.

What are the 4 stock valuation methods

Valuation models that fall into this category include the dividend discount model, discounted cash flow model, residual income model, and asset-based model.

What are the 4 main types of stock

Different Types of Stocks to Invest In: What Are They

| List | Type |

|---|---|

| 1 | Common stock |

| 2 | Preferred stock |

| 3 | Large-cap stocks |

| 4 | Mid-cap stocks |

What is common stock equivalent method valuation

Common Stock Equivalent Method (CSEM)

This method is pretty straightforward. Here, the enterprise value is allocated to all equity classes with the assumption that they are equal, as if there were no rights or preferences.

What is the basic valuation formula

Current Value = (Asset Value) / (1 – Debt Ratio)

To quickly value a business, find its total liabilities and subtract them from the total assets. This will give you an idea of its book value. This formula estimates the worth of a business by looking at its assets and subtracting any liabilities.

What is method of valuation

What is a method of valuation A method of valuation is the process used to determine the economic value of a business or company unit. This monetary value is the culmination of the company's growths, declines, investments, assets, inventory, and popularity translated into accurate figures on charts.

What are the methods of equity valuation

A company's equity value is determined based on the fair market value of net assets owned by the company. This method is most often used for entities with a going concern, as this approach emphasizes outstanding liabilities determining net asset value.

What 3 factors determine the value of a stock

In summary, the key fundamental factors are as follows: The level of the earnings base (represented by measures such as EPS, cash flow per share, dividends per share) The expected growth in the earnings base. The discount rate, which is itself a function of inflation.

What are the 3 most important criteria to consider when investing

Any investment can be characterized by three factors: safety, income, and capital growth. Every investor has to pick an appropriate mix of these three factors. One will be preeminent. The appropriate mix for you will change over time as your life circumstances and needs change.

What tool to analyze stock

Simple Moving Averages (SMA)

The Simple Moving Average (SMA) is a famous technical analysis tool that traders use to identify trends in the price of an asset. It calculates an investment's average cost over a specified period, and then plots that average on a chart.

What are the different ways of evaluating equity stock

Three major categories of equity valuation models are present value, multiplier, and asset-based valuation models. Present value models estimate value as the present value of expected future benefits. Multiplier models estimate intrinsic value based on a multiple of some fundamental variable.

What are the three methods of managing stock

Four major inventory management methods include just-in-time management (JIT), materials requirement planning (MRP), economic order quantity (EOQ) , and days sales of inventory (DSI).

What are the methods of valuation of shares 3

Methods of Valuation of Shares (5 Methods)A. Asset-Backing Method:B. Yield-Basis Method:C. Fair Value Method:D. Return on Capital Employed Method:E. Price-Earnings Ratio Method:

What are the three types of stock taking

There are several types of stocktaking.Annual stocktaking. Many businesses follow annual stocktaking, checking physical stocks once a year.Periodic stocktaking.Spot checks.Continuous stocktaking.Stockout validation.

What are the three types of stock record

Inventory RecordsThere are 3 main types of Inventory Records.Category Records keep information about groups of products.Vendor Records keep information about the companies and people you buy products and services from.Item Records are the individual products or services that you sell.

What are the three methods for estimating the cost of common stock

There are three methods associated with calculating the cost of common equity that you need to understand. Capital asset pricing model (CAPM) Discounted cash flow (DCF) method. Bond Yield Plus Risk Premium (BYPRP) Approach.

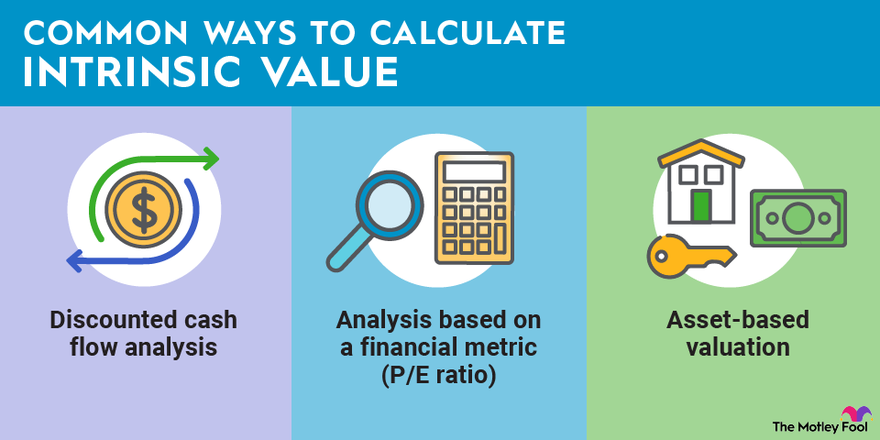

What are the three methods of valuation

Three main types of valuation methods are commonly used for establishing the economic value of businesses: market, cost, and income; each method has advantages and drawbacks. In the following sections, we'll explain each of these valuation methods and the situations to which each is suited.

What are the 3 fundamental concepts of valuation

Valuation methods typically fall under one of three basic appraisal approaches: the asset approach, the market approach, or the income approach. The asset approach uses appraisal methods that consist of a review of the individual assets of the company.

What are the 3 methods of valuation

3 Most Common Business Valuation MethodsMultiples or Comparables.Discounted Cash Flow (DCF)Asset Based Valuations.

What are the 5 methods of valuation

This module examines the traditional property valuation methods: comparative, investment, residual, profits and cost-based. There is also an introduction to modern methods of valuation.