What are the 3 main types of foreign exchange rate

The three major types of exchange rate systems are the float, the fixed rate, and the pegged float.

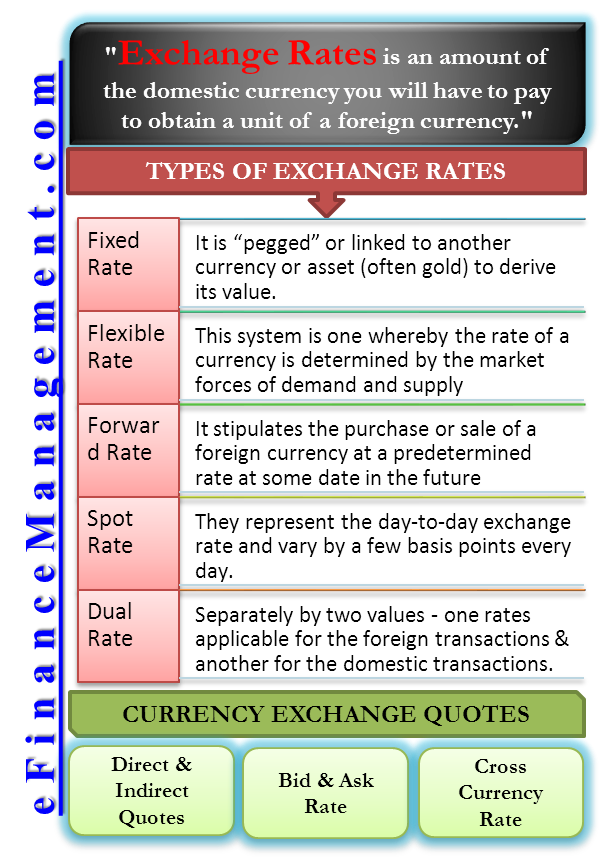

What are types of exchange rate

There are four main types of exchange rate regimes: freely floating, fixed, pegged (also known as adjustable peg, crawling peg, basket peg, or target zone or bands ), and managed float.

What are the 2 main types of exchange rates

Exchange rates of a currency can be either fixed or floating. Fixed exchange rate is determined by the central bank of the country while the floating rate is determined by the dynamics of market demand and supply.

What are the 5 types of foreign exchange

Types Of Foreign Exchange MarketThe Spot Market. In the spot market, transactions involving currency pairs take place.Futures Market.Forward Market.Swap Market.Option Market.

What are the 2 types of fixed exchange rate

The two major types of fixed exchange rate regimes were the gold standard and Bretton Woods. The gold standard relied on retail convertibility of gold, while the BWS relied on central bank management where the USD stood as a sort of substitute for gold.

Why are there different exchange rates

What drives exchange rates Exchange rates are constantly moving, based on supply and demand. Whether one currency is in higher demand than another, depends on the perceived value of owning it, either to pay for goods and services, or as an investment.

What is the best type of exchange rate

Fixed exchange rates work well for growing economies that do not have a stable monetary policy. Fixed exchange rates help bring stability to a country's economy and attract foreign investment. Floating exchange rates work better for countries that already have a stable and effective monetary policy.

What are 3 features of the foreign exchange market

Features of Foreign Exchange MarketHigh Liquidity: The foreign exchange market is the most easily liquefiable financial market in the whole world.Dynamic Market: In foreign exchange market is highly dynamic in nature.Market Transparency: The foreign exchange market is highly transparent.

What are the two types of exchange rate transactions

Exchange rates can be free-floating or fixed. A free-floating exchange rate rises and falls due to changes in the foreign exchange market. A fixed exchange rate is pegged to the value of another currency.

What is fixed vs free exchange rate

A fixed exchange rate denotes a nominal exchange rate that is set firmly by the monetary authority with respect to a foreign currency or a basket of foreign currencies. By contrast, a floating exchange rate is determined in foreign exchange markets depending on demand and supply, and it generally fluctuates constantly.

What are the two types of foreign exchange rate risk

There are three main types of foreign exchange risk, also known as foreign exchange exposure: transaction risk, translation risk, and economic risk.

How many types of currency are there

All currencies of all countries

Altogether, there are 162 official currencies around the world. Of these 162, however, 47 currencies are tied to another with a fixed exchange rate. This means that, for example, the Danish krone is a currency in its own, but is tied to euro with a constant rate.

Is the exchange rate different in different countries

There are countless geopolitical and economic announcements that affect the exchange rates between two countries, but a few of the most common include interest rate changes, unemployment rates, inflation reports, gross domestic product numbers, manufacturing data, and commodities.

What type of exchange rate do most countries use

floating regime

In a floating regime, exchange rates are generally determined by the market forces of supply and demand for foreign exchange. For many years, floating exchange rates have been the regime used by the world's major currencies – that is, the US dollar, the euro area's euro, the Japanese yen and the UK pound sterling.

What are the 5 types of foreign exchange market

Different types of Forex markets, such as the spot market, swap market, forward market, options market, futures market, and participants, make up the foreign exchange market structure.

What are the features of exchange rate

It is the main feature of exchange rate that it always fluctuates. If our currency will strong at that time, our exchange rate will differ from previous exchange rate. Suppose, today, one dollar's exchange rate is 44.89. If tomorrow, our currency strong, we have to pay less for buying one dollar.

What is floating vs fixed vs pegged exchange rate

Key Takeaways. A floating exchange rate is determined by the private market through supply and demand. A fixed, or pegged, rate is a rate the government (central bank) sets and maintains as the official exchange rate. The reasons to peg a currency are linked to stability.

What are the 2 exchange rate systems

Understanding Dual Exchange Rates

In a dual exchange rate system, currencies can be exchanged in the market at both fixed and floating exchange rates. A fixed rate would be reserved for certain transactions such as imports, exports, and current account transactions.

What are 4 types of money

There are 4 major types of Money :Commodity Money.Fiat Money.Fiduciary Money.Commercial Bank Money.

What are the 4 major currencies

Key TakeawaysThe major currency pairs on the forex market are the EUR/USD, USD/JPY, GBP/USD, and USD/CHF.The four major currency pairs are some of the most actively traded pairs in the world, along with the so-called commodity currency pairs: USD/CAD, AUD/USD, and NZD/USD.

Which exchange rate is best in the world

Kuwaiti dinar (KWD)

The Kuwaiti dinar is the strongest currency in the world with 1 Kuwaiti dinar buying 3.25 US dollars (or, put another way, US$1 equals 0.31 Kuwaiti dinars).

What are exchange rates in international trade

How do exchange rate fluctuations affect international trade Changes in currency exchange rates affect international trade by increasing or decreasing exports and imports. A strong domestic currency will cause exports to decrease and imports to increase. As exchange rates decrease, exports rise and imports go down.

What is an example of an exchange rate

the price of one currency in terms of another currency; for example, if the exchange rate for the euro (€) is 132 yen (¥), that means that each Euro that is purchased will cost 132 yen.

What are the different types of foreign exchange rate risk

There are three main types of foreign exchange risk, also known as foreign exchange exposure: transaction risk, translation risk, and economic risk.

Which is better floating rate or fixed rate

Floating rates are slightly lower than fixed rates. If you are comfortable with the prevailing interest rates, are reasonably sure that interest rates will rise in future, opt for a fixed rate home loan. If you are unsure about where interest rates are heading, opt for a floating rate home loan.