What are the 2 main types of exchange rates

Exchange rates of a currency can be either fixed or floating. Fixed exchange rate is determined by the central bank of the country while the floating rate is determined by the dynamics of market demand and supply.

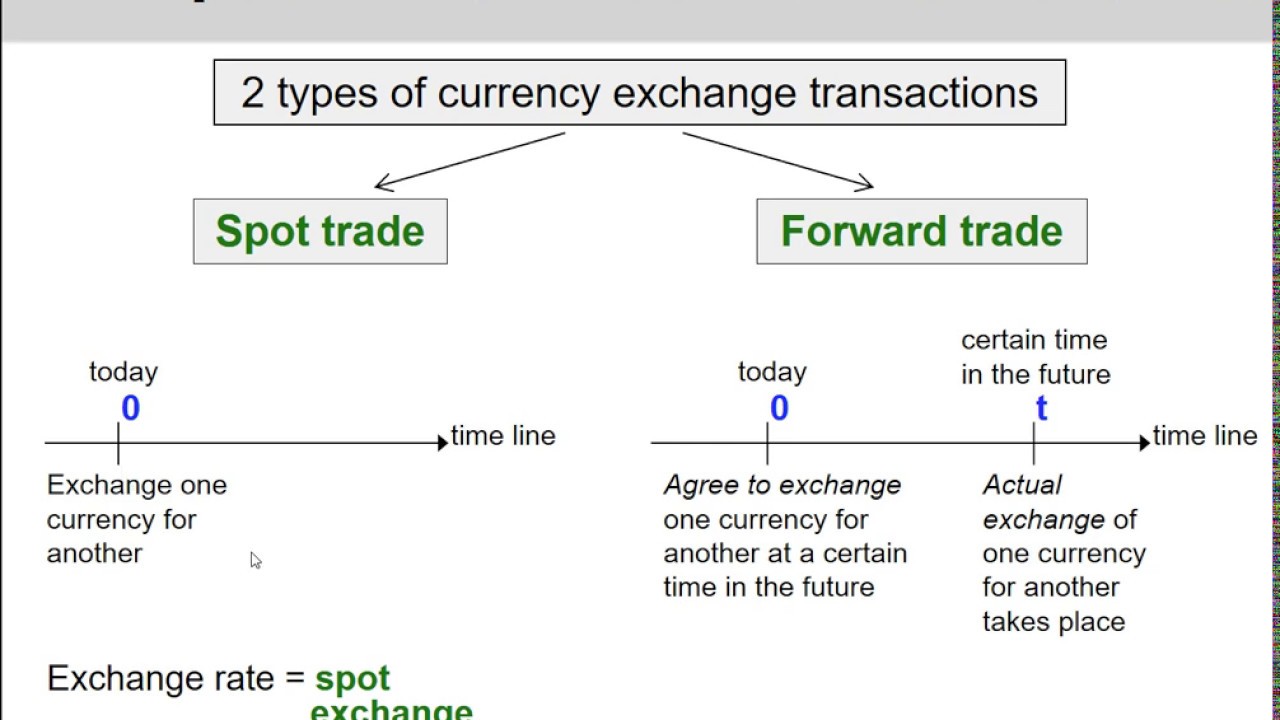

What are the two kinds of exchange rate transactions spot transactions and forward transactions

There are two kinds of exchange rate transactions. The predominant ones, called spot transactions, involve the immediate (two-day) exchange of bank deposits. Forward transactions involve the exchange of bank deposits at some specified future date.

What are the different types of exchange rates

There are four main types of exchange rate regimes: freely floating, fixed, pegged (also known as adjustable peg, crawling peg, basket peg, or target zone or bands ), and managed float.

What are the two methods of exchange

Important methods of exchange control are: (1) Intervention (2) Exchange Clearing Agreements (3) Blocked Accounts (4) Payment Agreements (5) Gold Policy (6) Rationing of Foreign Exchange (7) Multiple Exchange Rates.

What are the 3 basic types of exchange

An exchange rate regime is closely related to that country's monetary policy. There are three basic types of exchange regimes: floating exchange, fixed exchange, and pegged float exchange.

What are spot and forward transactions

With spot transactions, internationally traded currencies are bought and sold for other currencies at the spot rate. Forward transactions, on the other hand, are traded on a certain date in the future with the relevant premiums and discounts for calculating the forward rate being specified.

What are examples of exchange transactions

An exchange transaction is when a NFP exchanges value for donations in return. For example, if a museum donates free tickets in exchange for cash donations, then that is considered an exchange transaction.

What are the three types of exchange rates

The systems are: 1. Purely Floating Exchange Rates System 2. Fixed Exchange Rates System 3. Managed Exchange Rates System.

What are the 3 types of exchange

One of the things Economic Anthropology focuses on is the ways that goods and services are exchanged in different cultures. Methods of exchange can be grouped into three major types: reciprocity, redistribution, and market.

What is the most common exchange rate system

For many years, floating exchange rates have been the regime used by the world's major currencies – that is, the US dollar, the euro area's euro, the Japanese yen and the UK pound sterling.

What is spot transaction and spot rate

Spot rates are the current exchange rates at which specific currencies can be bought or sold on currency exchange markets. In plain English, they are the “right now” rate for any given currency. If you choose to make an exchange immediately, your chosen currencies will be exchanged at the current spot rate.

What is the difference between spot and forward exchange rates

What's the difference between the spot rate and forward rate The spot rate refers to the immediate exchange rate while the forward rate refers to the future exchange rate agreed upon in forward contracts.

What are the three types of foreign exchange transactions

There are three main forex markets: the spot forex market, the forward forex market, and the futures forex market.

What is exchange in transaction

Exchange transactions are transactions in which one entity receives assets or services, or has liabilities extinguished, and directly gives approximately equal value (primarily in the form of cash, goods, services, or use of assets) to another entity in exchange.

What is the exchange rate system

Exchange rates are determined by demand and supply in a managed float system, but governments intervene as buyers or sellers of currencies in an effort to influence exchange rates. In a fixed exchange rate system, exchange rates among currencies are not allowed to change.

What are the three types of exchange rate

4.5. 1 Types of Exchange Rate SystemsA floating exchange rate.A fixed exchange rate.A managed exchange rate.

What is spot vs swap transaction

Unlike a spot transaction where the value of one currency is traded against another, the forward swap market is essentially an interest rate market traded in forward swap points which represent the interest rate differential between two currencies from one value date to another and also indicate the difference between …

What is the main difference between forward transactions and currency futures

A forward contract is signed between party A and party B face to face (or over the counter), whereas in a futures contract there is an intermediary between the two parties. This intermediary is often called a clearance house, which is a part of a stock exchange.

What is exchange transaction rate

Transaction charges are charges applicable for trading on the exchanges & are charged on both buy & sell orders. BSE: 0.00345% of order amount NSE: 0.00345% of order amount. It is applicable for both buy and sell orders. CHECK PRICING.

What are examples of exchange and transactions

For example, if a museum donates free tickets in exchange for cash donations, then that is considered an exchange transaction. When not-for-profits recognize revenues in exchange for services provided to the resource's provider, they will be classified as increases to net assets without donor restrictions.

What are three exchange rate systems

The systems are: 1. Purely Floating Exchange Rates System 2. Fixed Exchange Rates System 3. Managed Exchange Rates System.

What is spot vs forward transaction

A spot rate is the current price at which a commodity, currency, or security can be purchased. A forward rate is the future price a currency trader agrees to or the yield on a bond on a future date.

What is spot and forward transactions

With spot transactions, internationally traded currencies are bought and sold for other currencies at the spot rate. Forward transactions, on the other hand, are traded on a certain date in the future with the relevant premiums and discounts for calculating the forward rate being specified.

What is the difference between forward rate and exchange rate

What's the difference between the spot rate and forward rate The spot rate refers to the immediate exchange rate while the forward rate refers to the future exchange rate agreed upon in forward contracts.

What are two differences between futures contracts and forward contracts

A forward contract usually only has one specified delivery date, whereas there is a range of delivery dates in a futures contract. A forward contract can normally be settled on the delivery date, either by delivering the underlying asset or by making a financial settlement.