What does a 3 to 1 stock split mean

A 3-for-1 stock split means that for every one share held by an investor, there will now be three. In other words, the number of outstanding shares in the market will triple. On the other hand, the price per share after the 3-for-1 stock split will be reduced by dividing the old share price by 3.

Is it better to buy before or after a stock split

Does it matter to buy before or after a stock split If you buy a stock before it splits, you'll pay more per share than what it'll cost after it splits. If you're looking to buy into a stock at a cheaper price, you may want to wait until after the stock split.

Is it good or bad to split Stocks

While a stock split doesn't change the value of your investment, it's generally a good sign for investors. In most cases it means that the company is confident about its position going forward, and that it wants to seek additional investment.

What does a stock split mean for investors

A stock split is when a company's board of directors issues more shares of stock to its current shareholders without diluting the value of their stakes. A stock split increases the number of shares outstanding and lowers the individual value of each share.

Will Tesla stock go up after split

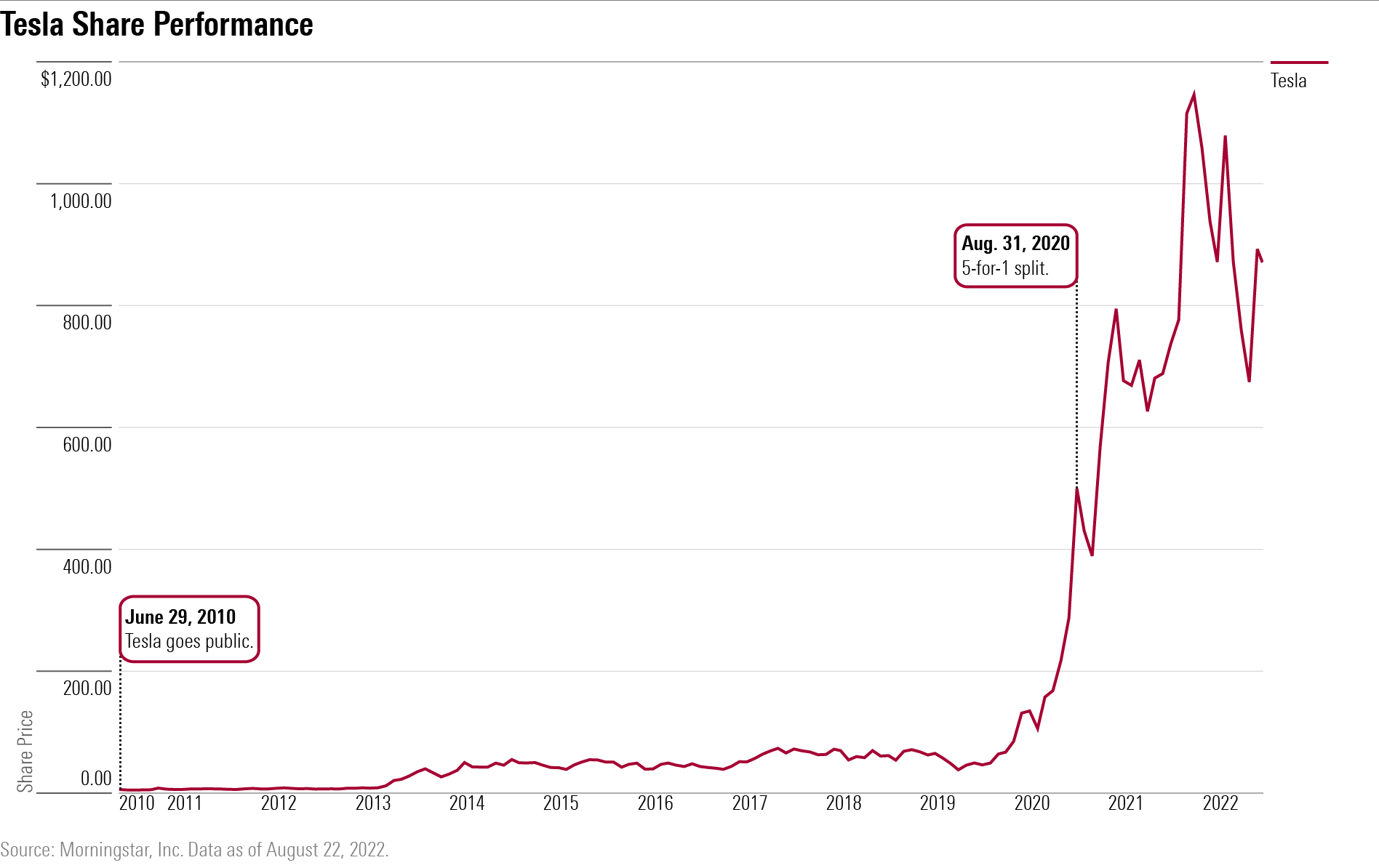

The first time Tesla split its stock in August 2020, shares had gained 81% between the split announcement and the day the stock split. In the month following the split, Tesla shares dropped about 14%, but recovered in less than two months, and were up about 36% six months after the split.

How does the Tesla stock split work

Investors received two additional shares for each share they held prior to the split. Each of the three shares will be valued at a third of the original price, leaving the total value of a shareholder's stock unchanged. The stock split has largely fallen out of fashion in corporate America.

Do stock prices go up after a split

By reducing the price with a split, the company can make its shares easier to buy. This can boost liquidity and encourage new investment. Lower share prices can also help a company compete for investors against similar firms trading at lower prices. Share prices often rise after a split, at least temporarily.

Do stocks go higher after a split

When a stock splits, it can also result in a share price increase—even though there may be a decrease immediately after the stock split. This is because small investors may perceive the stock as more affordable and buy the stock. This effectively boosts demand for the stock and drives up prices.

Do I lose money if my stock splits

Investors do not typically lose money as a result of a stock split. In fact, a stock split might increase the value of your investment as the lower share price draws in new investors.

What does 10 to 1 stock split mean

A 10 for 1 stock split means that for each share an investor has, there will now be ten. This overall value of the company will still be the same due to market capitalization. This can be figured out by multiplying the total shares by the price each share is worth.

Does the investor lose money when shares are split

Investors do not typically lose money as a result of a stock split. In fact, a stock split might increase the value of your investment as the lower share price draws in new investors.

Do stocks rise after a split

When a stock splits, it can also result in a share price increase—even though there may be a decrease immediately after the stock split. This is because small investors may perceive the stock as more affordable and buy the stock. This effectively boosts demand for the stock and drives up prices.

How much will Tesla stock be worth in 10 years

Baron said he believes Tesla can hit $500 to $600 per share by the year 2025 and the company could be worth $4.5 trillion in the next eight to 10 years. “But that's not including robots, that's not including autonomous vehicles, that's not including batteries,” Baron said in November 2022.

Is Tesla a good long-term stock

Tesla's long-term future looks bright, and the stock could easily be higher five or 10 years from now, but it's hard to see the stock as a good enough value today to buy shares.

Is Tesla stock split a good thing

The split brings down the price of the stock, which attracts a wider range of buyers. Investors who previously couldn't afford a share might now be tempted. But a split does not change the current value of the company in any way. Reverse stock splits can be used to reduce the number of shares outstanding.

Is Tesla stock split good for investors

The total value of your investment isn't directly impacted by the stock split because a company's market cap is unchanged by stock splits. The decrease in price per share is offset by the increase in the number of shares you own.

What is the downside of a stock split

Con: Could trigger volatility.

When there are changes in the price of a particular stock, there's a risk of triggering volatility as investors move in or out of the stock. Con: Does not add any new value: At least in the short term, the total value of your assets for the stock in question remains the same.

What is the benefit of stock split

Increases Liquidity – A stock split can make shares more affordable to smaller investors, which can increase liquidity in the stock. Doesn't Create Real Value – Stock splits don't increase the intrinsic value of the company. The total market capitalization remains the same as before the split.

Should I sell after a stock split

Splits are often a bullish sign since valuations get so high that the stock may be out of reach for smaller investors trying to stay diversified. Investors who own a stock that splits may not make a lot of money immediately, but they shouldn't sell the stock since the split is likely a positive sign.

Does the investor lose money after a stock split

Investors do not typically lose money as a result of a stock split. In fact, a stock split might increase the value of your investment as the lower share price draws in new investors.

Do stocks usually go up after a split

Share prices often rise after a split, at least temporarily. This may be due to purchases by investors who wanted to buy but were put off by high prices or to the attention generated by the stock split announcement.

What does a 20 to 1 stock split do

When a company splits its stock, that means it divides each existing share into multiple new shares. In a 20-1 stock split, every share of the company's stock will be split into 20 new shares, each of which would be worth one twentieth of the original share value.

What does a 5 1 split mean

As mentioned above, the stock split happens in a specified ratio. For example, if the ratio is 1:5, it means that for every one share held the shareholder will get 5 shares respectively. Remember that in a stock split, the face value of the share decreases by the ratio of the split.

What is the benefit of a stock split

Publicly traded companies periodically choose to split their stocks when share prices climb too high. Taking this step reduces the unit price of each stock. “For example, if a company's share price is $100, the board might decide that by splitting the shares, they can make their stock more accessible to more investors.

Why I don’t lose money when stock split

If you own a stock that splits, the total value of your shares always remains the same. The only thing that changes is the number of shares on the market. For example, if a company you invest in issues a 2-for-1 split, you'd receive one extra share for each share that you already own.