What is a 5-star rating on Morningstar

A 5-star rating means the stock is undervalued and trading at an attractive discount relative to its fair value estimate. To unlock pre-built screens curated by our seasoned analysts, subscribe to Morningstar Investor.

Is 4 stars a good Morningstar Rating

A 4-star rating means the stock is moderately undervalued and trading at a slight discount relative to its fair value estimate. Subscribe to Morningstar Investor to see what companies are trading at a discount.

What is the Morningstar star rating

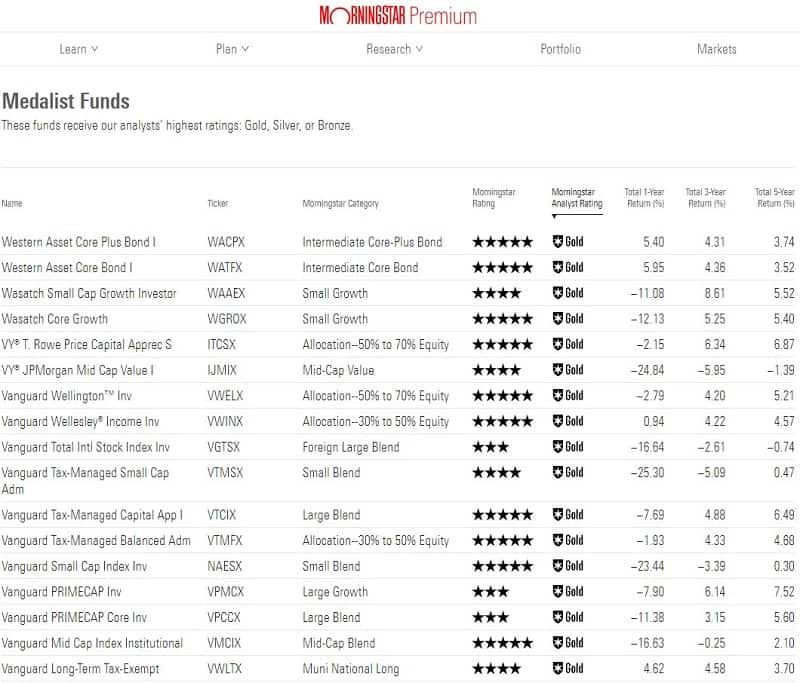

Star ratings are graded on a curve; the top 10% of funds receive five stars, the next 22.5% receive four stars, the middle 35% receive three stars, the next 22.5% receive two stars and the bottom 10% get one star. Morningstar doesn't offer an abstract rating for any fund; everything is relative and risk-adjusted.

Is a higher Morningstar Rating better

Morningstar ratings are a system for evaluating the strength of an investment based on how it has performed in the past. On a scale of one to five stars, a Morningstar rating measures investments based on backward-looking data. The more stars, the better a fund or stock's historic returns.

Is a Morningstar rating of 5 good

The Morningstar risk rating is a ranking given by research firm Morningstar to publicly traded mutual funds and exchange traded funds (ETFs). A score of 5 is given to the best risk performers, with a 1 to the worst. Morningstar ratings are based on the fund's historical performance compared to other like funds.

Is 3 stars a good Morningstar rating

A 3-star rating means the stock is fairly valued and trading at or close to its fair value estimate.

Can you trust Morningstar ratings

Key Takeaways. Morningstar is a highly regarded mutual fund and exchange-traded fund (ETF) rating agency. The agency's research is used by many big names in the financial sector, including the Financial Industry Regulatory Authority.

Is 3 stars a good Morningstar Rating

A 3-star rating means the stock is fairly valued and trading at or close to its fair value estimate.

Is a 2 star Morningstar Rating good

A 2-star rating means the stock is overvalued and trading at a slight premium relative to its fair value estimate.

Is a Morningstar Rating of 5 good

The Morningstar risk rating is a ranking given by research firm Morningstar to publicly traded mutual funds and exchange traded funds (ETFs). A score of 5 is given to the best risk performers, with a 1 to the worst. Morningstar ratings are based on the fund's historical performance compared to other like funds.

Is a 2 star Morningstar rating good

A 2-star rating means the stock is overvalued and trading at a slight premium relative to its fair value estimate.

Is a Morningstar Rating of 3 good

A 3-star rating means the stock is fairly valued and trading at or close to its fair value estimate.

Do Morningstar 5-star funds perform better

Over the full period, the average 5-star fund beat the category average by nearly 1.25% per year; the average 1-star fund lagged by around 2% per year. Higher-rated funds outperformed their average peer about 1.5 times as often as lower-rated funds during the full period spanning the rally and sell-off, as shown below.