What is requirement 7 of PCI DSS requires

PCI DSS Requirement 7: Restrict access to cardholder data by business need to know. To implement strong access control measures, service providers and merchants must be able to allow or deny access to cardholder data systems.

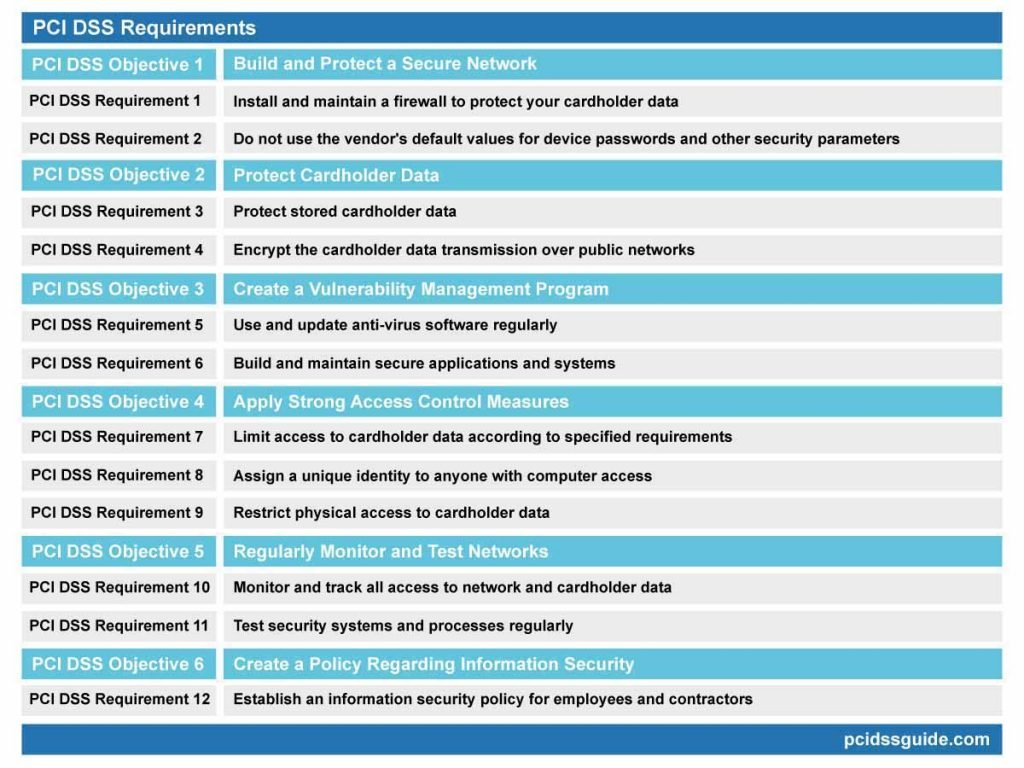

What does PCI DSS require

The PCI DSS 12 requirements are as follows: Install and maintain a firewall configuration to protect cardholder data. Do not use vendor-supplied defaults for system passwords and other security parameters. Protect stored cardholder data.

What is the requirement 10 of PCI DSS requires that organization

PCI DSS Requirement 10: Track and monitor all access to network resources and cardholder data. PCI DSS Requirement 10 is one of the most important PCI DSS compliance requirements, as it directly addresses network security and access.

What is PCI DSS compliance checklist

PCI requirements cover these four things: To protect cardholder data stored in your business environment. To use Antivirus solutions and regularly update them to enable maximum security. To ensure that access to cardholder data is regulated by access control systems, i.e. on a need-to-know basis.

What is PCI DSS requirement 7 and 8

7: Set the user ID lockout time at least 30 minutes or until a system administrator reset the account. PCI DSS Requirement 8.1. 8: If a session has been idle for more than 15 minutes, ask the user to re-authenticate to reactivate the terminal or session.

What is PCI DSS requirement 1.3 7

PCI DSS Requirement 1.3. 7: Do not disclose private IP addresses and routing information to unauthorized parties.

What does requirement 6 of PCI DSS state

PCI DSS Requirement 6 deals with the development of secure applications and systems. It aims to properly manage security patches and secure system and application configurations to ensure continued protection against misuse or compromise of cardholder data.

What is PCI DSS and why it required

PCI compliance is compliance with The Payment Card Industry Data Security Standard (PCI DSS), a set of requirements intended to ensure that all companies that process, store, or transmit credit card information maintain a secure environment.

What are the 12 PCI requirements

What are the 12 requirements of PCI DSSProtect your system with firewalls.Configure passwords and settings.Protect stored cardholder data.Encrypt transmission of cardholder data across open, public networks.Use and regularly update anti-virus software.Regularly update and patch systems.

What is requirement 9 PCI DSS

PCI DSS Requirement 9: Restrict physical access to cardholder data. Any physical access to systems holding cardholder data allows individuals to access devices or data and destroy systems or hard copies. Consequently, such access should be restricted to authorized personnel only.

What is requirement 6.3 of the PCI DSS

PCI DSS Requirement 6.3: Develop internal and external software applications securely. Security should be included in the definition, design, analysis and testing phases of the software development process.

What are the 6 compliance groups for PCI DSS

6 PRINCIPLES OF PCI DSSBuild and maintain a secure network and systems.Protect cardholder data.Maintain a vulnerability management program.Implement strong access control measures.Regularly monitor and test networks.Maintain an information security policy.

What is PCI 7

PCI DSS Requirement 7: Restrict access to cardholder data based on business requirements. Important data should be accessible only by authorized personnel. For this, systems and processes must be to limit access according to their merits and business responsibilities.

What is PCI requirement 8.1 7

If an account is locked out due to someone continually trying to guess a password, controls to delay reactivation of these locked accounts stops the malicious individual from continually guessing the password (they will have to stop for a minimum of 30 minutes until the account is reactivated).

What is PCI DSS requirement 3.6 7

PCI DSS Requirement 3.6. 7: Preventing unauthorized replacement of cryptographic keys. PCI DSS Requirement 3.6. 8: Cryptographic key custodians need to formally acknowledge that they understand and accept their key responsibilities.

What is PCI requirement 6.5 7

PCI Requirement 6.5. 7 requires that you protect all of your organization's web applications, internal application interfaces, and external application interfaces from XSS. Web applications, the PCI DSS states, have unique security risks as well as relative ease and occurrence of compromise.

Why is PCI required

PCI Compliance standards mean that your systems are secure, and your customers can trust you with their sensitive payment card information; trust leads to customer confidence and repeat customers. PCI Compliance improves your reputation with acquirers and payment brands – just the partners your business needs.

What 4 things does PCI DSS cover

PCI DSS controls cover any business that:Processes digital transactions and payments using cards.Stores credit card data.Transmits cardholder information to another entity.Has contact with protected cardholder data.

What is PCI requirement 7.1 4

PCI DSS Requirement 7.1. 4: Request documented approval from the competent parties that indicate the required privileges. Written or electronically documented approvals ensure that those with access and privileges are known and empowered by management.

What is PCI requirement 11

PCI Requirement 11 focuses on a critical aspect of PCI compliance: testing. This testing should be of wireless access points, incident response procedures, vulnerability scans, penetration testing, intrusion-detection, change-detection, and policies and procedures.

What is the PCI DSS requirement 1.3 7

PCI DSS Requirement 1.3. 7: Do not disclose private IP addresses and routing information to unauthorized parties.

What is the PCI DSS compliance process

Compliance with PCI DSS is a continuous process that involves three steps: Assess. Identify and inventory assets and processes that handle cardholder data, and analyze them for vulnerabilities that could lead to exposure. Repair.

Why do we need PCI DSS compliance

The Payment Card Industry Data Security Standard (PCI DSS, or just PCI) is mandated by credit card companies to help protect cardholder data. The standard outlines guidelines on how to capture, process, and store sensitive customer data.

What is requirement 5 of PCI DSS

PCI REQUIREMENT 5: Protect All Systems and Networks from Malicious Software. PCI REQUIREMENT 6: Develop and Maintain Secure Systems and Software. Implement Strong Access Control Measures. Regularly Monitor and Test Networks.

Does PCI DSS require compliance

According to an American Bar Association post, PCI DSS compliance is not a legal requirement, but because each credit card company has its own PCI DSS language and related fees for noncompliance, PCI DSS compliance becomes part of the contractual agreement between the vendor and credit card company.