What is the accounting standard number 5

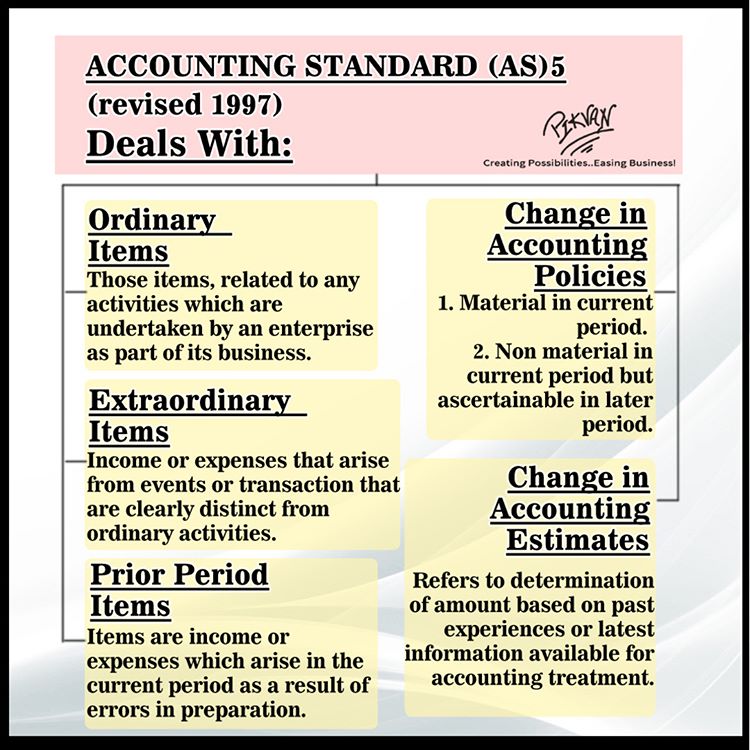

Accounting Standard 5 (AS 5) deals with the classification and disclosure of specific items in the Statement of Profit and Loss. The purpose of AS 5 is to suggest such a classification and disclosure in order to bring uniformity in the preparation and presentation of statement of net profit or loss across enterprises.

What is the scope of accounting standard 5

Scope. 1. This Standard should be applied by an enterprise in presenting profit or loss from ordinary activities, extraordinary items and prior period items in the statement of profit and loss, in accounting for changes in accounting estimates, and in disclosure of changes in accounting policies.

What is as 5 change in accounting policy

The objective of AS 5: Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies, is to prescribe the classification and disclosure of certain items in the statement of profit and loss so that all enterprises prepare and present such a statement on a uniform basis.

What are prior period items as per as 5

Prior Period Items are income or expenses which arise in the current period as a result of errors or omissions in the preparation of the financial statements of one or more prior periods.

When was the International accounting standard 5 issued

March 2004

In March 2004 the Board issued IFRS 5 Non‑current Assets Held for Sale and Discontinued Operations to replace IAS 35.

What is accounting standard 6

AS-6 deals with depreciation of the tangible asset. Hence, only the historical cost, accumulated depreciation on the asset and total depreciation for the period for each class of asset will be recorded.

What is the objective and scope of IFRS 5

Objective of IFRS 5

IFRS 5 focuses on 2 main areas: It specifies the accounting treatment for assets (or disposal groups) held for sale, and. It sets the presentation and disclosure requirements for discontinued operations.

What is accounting standards 6

AS-6 deals with depreciation of the tangible asset. Hence, only the historical cost, accumulated depreciation on the asset and total depreciation for the period for each class of asset will be recorded.

What is the 5th steps on the accounting cycle

Defining the accounting cycle with steps: (1) Financial transactions, (2) Journal entries, (3) Posting to the Ledger, (4) Trial Balance Period, and (5) Reporting Period with Financial Reporting and Auditing.

What are the 4 phases of accounting 5 enumerate and distinguish

The four phases of accounting are as follows:Recording transactions.Classifying transactions.Summarising.Interpreting financial data.

What is the meaning of IFRS 5

IFRS 5 refers to the International Financial Reporting Standards relating to Non-current assets held for sale and discontinued operations.

What is the purpose of IFRS 5

The objective of IFRS 5 is to specify the accounting for assets held for sale, and the presentation and disclosure of discontinued operations.

What is accounting standard 7

Accounting Standard 7 (AS 7) relates with accounting of construction contracts. The very purpose of this accounting standard is to specify the accounting treatment of revenue and costs associated with construction contracts.

What is accounting standards 4

Ans: As per AS 4, adjustments to assets and liabilities are required for events occurring after the balance sheet date that provide additional information materially affecting the determination of the amounts relating to conditions existing at the balance sheet date.

What is IFRS 5 summary

IFRS 5 became effective on January 1 2005, and has two main areas of focus: It specifies the accounting treatment for assets (or disposal groups) held for sale, and. It sets the presentation and disclosure requirements for discontinued operations.

What does IFRS 5 deals with

Key provisions of IFRS 5 relating to assets held for salemanagement is committed to a plan to sell.the asset is available for immediate sale.an active programme to locate a buyer is initiated.the sale is highly probable, within 12 months of classification as held for sale (subject to limited exceptions)

What is accounting standards 7

AS 7 Construction Contract describes and lays out the accounting treatment in respect of the revenue and costs in relation to a construction contract. AS 7 Construction Contract is to be used in for the accounting of construction contracts in the financial statements of the contractors.

What does accounting standard 7 mean

Accounting Standard 7 (AS 7) relates with accounting of construction contracts. The very purpose of this accounting standard is to specify the accounting treatment of revenue and costs associated with construction contracts.

What are the 5 principles of an accountant 4 explain

Although the guidelines for accountants are extensive, there are five main principles that underpin accounting practices and the preparation of financial statements. These are the accrual principle, the matching principle, the historic cost principle, the conservatism principle and the principle of substance over form.

What are the 5 elements of accounting

In general, there are 5 major account subcategories: revenue, expenses, equity, assets, and liabilities. A business transaction will fall into one of these categories, providing an easily understood breakdown of all financial transactions conducted during a specific accounting period.

What is the summary of IFRS 5

Summary. Under IFRS 5, a discontinued operation may be presented as a single line item within the statement of profit or loss and other comprehensive income or an entire separate column, detailed line by line. If the former approach is taken, a disclosure note must present a more detailed analysis.

What is the introduction of IFRS 5

IFRS 5 requires that assets held for sale be measured at the lower of carrying amount and fair value less costs to sell, which can be difficult to determine, particularly in a volatile market environment.

What is accounting standard 8 for

8 Ind ASs set out accounting policies that result in financial statements containing relevant and reliable information about the transactions, other events and conditions to which they apply. Those policies need not be applied when the effect of applying them is immaterial.

What is the definition of IFRS 5

IFRS 5 lays out certain criteria that must be met to classify a sale as highly probable: The management must have a commitment to sell the asset. The asset must be actively marketed for sale at a reasonable price. An active program to find a buyer must be initiated.

What is accounting standard No 8

What is Indian Accounting standard 8 This standard prescribes the guidelines for selecting and modifying accounting policies, together with the accounting treatment and disclosure of changes in accounting policies, changes in accounting estimates and corrections of error.