What is the meaning of private bank

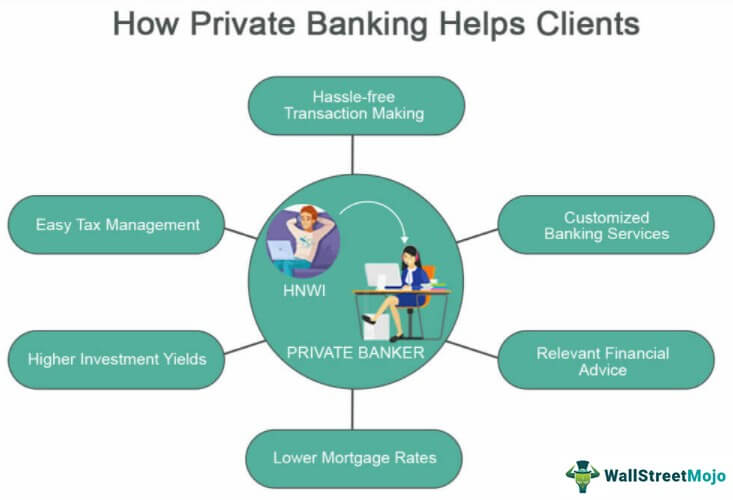

Private banking consists of personalized financial services and products offered to the high-net-worth individual (HNWI) clients of a retail bank or other financial institution. It includes a wide range of wealth management services, and all provided under one roof.

Which is best private bank

List of 10 Best Private Banks in India 2023

| Bank Name | Established On | Revenue in 2023 |

|---|---|---|

| HDFC Bank | 1994 | ₹ 2.05 lakh cr. |

| ICICI Bank | 1994 | ₹ 186,178.80 cr. |

| Axis Bank | 1993 | ₹ 106,155 cr. |

| Kotak Mahindra Bank | 2003 | ₹ 67,981.02 cr. |

What are 3 examples of a bank

They are commercial banks, thrifts (which include savings and loan associations and savings banks) and credit unions. These three types of institutions have become more like each other in recent decades, and their unique identities have become less distinct.

What are the functions of a private bank

Private banking provides investment-related advice and aims to address the entire financial circumstances of each client. Private banking services typically aid clients in protecting and maintaining their assets. Employees designated to aid each client work to provide individualized financing solutions.

What is the difference between a bank and a private bank

Commercial banking provides financial services to corporations, municipalities, nonprofit organizations and other institutions. Private banking offers personal services to individuals or families.

What is a private bank vs regular bank

Regular banking services are open to anyone – there are many banks that don't even require a minimum deposit amount to open accounts. Private banking, on the other hand, is only available for individuals with higher net worth due to the high minimum balance requirements and potential fees.

Which is the largest private bank

HDFC Bank

As of March 2021, with total assets of more than 15 trillion Indian rupees, HDFC Bank is the largest private sector bank in India. If we consider both the public sector banks and private sector banks, then, State Bank of India (SBI) is the largest bank in India having assets worth more than 40 trillion Indian rupees.

Why is private banking better

Private banking may include better interest rates on deposit accounts, like certificates of deposit and savings accounts, and lower annual percentage rates on loans and mortgages. Many of these accounts also have few or no fees attached.

What are the 3 most popular banks

JPMorgan Chase – $3.31 Trillion.Bank of America – $2.41 Trillion.Citigroup – $1.714 Trillion.Wells Fargo & Co. – $1.712 Trillion.U.S. Bancorp – $591.21 Billion.PNC Financial Services – $553.39 Billion.Truist Financial Corporation – $534.19 Billion.Goldman Sachs – $513.91 Billion.

What are the five examples of banks

Retail Banks. Retail banks, also referred to as consumer banking or personal banking, are the types of banks that offer services that cater to individuals.Commercial Banks.Investment Banks.Credit Unions.Private Banks.Savings and Loan Associations.Challenger Banks.Neobanks.

What is the difference between a public bank and a private bank

Public sector banks are controlled by the government. Private sector banks are controlled by companies or an individual. More than 50% of the shareholding of public sector banks lies with the government (state or central). The majority shareholding of private sector banks lies with private companies or individuals.

What type of banking is private

Private banking is a form of banking service in which the HNWIs get a dedicated financial representative who manages their banking and financial matters. This facility is available only to high-net-worth individuals (HNWI) who have a certain minimum amount of investable assets.

Which country has most private banks

Historically, Switzerland was favoured as a prime location for offshore banking (more information), and still remains the largest centre for offshore private wealth today with over $2 trillion in AUM. Switzerland has long been a stable country with a strong economy.

Who is the owner of a private bank

Private banks are banks owned by either the individual or a general partner(s) with limited partner(s). Private banks are not incorporated. In any such case, creditors can look to both the "entirety of the bank's assets" as well as the entirety of the sole-proprietor's/general-partners' assets.

What is the difference between banking and private banking

What is the difference between commercial and private banking Commercial banking provides financial services to corporations, municipalities, nonprofit organizations and other institutions. Private banking offers personal services to individuals or families.

What are the advantages and disadvantages of private bank

Private banking allows access to personalized service, all-in-one financial solutions, attractive interest rates, reduced fees, and exclusive perks. Its drawbacks include low expertise, limited product offerings, high employee turnover, and potential conflicts of interest.

Which are the 4 big banks

What are the Big Four Banks The term 'Big Four Banks' alludes to the Commonwealth Bank of Australia (ASX:CBA), Westpac Banking Corporation (ASX:WBC), Australia and New Zealand Banking Group – or ANZ Bank for short – (ASX:ANZ) and National Australia Bank (ASX:NAB).

What are the 4 most common types of bank accounts

The most common types of bank accounts include:Checking accounts.Savings accounts.Money market accounts (MMAs)Certificate of deposit accounts (CDs)

What are the 4 types of banks

The 4 different types of banks are Central Bank, Commercial Bank, Cooperative Banks, Regional Rural Banks. You can read about the Types of Banks in India – Category and Functions of Banks in India in the given link.

Is private banking better

"Though expensive, private banking is often worth the price for individuals who demand a high degree of service, want ongoing professional advice for no extra charge and have their assets held in sophisticated structures that require professional management,” Frederick says. Dedicated help.

What banks are private banks

The Private Banking Top 10 List.UBS.Morgan Stanley.Bank of America.J.P. Morgan Private Bank.Citigroup.BNP Paribas.Goldman Sachs.

What is the largest private bank

By AUM

| Rank | Bank name | Total assets (2019) (US$ Billion) |

|---|---|---|

| 1 | UBS Global Wealth Management | 2,260.0 |

| 2 | Morgan Stanley Wealth Management | 1,046.0 |

| 3 | Bank of America Global Wealth and Investment Management | 1,021.2 |

| 4 | Credit Suisse Private Banking & Wealth Management | 770.0 |

Which bank is biggest in private banking

HDFC

HDFC is the largest private bank in India in terms of market capitalisation with total assets of more than 16 trillion rupees.

Is public bank a private bank

Public banks are owned and operated by governments, while credit unions are private entities collectively owned by their members.

What is the difference between private and foreign banks

Private sector Banks – A bank where the majority stakes are owned by a private organization or an individual or a group of people. Foreign Banks – The banks with their headquarters in foreign countries and branches in our country, fall under this type of bank.