Which is better NRI or NRE

Though there are several differences between an NRE and NRI account, you will need both to manage your funds. An NRE account proves useful for your foreign earnings and you can even send money back to your country of residence freely. An NRI account helps keep your income earned in India safe and within India.

What is the difference between NRI and NRE

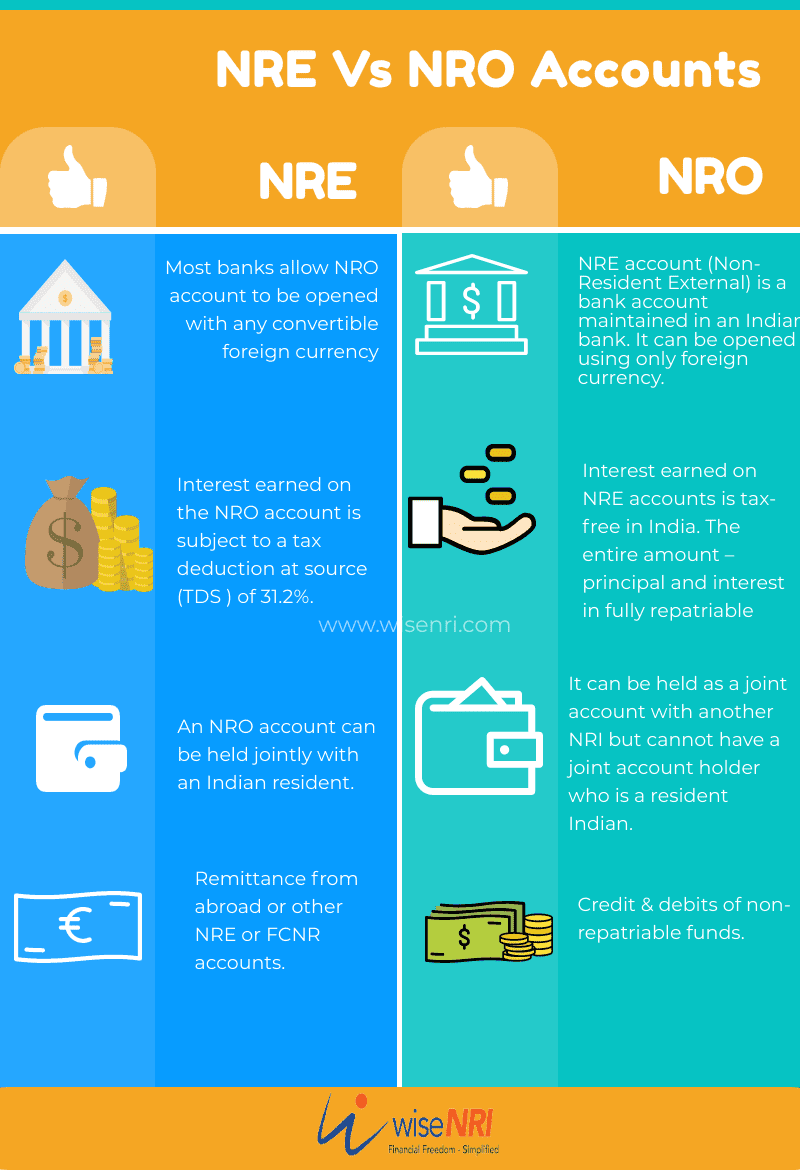

In terms of definition, the NRE full form is non-resident external. These accounts are used to deposit money that you are earning in foreign currency. On the other hand, an NRI (non-resident Indian) account is used to manage the money and earnings that are generated in India and in Indian rupees.

What is the difference between FCNR NRE and NRO account

NRO Account is for depositing income that one earns in India. NRE account is for depositing income earned outside India in India. FCNR account is for depositing earnings in foreign currency in an Indian account. Deposits made in this account are repatriable to the NRI's country of residence with certain limits.

Which account is best NRI or NRO

There is no universal right or wrong account. As an NRI, you should arrive at a decision based on your unique needs and income sources. You can use an NRE bank account to store foreign currency converted to Indian rupees, while an NRO account is used to keep both foreign income and money earned in India.

What is the disadvantage of NRI

Disadvantages of being an NRI

Some of the drawbacks of being an NRI are listed below: Even though NRIs do not pay income tax to the Indian government, they have to pay taxes to the government of the country of residence. The rate of taxes on income is much higher than India in most first world countries.

Is NRO account taxable in India

In India, the interest earned on deposits in NRO accounts is fully taxable. The interest income on funds in an NRO account is subject to tax deducted at source (TDS). A 30% tax on the NRO account, in addition to the applicable cess and surcharge, is levied on the interest income from these accounts.

Is it better to keep money in NRE or NRO account

You should opt for NRE Accounts if you want to hold or maintain your overseas earnings in Indian currency. NRE Accounts are also suitable if you wish to keep your savings liquid. You should opt for NRO Accounts if you want to save your earnings from India in Indian currency itself.

What is the disadvantage of NRO account

Limitations of NRO Accounts

One of the major disadvantages of an NRO account is the cap of USD 1 million on the repatriation of funds. Moreover, the interest income of an NRO account is also subject to taxes.

Can I withdraw money from NRO account in India

This account allows you to receive funds in either Indian or foreign currency. However, only Indian currency can be withdrawn as NRO Accounts are kept in Indian currency and cannot be freely repatriated into any foreign currency.

How can NRI avoid tax in India

Submitting Form 15G or Form 15H: NRIs can submit Form 15G or Form 15H to the Indian income tax department to avoid TDS on their income if their total income is below the taxable limit. Form 15G is for individuals and HUFs, while Form 15H is for senior citizens.

What is the disadvantage of NRO

Limitations of NRO Accounts

But the NRE and NRO full form is not the only difference between the two types of accounts. One of the major disadvantages of an NRO account is the cap of USD 1 million on the repatriation of funds. Moreover, the interest income of an NRO account is also subject to taxes.

Do I need to pay tax on NRO account in India

In India, the interest earned on deposits in NRO accounts is fully taxable. The interest income on funds in an NRO account is subject to tax deducted at source (TDS). A 30% tax on the NRO account, in addition to the applicable cess and surcharge, is levied on the interest income from these accounts.

Can I transfer money from NRO to international account

Two documents are required to remit funds from an NRO account: Form 15CA and Form 15CB. The purpose of these documents is to ensure that taxes are paid on funds before they are remitted abroad.

Is money sent to India taxable if NRI

However, if an NRI sends money to somebody who is not related by blood, then there is a tax implication. An amount over Rs 50,000 per year is subject to taxation in the hands of the receiver. For an NRI who is sending money from the US, then blood relation does not make a difference.

How much NRI is tax free in India

As a Non-resident, you still get the benefit of the basic exemption limit of Rs. 2,50,000 from your total income. However, If your total income in India consists of only short-term capital gains or long-term capital gains, then the benefit of the basic exemption limit is not available in respect of such gains.

How much money can be kept in NRO account

USD 1 million

NRO accounts have limited access for repatriation. An NRO account restricts you from remitting more than USD 1 million inclusive of taxes during an assessment year. You can repatriate the interest amount freely, but the principal amount can be repatriated only within set limits.

Can money be transferred from NRO to NRI account

You cannot transfer money to a NRE account from a savings account in India. However, you can transfer money from NRO to NRE account. You can also transfer money from one NRE account to another.

How much money can an NRI transfer to India

As of the financial year 2021-2022, the LRS limit for NRIs is INR 2,50,00,000 per financial year. This limit applies to the total amount of funds transferred by an NRI during the financial year, and includes all transfers made for any purpose, including investments, gifts, and personal expenses.

How can I avoid NRI tax in India

NRIs can avoid double taxation (meaning: getting taxed on the same income twice in the country of residence and India) by seeking relief from the Double Taxation Avoidance Agreement (DTAA) between the two countries. Under DTAA, there are two methods to claim tax relief – exemption method and tax credit method.

How much money can NRI transfer to India

As of the financial year 2021-2022, the LRS limit for NRIs is INR 2,50,00,000 per financial year. This limit applies to the total amount of funds transferred by an NRI during the financial year, and includes all transfers made for any purpose, including investments, gifts, and personal expenses.

Do NRI need to declare foreign income in India

By default, income earned by an NRI abroad is not taxable in India. But if the income in India through aspects like capital gains from investments in shares, mutual funds, property rental and term deposits exceed the basic exemption limit as defined in the Income Tax Act, an NRI would have to file a tax return.

What are the disadvantages of NRO account

Limitations of NRO Accounts

One of the major disadvantages of an NRO account is the cap of USD 1 million on the repatriation of funds. Moreover, the interest income of an NRO account is also subject to taxes.

Can you withdraw money from NRO account abroad

This account allows you to receive funds in either Indian or foreign currency. However, only Indian currency can be withdrawn as NRO Accounts are kept in Indian currency and cannot be freely repatriated into any foreign currency.

How much money can NRI transfer to India without tax

From October 1, 2020, remittances of up to Rs700,000 (Dh33,103) in a financial year are free from tax liability. Amount exceeding Rs700,000 is liable to TCS (Tax Collected at Source) in the hands of the individual at 5 per cent. (TCS is collected by the receiver at the time of receipt of payment.)

Is remittance received in India is taxable for NRI

If an NRI receives income in India, such income is taxable in India,i.e. India as a source state has the right to tax such income. However, the country where such NRI is a resident will also have a right to tax such income as it is the residence state.