What is the 50 30 20 budgeting rule

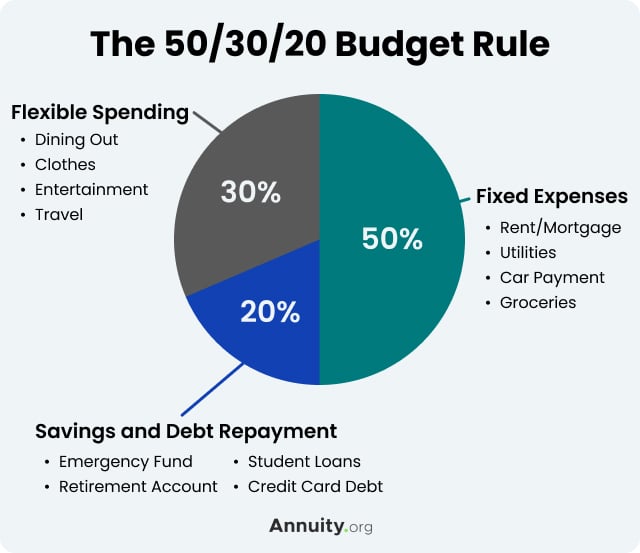

The rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do. The remaining half should be split up between 20% savings and debt repayment and 30% to everything else that you might want.

What are the benefits of a 50 30 20 budget

Why Is the 50/30/20 Rule Easy To FollowOnly requires you to track three categories.May be less intimidating than more complicated budgeting methods.Provides a clear framework of where your money should be going.Allows you to set spending boundaries while still treating yourself.Clarifies how much you should be saving.

What is the disadvantage of 50 30 20 budget

Drawbacks of the 50/30/20 rule:Lacks detail.May not help individuals isolate specific areas of overspending.Doesn't fit everyone's needs, particularly those with aggressive savings or debt-repayment goals.May not be a good fit for those with more complex financial situations.

What is the disadvantage of 50-30-20 budget

Drawbacks of the 50/30/20 rule:Lacks detail.May not help individuals isolate specific areas of overspending.Doesn't fit everyone's needs, particularly those with aggressive savings or debt-repayment goals.May not be a good fit for those with more complex financial situations.

What are the pros and cons for the 50-30-20 budget

Here are the pros and cons of the 50-30-20 budget method:PRO: It's simple.PRO: You learn where your money goes each month.PRO: It's doesn't feel like a diet.PRO: It pushes you to reduce your fixed costs.PRO: You don't need to monitor every single purchase.CON: It doesn't take into account your circumstances.

Is 50 30 20 a good budget

The 50/30/20 Rule can be a good budgeting method for some, but whether the system is right for you will be determined by your unique monthly expenses. Depending on your income and where you live, earmarking 50% of your income toward your needs may not be enough.

Who came up with 50 30 20 budget

Senator Elizabeth Warren

The 50-30-20 Budgeting Strategy

Created by Senator Elizabeth Warren, the basic rule is to divide up after-tax income, and spend 50% of it on needs, 30% on wants, and 20% on savings.

Is saving 20% realistic

If you can afford it, saving 50% of your paycheck can help you reach financial stability in the future. However, if that isn't feasible right now, start by setting aside 10-20%, then gradually increase the amount over time until you reach a comfortable level of savings.

Where did the 50 30 20 budget come from

The 50/30/20 rule is a simplified budgeting method designed to help you better manage your spending while also stowing away funds for the future. The rule originated in a book titled All Your Worth: The Ultimate Lifetime Money Plan, written by Sen. Elizabeth Warren and her daughter, Amelia Warren Tyagi.

What is the 70 20 10 rule money

The biggest chunk, 70%, goes towards living expenses while 20% goes towards repaying any debt, or to savings if all your debt is covered. The remaining 10% is your 'fun bucket', money set aside for the things you want after your essentials, debt and savings goals are taken care of.

What is the 70 20 rule for savings

A new money rule: 70-20-10

That's why we really like the idea of a 70-20-10 rule for your money. Applying around 70% of your take-home pay to needs, letting around 20% go to wants, and aiming to save only 10% are simply more realistic goals to shoot for right now.

What are the pros and cons of the 50 30 20 method of budgeting

Here are the pros and cons of the 50-30-20 budget method:PRO: It's simple.PRO: You learn where your money goes each month.PRO: It's doesn't feel like a diet.PRO: It pushes you to reduce your fixed costs.PRO: You don't need to monitor every single purchase.CON: It doesn't take into account your circumstances.

What is the 75 15 10 rule

for anybody with any amount of money. so for every dollar you make, you can spend 75 cents. then 15 cents is the minimum that you can invest, and 10 cents is the minimum that you save. this allows you to allocate 25 of your income. towards wealth building activities.

What is the 40 40 20 budget rule

It goes like this: 40% of income should go towards necessities (such as rent/mortgage, utilities, and groceries) 30% should go towards discretionary spending (such as dining out, entertainment, and shopping) – Hubble Spending Money Account is just for this. 20% should go towards savings or paying off debt.

What is the 80 10 10 money rule

The 80/10/10 budget is just one way this can be done! In this approach, like other popular budgets, 80% of income goes towards spendings, such as bills, groceries, or anything else needed. 10% of income goes directly into savings to ensure that money is added regularly. The last 10% of income goes to charity.

What is the 80 20 10 savings rule

If you save 20% of your income, you will likely have a much higher savings rate than if you only save 10 or 5 percent. Reducing expenses: The 80/20 rule for investing can also help you identify the 20% of expenses that are responsible for 80% of your income – money that can be channeled into your retirement savings.

What is the 80 10 10 rule

The 80/10/10 budget is just one way this can be done! In this approach, like other popular budgets, 80% of income goes towards spendings, such as bills, groceries, or anything else needed. 10% of income goes directly into savings to ensure that money is added regularly. The last 10% of income goes to charity.

What is the 90 10 rule in spending

What Is the 90/10 Rule in Investing The 90/10 rule in investing is a comment made by Warren Buffett regarding asset allocation. The rule stipulates investing 90% of one's investment capital towards low-cost stock-based index funds and the remainder 10% to short-term government bonds.

What is the 80 20 rule for spend

With the 80/20 rule of thumb for budgeting, you put 20% of your take-home pay into savings. The remaining 80% is for spending. It's a simplified version of the 50/30/20 rule of thumb, which allocates 50% of your take-home pay to needs, 30% to wants, and 20% to saving.

What is the 40 rule money

40% of income should go towards necessities (such as rent/mortgage, utilities, and groceries) 30% should go towards discretionary spending (such as dining out, entertainment, and shopping) – Hubble Spending Money Account is just for this. 20% should go towards savings or paying off debt.

What is 15 rule of money

What is the 15-15-15 rule The rule follows a series of three 15s to help investors get 7-figure returns. As per the rule, if you invest ₹15000 per month for 15 years in a fund scheme that offers a 15% interest annually, you can gather ₹1 crore at the end of tenure.

What is the 70 10 10 10 savings rule

This principle consists of allocating 10% of your monthly income to each of the following categories: emergency fund, long-term savings, and giving. The remaining 70% is for your living expenses. 10% – Long Term Savings – Saving for big expenses such as university, new home, retirement, etc.

What is the 50 40 10 rule

that doesn't involve detailed budgeting categories. Instead, you spend 50% of your after-tax pay on needs, 40% on wants, and 10% on savings or paying off debt.

What is the 80 20 rule expenses

The 80/20 budgeting method is a common budgeting approach. It involves saving 20% of your income and limiting your spending to 80% of your earnings. This technique allows you to put savings first, and it's both flexible and easy.

What is the 80 20 10 budget

Ideally, most of the money should go to retirement investments, since financial planners commonly recommend putting at least 10 to 15% of your paycheck away for retirement. The remaining 80% goes toward needs and wants, including food, rent and entertainment.