What is the difference between Level 1 and Level 2 PCI

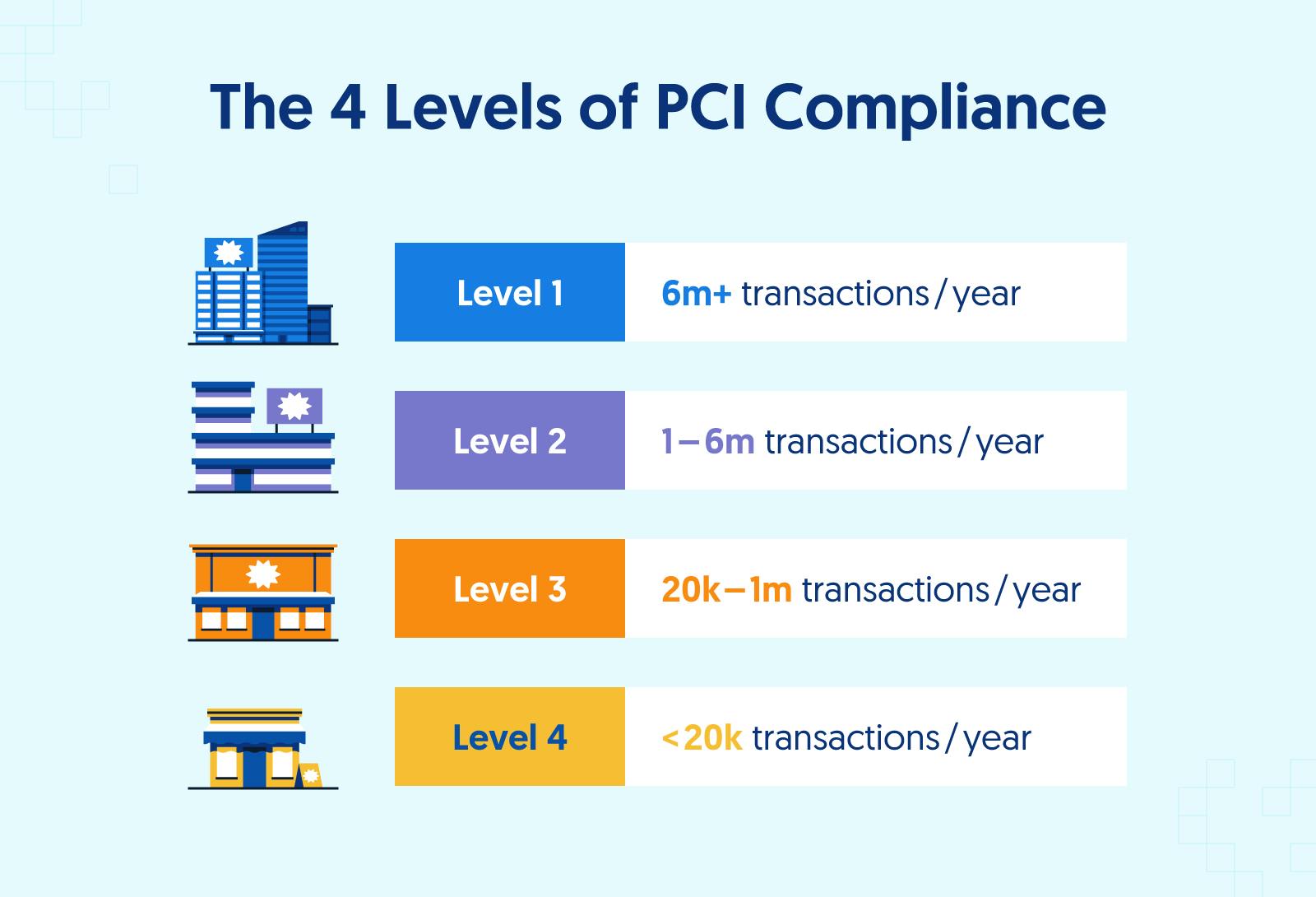

Level 1: Merchants that process over 6 million card transactions annually. Level 2: Merchants that process 1 to 6 million transactions annually. Level 3: Merchants that process 20,000 to 1 million transactions annually. Level 4: Merchants that process fewer than 20,000 transactions annually.

What is PCI Level 2 compliance

PCI Level 2 compliance is mandatory for businesses that process, store or transmit credit card data and process between one and six million transactions per year. PCI DSS compliance can be challenging for companies of all levels.

What is PCI Level 1 compliance

PCI DSS Level 1 is the highest level of compliance and payment security standards merchants can comply with to securely store, transmit, and process credit card information.

What is the difference between PCI Level 2 and Level 3

PCI Level 2: Businesses processing 1 million to 6 million transactions per year. PCI Level 3: Businesses processing 20,000 to 1 million transactions per year. PCI Level 4: Businesses processing less than 20,000 transactions per year.

What is the difference between Level 1 Level 2 and Level 3 processing

Level 1 processing is the default. It doesn't require businesses to provide additional processing data. Meanwhile, Level 2 processing and Level 3 processing require much more information. Because Level 2 and Level 3 collect more data, they're more secure for you, as the business owner, than Level 1 processing.

What is Level 3 PCI compliance

PCI DSS Compliance Level 3

Applies to: Merchants that process between 20,000 and 1 million transactions each year. For example, small-to-medium businesses operating in a local area. PCI DSS Level 3 merchants do not need to perform an external audit, and do not need to submit a Report of Compliance (ROC).

What is PCI Level 1 service provider

Level 1 Service Provider

These are service providers that store, process, or transmit more than 300,000 credit card transactions annually. Note: Receiving a ROC and validating as a Level 1 Service Provider allows you to be on Visa's Global Registry of Approved Service Providers.

What are the different PCI levels

Level 1: Merchants processing over 6 million card transactions per year. Level 2: Merchants processing 1 to 6 million transactions per year. Level 3: Merchants handling 20,000 to 1 million transactions per year. Level 4: Merchants handling fewer than 20,000 transactions per year.

What is PCI standards Level 4

Level 4 applies to merchants that process fewer than 20,000 Visa or Mastercard e-commerce transactions per year or up to 1 million total Visa or Mastercard credit card transactions and that have not suffered a data breach or attack that compromised card or cardholder data.

What is Level II and Level III processing

Level 2 and Level 3 card data (also known as Level II and Level III) is a set of additional information that can be passed during a credit card transaction. Level 2 and Level 3 card data provides more information for business, commercial, corporate, purchasing, and government cardholders.

What is Level 2 card processing

Level 2 processing allows you to take advantage of lower interchange rates, and is generally best for merchants that do business with small or medium-sized businesses. Data requirements can vary between card networks, but generally, to qualify for level 2, you'll need to provide the: Sales tax indicator and amount.

What is Level 4 PCI compliance

PCI DSS Compliance Level 4

Applies to: Any merchant processing fewer than 20,000 e-commerce transactions per year, and all other merchants — regardless of acceptance channel — processing up to 1 million Visa transactions per year. For example, a small local business.

What are the 4 levels of PCI compliance

Level 1: Merchants processing over 6 million card transactions per year. Level 2: Merchants processing 1 to 6 million transactions per year. Level 3: Merchants handling 20,000 to 1 million transactions per year. Level 4: Merchants handling fewer than 20,000 transactions per year.

What is PCI Category 2

Service providers–entities that process credit card payments for merchants and their financial institutions (also known as “acquiring banks”) or that handle card and cardholder data in some other capacity, such as data destruction–qualify as PCI Compliance Level 2 if they process, store, or transmit fewer than 300,000 …

What is PCI Level 3

PCI DSS compliance Level 3 applies to mid-sized merchants, generally speaking, that process 20,000 to 1 million credit card transactions per year.

What is required for Level 4 PCI compliance

Vendors that qualify as PCI Level 4 must achieve PCI DSS compliance by meeting the purchasing bank's requirements. Typically, what they should do is as follows: Complete a Self-Assessment Questionnaire (SAQ) Have a Approved Scanning Vendor (ASV) perform a quarterly network scan.

What is Level 2 processing

Level 2 processing allows you to take advantage of lower interchange rates, and is generally best for merchants that do business with small or medium-sized businesses. Data requirements can vary between card networks, but generally, to qualify for level 2, you'll need to provide the: Sales tax indicator and amount.

How do you define PCI compliance Level 3

The Payment Card Industry Data Security Standard's (PCI DSS) compliance Level 3 applies to mid-size merchants that, generally speaking, process between 20,000 and 1 million credit card transactions per year.

What is a Level 1 PCI service provider

Level 1 Service Provider

These are service providers that store, process, or transmit more than 300,000 credit card transactions annually. PCI Requirements validated. Annual Report on Compliance (ROC) by a Qualified Security Assessor (QSA)