What is PCI Level 2 or 3

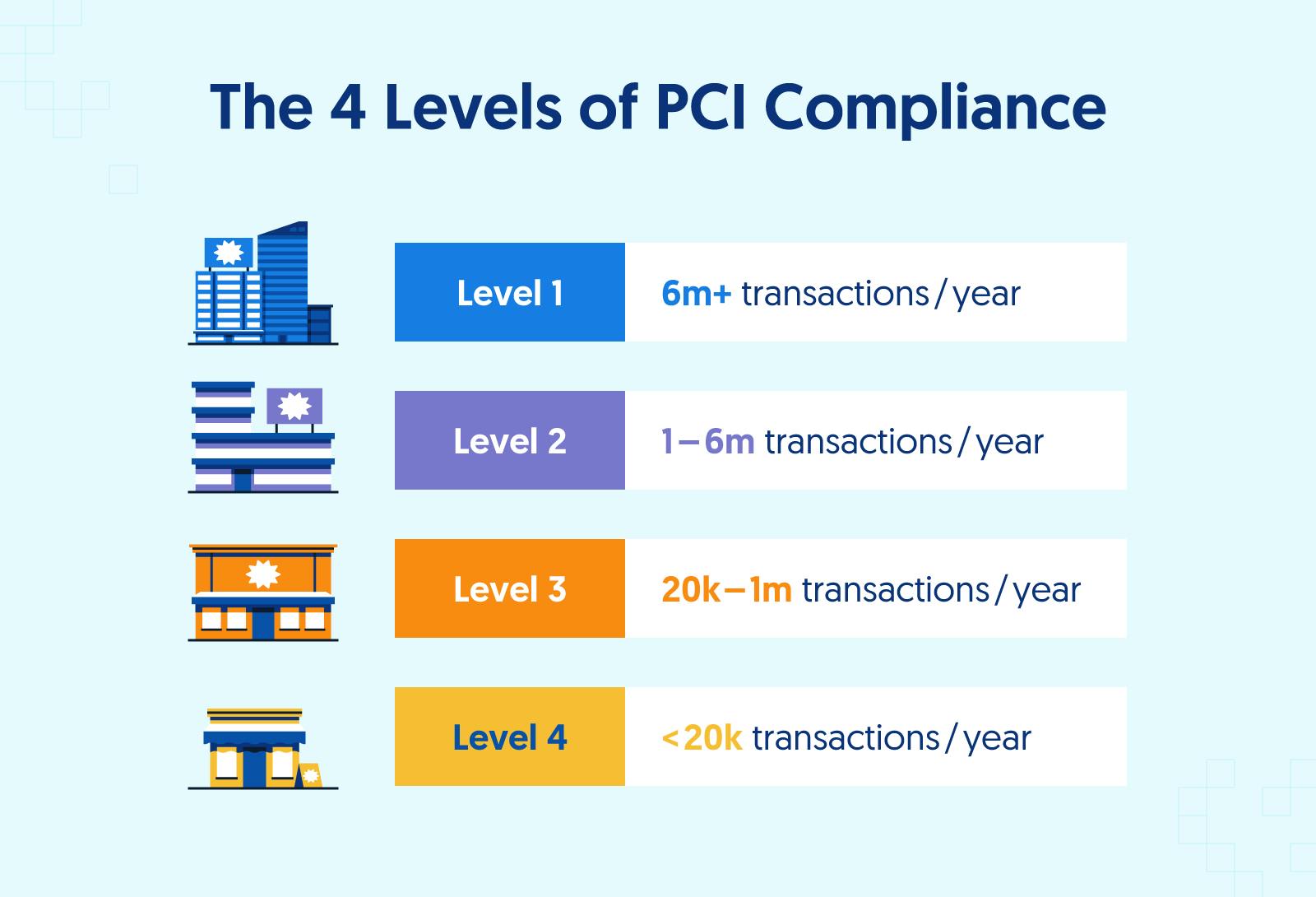

PCI Level 2: Businesses processing 1 million to 6 million transactions per year. PCI Level 3: Businesses processing 20,000 to 1 million transactions per year.

Bản lưu

What is Level 3 PCI compliance

PCI DSS Compliance Level 3

Applies to: Merchants that process between 20,000 and 1 million transactions each year. For example, small-to-medium businesses operating in a local area. PCI DSS Level 3 merchants do not need to perform an external audit, and do not need to submit a Report of Compliance (ROC).

Bản lưu

What is PCI Level 2

PCI Merchant Level 2 applies to merchants who process, store, or forward 1 million to 6 million credit card transactions per year. However, major credit cards also have their set merchant tiers, so your organization's definition depends in part on what cards they accept.

Bản lưu

What are the different PCI levels

Level 1: Merchants processing over 6 million card transactions per year. Level 2: Merchants processing 1 to 6 million transactions per year. Level 3: Merchants handling 20,000 to 1 million transactions per year. Level 4: Merchants handling fewer than 20,000 transactions per year.

Bản lưu

What is PCI Level 1 vs Level 3

Level 1: Merchants that process over 6 million card transactions annually. Level 2: Merchants that process 1 to 6 million transactions annually. Level 3: Merchants that process 20,000 to 1 million transactions annually. Level 4: Merchants that process fewer than 20,000 transactions annually.

What is a PCI Level 3 merchant

Level 3. Merchants with between 20,000 and 1 million online transactions annually. Level 4. Merchants with fewer than 20,000 online transactions annually or any merchant that processes up to 1 million regular transactions per year.

What is Level 3 card processing

Level 3 Processing was originally invented to prevent excess government spending. It allows invoice information, including line-item details, to be passed to the cardholder's bank statement. Credit card issuing banks assign certain interchange fees for different types of cards.

What is PCI Level 4

Level 4 applies to merchants that process fewer than 20,000 Visa or Mastercard e-commerce transactions per year or up to 1 million total Visa or Mastercard credit card transactions and that have not suffered a data breach or attack that compromised card or cardholder data.

What is PCI Category 1 vs 2

Category 1 systems are those that exist in or create the cardholder data environment (CDE) and are always in scope for PCI compliance. Category 2 systems are those that do NOT directly process, store or transmit SAD/CHD but provide services to Category 1 systems such as directory services, DNS, DHCP, SIEM, NTP, etc.

What is the difference between Level 1 Level 2 and Level 3 processing

Level 1 processing is the default. It doesn't require businesses to provide additional processing data. Meanwhile, Level 2 processing and Level 3 processing require much more information. Because Level 2 and Level 3 collect more data, they're more secure for you, as the business owner, than Level 1 processing.

What is PCI Level 1 vs Level 2

Level 1: Merchants that process over 6 million card transactions annually. Level 2: Merchants that process 1 to 6 million transactions annually. Level 3: Merchants that process 20,000 to 1 million transactions annually. Level 4: Merchants that process fewer than 20,000 transactions annually.

What is a Level 2 merchant

Level 2. Any merchant with more than one million but less than or equal to six million total combined Mastercard and Maestro transactions annually. Any merchant meeting the Level 2 criteria of Visa.

What is Level 1 2 and 3 data

Level 1, 2, and 3 data are used in payment processing to provide additional information about a transaction. The main difference between them is the amount of data they provide. Level 1 data includes basic information about a transaction, such as the amount, card number, and expiration date.

What is PCI Level 1

PCI DSS Level 1 is the highest level of compliance and payment security standards merchants can comply with to securely store, transmit, and process credit card information.

What is Level 3 processing

Level 3 Processing was originally invented to prevent excess government spending. It allows invoice information, including line-item details, to be passed to the cardholder's bank statement. Credit card issuing banks assign certain interchange fees for different types of cards.

What are Level 3 transactions

A level 3 transaction is the highest data level and includes the maximum amount of information about the transaction. In addition to all of the data fields that make up level 1 and level 2 transactions, level 3 transactions require the following data fields: Ship-from ZIP/postal code. Ship-to/destination ZIP code.

What is a Level 3 merchant

Level 1: Merchants that process over 6 million card transactions annually. Level 2: Merchants that process 1 to 6 million transactions annually. Level 3: Merchants that process 20,000 to 1 million transactions annually. Level 4: Merchants that process fewer than 20,000 transactions annually.

What are Level 2 transactions

As well as the data needed for level one processing, level 2 transactions require more information, including taxes, customer details, and the merchant ZIP. In exchange for this data, businesses get to access lower interchange fees, which are charged by issuing banks to cover handling, risk, and potential fraud.

What is the difference between Level 2 and Level 3 data

Level 2 credit card processing is similar to Level 3 processing, but with less requirements. Just like with Level 3 data, merchants are required to input additional data fields – but typically, the required fields are easier to enter and there are fewer fields to deal with.

What is Level 2 Level 3 data

Level 2 and Level 3 card data (also known as Level II and Level III) is a set of additional information that can be passed during a credit card transaction. Level 2 and Level 3 card data provides more information for business, commercial, corporate, purchasing, and government cardholders.

What is Level II and Level III data

Level 2 and Level 3 card data (also known as Level II and Level III) is a set of additional information that can be passed during a credit card transaction. Level 2 and Level 3 card data provides more information for business, commercial, corporate, purchasing, and government cardholders.

What is merchant level 4 PCI

Level 4 applies to merchants that process fewer than 20,000 Visa or Mastercard e-commerce transactions per year or up to 1 million total Visa or Mastercard credit card transactions and that have not suffered a data breach or attack that compromised card or cardholder data.

What is a Level 3 transaction

A level 3 transaction is the highest data level and includes the maximum amount of information about the transaction. In addition to all of the data fields that make up level 1 and level 2 transactions, level 3 transactions require the following data fields: Ship-from ZIP/postal code. Ship-to/destination ZIP code.

What is level 2 or level 3 data interchange

Level 2 vs Level 3 Card Data

The higher the level, the more details required. The lower the level, the greater the cost and risk. It's important to note only Visa, MasterCard, and American Express have higher-level interchange options. Also, American Express only goes to Level 2 processing.

Is Level 3 better than a level

BTEC Nationals are Level 3 qualifications, the same standard as A-level study. BTEC Higher Nationals are Level 4/5 study, the same level as the first two years of degree study. Sixth form colleges are most likely to offer BTEC Nationals.