What is the rule of triple money

The formula to determine the Rule of 114 is, to divide 114 by the interest rate equal to the number of years it will take to triple your money. For instance, if you deploy Rs 1,00,000 into an investment with a 12% annual expected return, then the time to triple is 114/12, or 9.5 years.

What is the rule of 115

There is also a related but lesser-known rule, called the “Rule of 115”. By dividing 115 by the rate of return, the estimated time for an investment to triple (3x) can be calculated. Continuing off the previous example with the 6% return assumption: Implied Number of Years to Triple (3x) = 115 ÷ 6 = 19 Years.

How many years will it take for a certain sum of money to triple its amount when deposited at a rate of 12% compounded continuously

Hence, it will take 9.2 years for an investment to triple if it is compounded continuously at 12%.

What is the rule of 144

Rule of 144:

This concept essentially applies to people who stay invested for a very long time in order to watch their money grow four times as much. For example: If you invest Rs. 1,000,000 with a 10% annual expected return, then Time by Fourfolding is 144/10 = 14.4 years.

What is the rule of 115 triple

Rule of 115: If 115 is divided by an interest rate, the result is the approximate number of years needed to triple an investment. For example, at a 1% rate of return, an investment will triple in approximately 115 years; at a 10% rate of return it will take only 11.5 years, etc.

What is rule of 144 money

Rule of 144:

This concept essentially applies to people who stay invested for a very long time in order to watch their money grow four times as much. For example: If you invest Rs. 1,000,000 with a 10% annual expected return, then Time by Fourfolding is 144/10 = 14.4 years.

What is rule 144 in time value of money

Rule of 144

For example, if you invest Rs 1 lakh in a product that gives you 6 percent interest rate, it will become Rs 4 lakh in 24 year as per the rule 144. All you need to do is divide 144 with the interest rate of the product to calculate the number of years in which the money will grow four times.

How long will it take to triple your money at a 7% annual rate of return

Assuming a 7% interest rate, it will take approximately 10.3 years for the original principal to double and 16.4 years to triple.

How do you calculate how long it will take to triple your money

Just like the Rule of 72, the Rule of 115 calculates just how long it will take for you to triple your money. Simply divide your interest rate by 115. If your money earns an interest rate of 10 percent, it will take you 11.5 years to triple it; 115 divided by 10 equals 11.5.

What is Rule 144 simplified

Key Takeaways. Rule 144 provides a framework for selling restricted and controlled securities in the public market. The rule applies to reporting and non-reporting companies and allows for the sale of securities to accredited and non-accredited investors.

What is rule of 72 rule of 114 and 144

There is an important implication to the Rules of 72, 114 and 144. Notice that the numbers don't double That is, while it takes the interest rate divided into 72 to double, the interest rate divided into 144 doesn't triple, it quadruples! That's the power of compounding.

What is the Rule of 72 and 115

The rules of 72 and 115 provide a quick way of seeing the value and speed of compounding. These are short cuts to determine how long it takes compounded money to double and triple. To calculate how long it takes money to double, divide the interest rate into 72. To see how long money triples, divide it into 115.

What is Rule 144 for dummies

SEC Rule 144 outlines the conditions under which restricted and control securities can be sold in the public market. Rule 144 requires affiliates of an issuing company who want to sell their holdings to wait for at least a minimum holding period and comply with various reporting requirements and disclosures.

What is Rule 144 and 701

Rule 701 is an exemption for the offer and sale of unregistered securities by the issuer company. The exemption that applies to sales of unregistered stock by the shareholder is Rule 144.

What is Rule 144 rule

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

Is a 7% return realistic

According to conventional wisdom, an annual ROI of approximately 7% or greater is considered a good ROI for an investment in stocks. This is also about the average annual return of the S&P 500, accounting for inflation. Because this is an average, some years your return may be higher; some years they may be lower.

What is the rule of 144 in investing

Rule of 144:

This concept essentially applies to people who stay invested for a very long time in order to watch their money grow four times as much. For example: If you invest Rs. 1,000,000 with a 10% annual expected return, then Time by Fourfolding is 144/10 = 14.4 years.

What is the rule of 144 and 72

Rule of 144

Two multiplied by 72 is 144. Hence, you can simply understand that 'rule of 144' helps you calculate in how many years your money will grow four times if you know the rate of return.

What is Rule 144 limit

If you are an affiliate, the number of equity securities you may sell during any three-month period cannot exceed the greater of 1% of the outstanding shares of the same class being sold, or if the class is listed on a stock exchange, the greater of 1% or the average reported weekly trading volume during the four weeks …

Who does Rule 144 apply to

Rule 144 applies if you are: a non-affiliate shareholder who wants to sell their restricted securities. an affiliate of the issuing company who wants to sell their securities (whether they are restricted or "free trading") into the public market.

Why does Rule 144 exist

Rule 144 is important because it provides an exemption under which you can sell these securities in the public stock market without registering them with the SEC.

What is Rule 144 in finance

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

What is the rule of 72 S&P 500

But by examining historical data, we can make an educated guess. According to Standard and Poor's, the average annualized return of the S&P index, which later became the S&P 500, from 1926 to 2020 was 10%. At 10%, you could double your initial investment every seven years (72 divided by 10).

Is 20% return possible

A 20% return is possible, but it's a pretty significant return, so you either need to take risks on volatile investments or spend more time invested in safer investments.

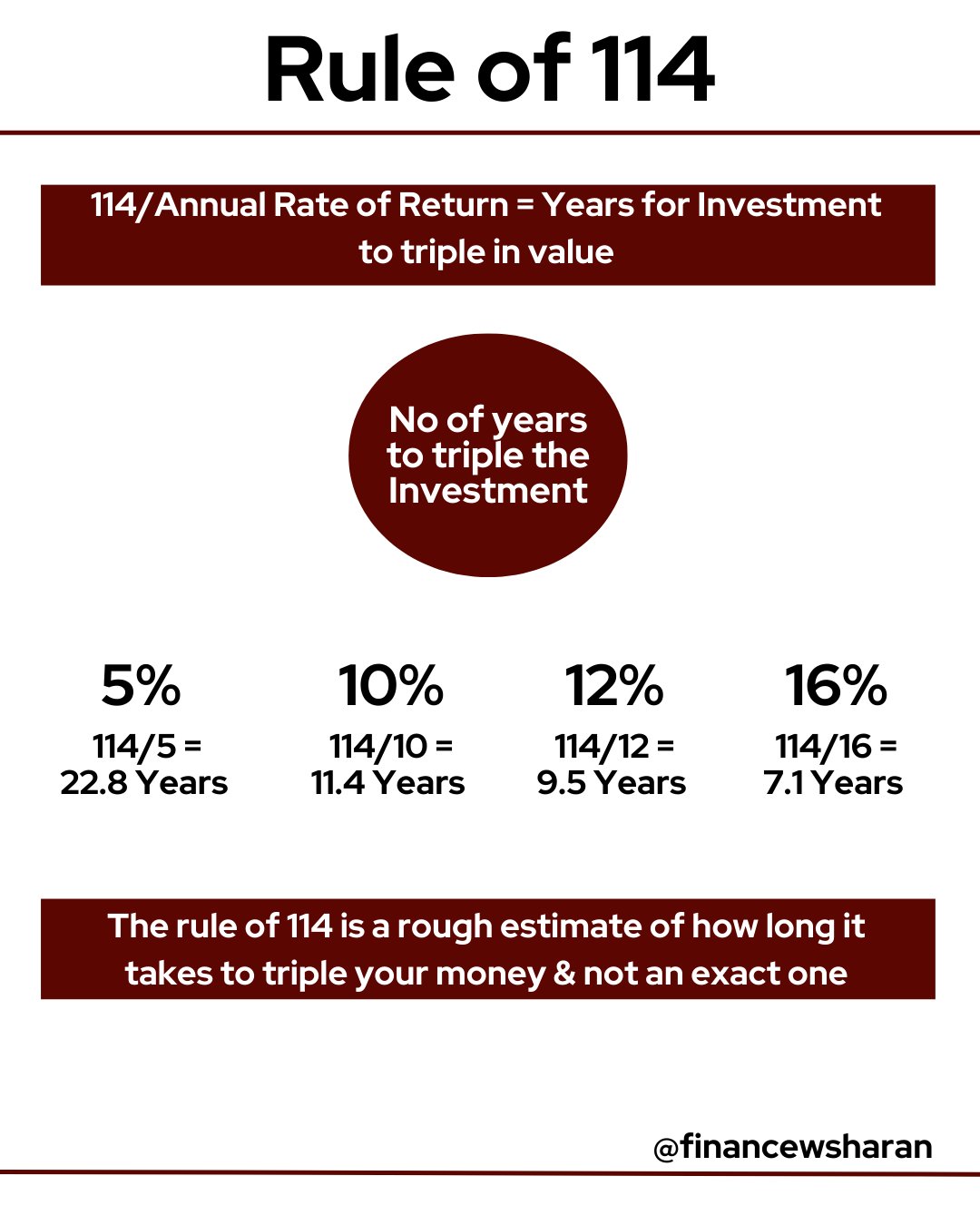

What is rule of 114

Rule of 114:

The amount of years left is how long it will take for your investment to treble. For example: If you put Rs 100,000 into an investment with a 10% annual expected return, then the Time to triple is 114/10, or 11.4 years.