What needs to be declared is custom

Most countries require travellers to complete a customs declaration form when bringing notified goods (alcoholic drinks, tobacco products, animals, fresh food, plant material, seeds, soils, meats, and animal products) across international borders.

What documents are required for customs clearance in India

List of Documents required for Imports Customs ClearanceBill of Entry.Commercial Invoice.Bill of Lading or Airway Bill.Import License.Certificate of Insurance.Letter of Credit or LC.Technical Write-up or Literature (Only required for specific goods)Industrial License (for specific goods)

What must be included in customs documentation

The eight documents required to clear U.S. importsCommercial Invoice.Packing List.Certificate of Origin (C.O.O.)Bill Of Lading (BOL)Air Waybill (AWB)ISF 10+2 Form.Arrival Notice.Delivery Order (D/O)

What is included in a customs declaration

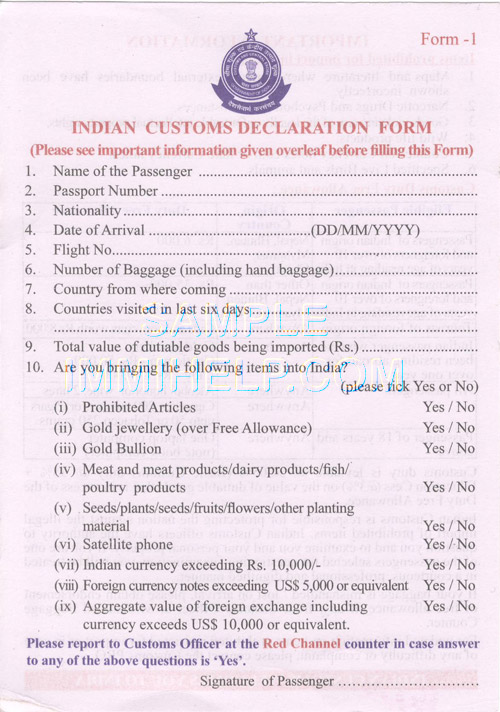

What is a customs declaration A customs declaration is an official document that lists and gives details of goods that are being imported or exported. In legal terms, a customs declaration is the act whereby a person indicates the wish to place goods under a given customs procedure.

How do I know if I have goods to declare

In essence, you have to declare any items you purchased and/or are carrying with you upon your return to the United States that you did not have when you left. This may include gifts you bought for others or received while abroad, souvenirs, or even found items.

Do I need customs declaration for documents

Do all shipments need a customs form You do not need a customs form if you're sending First-Class Mail International® that weighs under 15.994 oz. First-Class Mail International must contain only nonnegotiable documents or correspondence.

How much customs will I have to pay in India

Types of Customs Duty

| Types of custom duty | Rates |

|---|---|

| Basic Customs Duty (BCD) | 0 to 100% (depending upon the HS code and its origin) |

| Special Additional Duty (SAD) | 4.00% |

| Countervailing Duty (CVD) | 0% to 12% (depends upon the goods) |

| Social Welfare Surcharge (SWS) | 10% |

What is customs clearance process in India

The importer of the goods should file a bill of entry (customs copy) electronically for the clearance of the goods, before or on arrival of the goods. In the bill of entry, the duty and taxes to be paid is assessed by the importer himself and this is called self- assessment.

What is subject to customs clearance

Goods subject to customs clearance include items that are being imported or exported, as well as personal effects and commercial shipments. The purpose of customs clearance is to ensure that all applicable import duties and taxes are paid and that goods comply with all relevant regulations.

Do you have to declare everything at customs

All travelers must complete a CBP Declaration Form 6059B itemizing all purchased merchandise and agricultural products. Here are your options: Complete a paper form that may be obtained at the port of entry or on the flight or cruise.

What do you show at customs

You will need to provide information like your name, country of residence, passport number, flight number, and countries you visited. Refer to your passport and travel ticket to help you complete the form. Make sure the information you provide is accurate. Any mistakes could slow down the customs process.

Do you have to declare everything you bought

All travelers must complete a CBP Declaration Form 6059B itemizing all purchased merchandise and agricultural products.

What is the duty free allowance for India

ALLOWANCE WHEN YOU ARE ARRIVING TO INDIA :

100 cigarettes or 25 cigars or 125g of tobacco. 2 liter of alcoholic liquor or wine. Total Value Duty Free Purchases cannot exceed Rs 50,000.

Do you have to go through customs if you have nothing to declare

If you have nothing to declare, you can head to baggage claim. A CBP agricultural officer may ask to search your baggage on your way out; this is routine and isn't anything to worry about. Once you've grabbed your checked luggage, congratulations! You've cleared customs.

What happens if you don’t fill out a customs form

When you mail a package to another country, the contents and value of an item must be declared on the customs form. The mailer is responsible for completing the appropriate customs form. If the form is not completed correctly, mail may be delayed, or duty and taxes could be incorrect.

How much do I declare at customs

You may bring back more than your exemption, but you will have to pay duty on it. In most cases, the personal exemption is $800, but there are some exceptions to this rule, which are explained below. Depending on the countries you have visited, your personal exemption will be $200, $800, or $1,600.

Do Indian customs check every package

Customs does not normally open every parcel; these checks are rather random; however, their frequency increases when the declared gift value is over $100 USD.

Does Indian customs open every package

Customs does not normally open every parcel; these checks are rather random; however, their frequency increases when the declared gift value is over $100 USD.

How do I complete customs clearance

Customs Clearance Process: 4 Easy Steps to FollowKey Points:A customs officer examines your customs paperwork.Import duties and taxes are assessed using the customs paperwork.Customs requests payment for taxes and duties, if applicable.Your shipment clears customs once all duties are paid.

What is the customs clearance process in India

Procedure for Clearance of Imported and Export GoodsSigned invoice.Packing list.Bill of Lading or Delivery Order/Airway Bill.GATT declaration form duly filled in.Importers/CHA's declaration.License wherever necessary.Letter of Credit/Bank Draft/wherever necessary.Insurance document.

How much should I declare on customs

The value you declare for personal shipments should be the cost at which you purchased the item; for customs declarations in the case of retail shipments, the value should be the price at which you intend to sell the item. Customs use this value to clear your shipment and determine taxes and duties.

What will not go through customs

Restricted means that special licenses or permits are required from a federal agency before the item is allowed to enter the United States. Examples of restricted items include firearms, certain fruits and vegetables, animal products, animal by products, and some animals.

What do customs officers look for

Generally, customs officers may stop people at the border to determine whether they are admissible to the United States, and they may search people's belongings for contraband. This is true even if there is nothing suspicious about you or your luggage.

Why do I always get flagged at the airport

Tripping the system during a background check

Other times, you could engage in some type of suspicious travel activity that triggers an additional screening which could include things like: Visits to high-risk countries. Unusual travel patterns (last minute one-way flight) Paying cash for tickets.

What happens if you don’t declare items

The penalty for the failure to disclose usually occurs in a seizure of the property or a forfeit of ownership with merchandise or other items. Additional penalties are often normal to include a monetary fine.