What happens when exchange rate rises

In the goods market, a positive shock to the exchange rate of the domestic currency (an unexpected appreciation) will make exports more expensive and imports less expensive. As a result, the competition from foreign markets will decrease the demand for domestic products, decreasing domestic output and price.

When exchange rate goes up

If the dollar appreciates (the exchange rate increases), the relative price of domestic goods and services increases while the relative price of foreign goods and services falls.

What does an increase in exchange rate mean

(a) Rise in exchange rate means depreciation of domestic currency due to which (i) Domestic goods become cheaper. As a result, exports of the domestic country will increase. ( ii) Imports become expensive and the demand for imports will fall.

What causes an exchange rate to rise or fall

Exchange rates are determined by factors, such as interest rates, confidence, the current account on balance of payments, economic growth and relative inflation rates.

What factors increase exchange rate

10 Factors that influence currency exchange rates:Inflation >Interest rates >Government Debt/Public >Political Stability >Economic Recession >Terms of Trade >Current account deficit >Confidence and speculation >

What causes dollar to rise

The demand for the dollar increases when international parties, such as foreign citizens, foreign central banks, or foreign financial institutions demand more dollars. Demand for the dollar is usually high as it is the world's reserve currency.

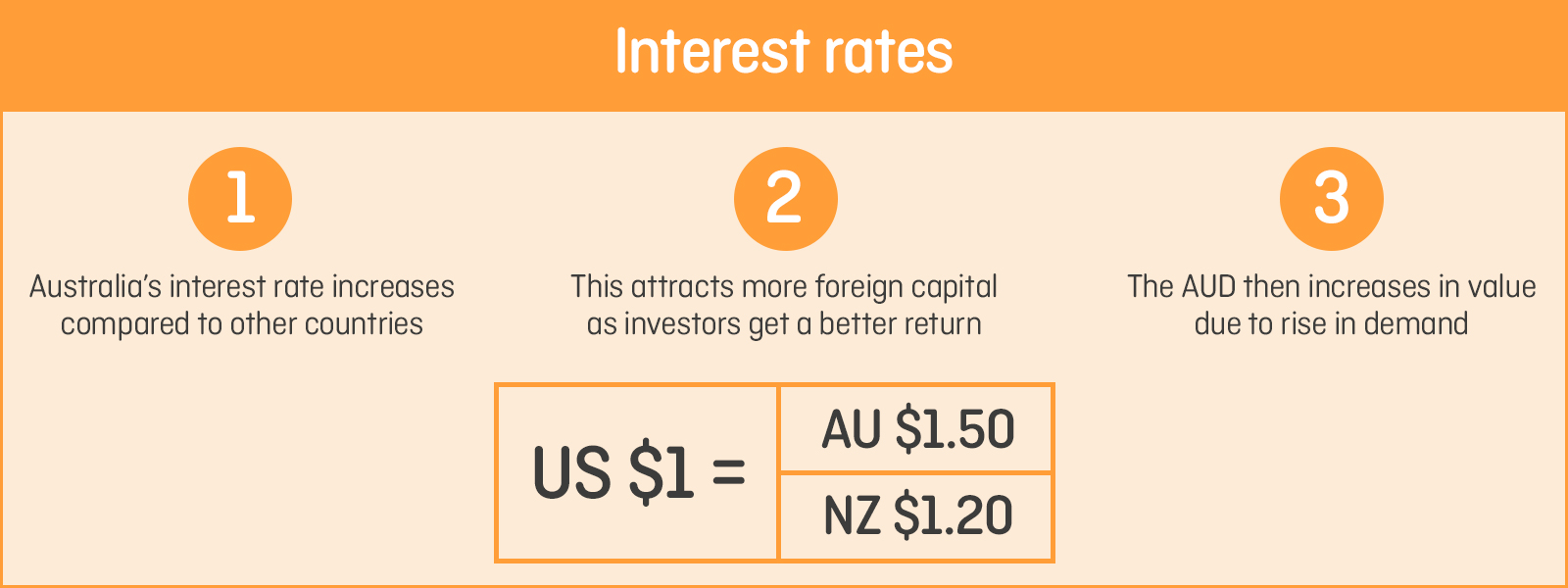

What causes real exchange rate to increase

Higher interest rates offer lenders in an economy a higher return relative to other countries. Therefore, higher interest rates attract foreign capital and cause the exchange rate to rise.

Is it good if the exchange rate is high

A higher exchange rate indicates a stronger currency, benefiting importers and travelers from the stronger currency's country while boosting exporters in the weaker currency's region.

How do exchange rates affect the economy

The exchange rate affects the real economy most directly through changes in the demand for exports and imports. A real depreciation of the domestic currency makes exports more competitive abroad and imports less competitive domestically, thereby increasing demand for domestically produced goods.

What would cause the real exchange rate to rise

Technology changes that cause productivity increases in goods commonly traded between countries, called tradables, are thought to be one of those factors. Because productivity increases lead to lower production costs, the REERs would rise to maintain equilibrium.

What are the three factors that affect exchange rates

10 Factors that influence currency exchange rates:Inflation >Interest rates >Government Debt/Public >Political Stability >Economic Recession >Terms of Trade >Current account deficit >Confidence and speculation >

Does inflation affect exchange rate

In general, when inflation is high, it makes a currency weaker, suppressing investment, and thus negatively impacting the exchange rate. When inflation is low, a currency is stronger, improving its exchange rate.

What makes a currency strong or weak

A currency's strength is determined by the interaction of a variety of local and international factors such as the demand and supply in the foreign exchange markets; the interest rates of the central bank; the inflation and growth in the domestic economy; and the country's balance of trade.

Which of the following will cause a change in the exchange rate

Exchange rates are the prices of foreign currencies, which are determined in their respective foreign currency markets. A variety of factors can influence these exchange rates, including the amounts of imports and exports, GDP, market expectations, and inflation.

What factors influence exchange rate

7 factors affecting exchange ratesInterest and inflation rates. Inflation is the rate at which the cost of goods and services rises over time.Current account deficits.Government debt.Terms of trade.Economic performance.Recession.Speculation.

What causes exchange rate to appreciate

Currency appreciation is an increase in the value of one currency in relation to another currency. Currencies appreciate against each other for a variety of reasons, including government policy, interest rates, trade balances, and business cycles.

How exchange rates affect inflation

How the exchange rate affects inflation. A depreciation means the currency buys less foreign exchange, therefore, imports are more expensive and exports are cheaper. After a depreciation, we get: Imported inflation.

How does exchange rate cause inflation

The increase in the foreign exchange rate leads to the cheaper domestic goods for foreign consumers, resulting in the increase of exports and total demands and prices. The increase in the foreign exchange price raises the inflation rate.

How do exchange rates affect international markets

Changes in currency exchange rates affect international trade by increasing or decreasing exports and imports. A strong domestic currency will cause exports to decrease and imports to increase. As exchange rates decrease, exports rise and imports go down.

How does inflation affect exchange rate

In general, inflation tends to devalue a currency since inflation can be equated with a decrease in a currency's buying power. As a result, countries experiencing high inflation tend to also see their currencies weaken relative to other currencies.

What are the main causes of changes in exchange rates

7 factors affecting exchange ratesInterest and inflation rates. Inflation is the rate at which the cost of goods and services rises over time.Current account deficits.Government debt.Terms of trade.Economic performance.Recession.Speculation.

Is high exchange rate good or bad

A higher exchange rate indicates a stronger currency, benefiting importers and travelers from the stronger currency's country while boosting exporters in the weaker currency's region.

What affects exchange rates

10 Factors that influence currency exchange rates:Inflation >Interest rates >Government Debt/Public >Political Stability >Economic Recession >Terms of Trade >Current account deficit >Confidence and speculation >

What can affect the exchange rate

7 factors affecting exchange ratesInterest and inflation rates. Inflation is the rate at which the cost of goods and services rises over time.Current account deficits.Government debt.Terms of trade.Economic performance.Recession.Speculation.

What happens when dollar is strong

Strong Dollar: An Overview

A strengthening U.S. dollar means it can buy more of a foreign currency than before. For example, a strong dollar benefits Americans traveling overseas because $1 buys more. However, this would disadvantage foreign tourists visiting the U.S. because their currency would buy less.