Who has the highest money market rates right now

Current rates for our top 10 money market accounts*Redneck Bank: 5.05% APY.Prime Alliance Bank: 4.50% APY.UFB Direct: 4.81% APY.TIAA Bank: 4.50% APY.Sallie Mae Bank: 4.50% APY.Zynlo Bank: 5.00% APY.Quontic Bank: 4.75% APY.ConnectOne Bank: 3.34% APY.

What is the best example of money market

Money markets include markets for such instruments as bank accounts, including term certificates of deposit; interbank loans (loans between banks); money market mutual funds; commercial paper; Treasury bills; and securities lending and repurchase agreements (repos).

What is better than a money market account

CD rates are typically higher than money market account rates. Banks have an incentive to give you better rates for CDs because you promise to give up access to your money until the end of the CD term.

How to invest in money market

Here are some key money market instruments in India:Treasury Bills or T-Bills.Certificate of Deposit or CD.Repurchase Agreements or Repos.Commercial Paper or CP.– Risks and Returns.– Expense Ratio.– Invest according to your Investment Plan.Capital Gains Tax.

Which bank gives 7% interest on savings account

Which bank gives 7% interest on a savings account Right now, only one financial institution is paying at least 7% APY: Landmark Credit Union. Landmark pays 7.50% on its Premium Checking Account — however, there are some major caveats to consider.

Where can I get 6% interest

Best 6% interest savings accountsDigital Federal Credit Union (DCU) Primary Savings.Mango Savings™

What are 3 examples of money market funds

Regulations from the U.S. Securities and Exchange Commission (SEC) define 3 categories of money market funds based on investments of the fund—government, prime, and municipal.

What is money market in USA

The money market refers to the market for highly liquid, very safe, short-term debt securities. Because of these attributes, they are often seen as cash equivalents that can be interchangeable for money at short notice.

What is the safest type of money market fund

U.S. government money market funds are typically regarded as the safest of the three, and within that category, those with a high concentration of Treasuries—with full government backing—would be exposed to a lower likelihood of default risk.

Is money market safer than savings

Money market accounts and savings accounts are equally safe places for consumers to keep their savings. However, it's important to open accounts at banks that are covered by FDIC insurance. You can check if your bank is FDIC-insured here.

Are money markets still a good investment

Key Takeaways. Money market investing can be advantageous if you need a relatively safe place to park cash in the short term or if you're diversifying a growth portfolio. Some disadvantages are low returns, a loss of purchasing power, and the lack of FDIC insurance.

Is it wise to invest in a money market account

If you want to earn a higher APY and you can meet a higher account minimum, a money market account is a good choice. It's also a smart option if you need easy access to your money.

How can I get 5% interest on my money

Here are the best 5% interest savings accounts you can open today:Columbia Bank Savings Account – 5.15% APY.American First Credit Union Money Market Account – 5.15% APY.12 Months: Bread Savings – 5.25% APY.18 Months: Discover Bank – 5.00% APY.3 Years: Ibexis Fixed Annuity – Up to 5.27% APY.

How do I get 5% interest on my bank account

Best 5% interest savings accountsBest overall: Western Alliance Bank Savings Account.Best for earning a high APY: Newtek Bank Personal High Yield Savings.Best for no fees: Bask Interest Savings Account.Best for easy access to your cash: Panacea High-Yield Savings Account.

Do banks have money market funds

A money market account is a type of account offered by banks and credit unions. Like other deposit accounts, money market accounts are insured by the FDIC or NCUA, up to $250,000 held by the same owner or owners. Money market accounts tend to pay you higher interest rates than other types of savings accounts.

Do money market funds earn interest

A money market fund is an investment that is sponsored by an investment fund company. Therefore, it carries no guarantee of principal. A money market account is a type of interest-earning savings account.

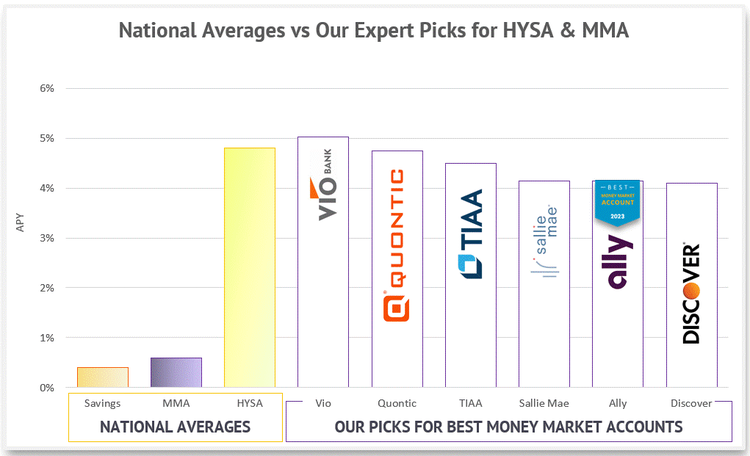

What are the top US money market rates

Best Money Market Account RatesUFB Direct – 5.06% APY.All America Bank – 5.05% APY.Redneck Bank – 5.05% APY.Northern Bank Direct – 4.95% APY.Merchants Bank of Indiana – 4.75% APY.Quontic Bank – 4.75% APY.Brilliant Bank – 4.65% APY.Prime Alliance Bank – 4.50% APY.

What is the biggest disadvantage of money market

Cons of money market accountsDepending on your bank, there could be withdrawal limits. Many banks have withdrawal limits on how much you can withdraw from your money market account and how often.Many accounts have monthly fees.Your account might have a minimum balance requirement.

Is money market safer than stocks

Other assets like bonds provide relatively lower risk compared to less conservative assets such as options, stocks, or alternative assets. Money market accounts (MMAs) and similar investments that pay a higher return than a traditional savings account also offer lower risk.

Which bank gives 7% interest monthly

Which bank gives 7% interest on a savings account Right now, only one financial institution is paying at least 7% APY: Landmark Credit Union.

How do you earn 10% interest

Where can I get 10 percent return on investmentInvest in stocks for the short term.Real estate.Investing in fine art.Starting your own business.Investing in wine.Peer-to-peer lending.Invest in REITs.Invest in gold, silver, and other precious metals.

Where can I get 7% interest on my money

You want to maximize your money, so you need to find out which bank is giving 7% interest on a savings account. This sky-high interest rate certainly isn't the standard, and it's actually only offered on a checking account: the Premium Checking account at Landmark Credit Union.

Where can I get 4% interest on my money

Ally Bank: 4.00% APY on their Online Savings Account. Axos Bank: up to 3.30% APY on their Rewards Checking Account. Capital One: 4.30% APY on their Savings Account. American Express: 4.00% APY on their High Yield Savings Account.

How safe are money markets

Money market funds are traditionally super safe investments and pay out a higher return than what you might get from a regular bank account. But after recent bank failures and debates over the debt ceiling, this huge part of the financial system could be on shaky ground.

Should I move money into money market

But generally, yes, it is worth having. Money market accounts offer a low-risk environment with a higher interest rate to grow your money. Money market accounts are insured by the FDIC and can help individuals reach their short-term savings goals.