Which bank is too big to fail

Companies Considered Too Big to Fail

The Goldman Sachs Group Inc. JPMorgan Chase & Co. State Street Corp. Wells Fargo & Co.

Which is the highest risk in bank

The three largest risks banks take are credit risk, market risk and operational risk.

What are the chances of banks failing

Bank failures happen more often than you might think—there have been 566 in the U.S. since we entered the new millennium. That's an average of almost 25 per year.

When a bank failure is less likely to occur

Ans) a. A bank failure is less likely to occur when a bank has more bank capital. B.

Is UBS too big to fail

UBS is now 'the world's safest bank' for depositors because Switzerland has made it too big to fail, analyst says | Business Insider India.

What banks are failing in 2023

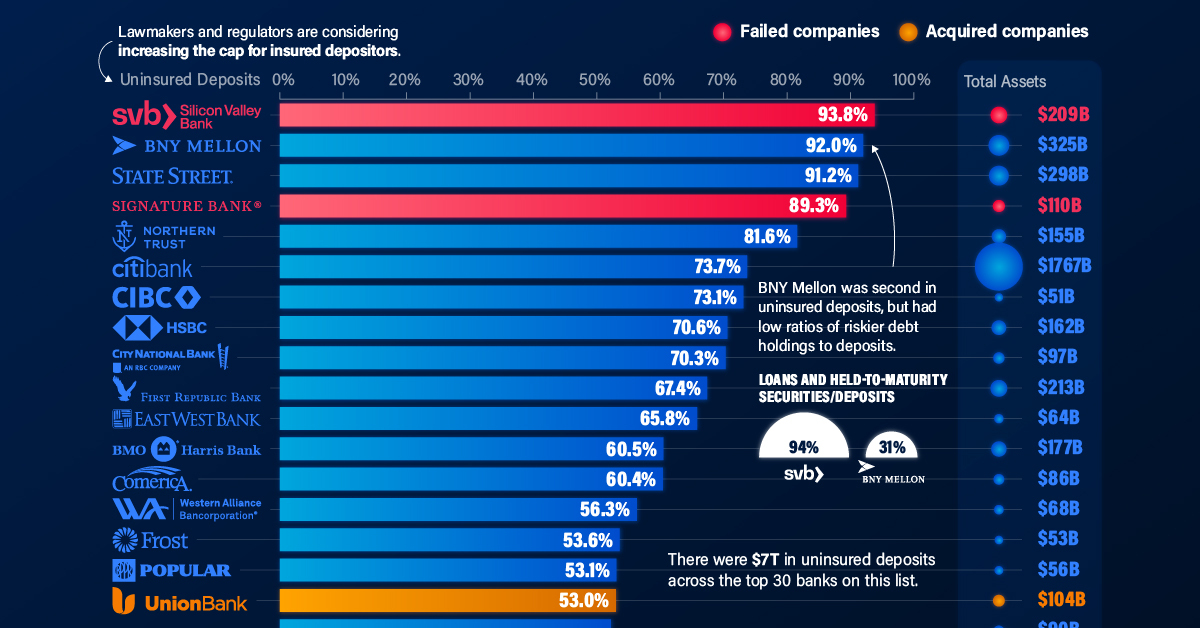

Over the course of a few weeks in the spring of 2023, multiple high-profile regional banks suddenly collapsed: Silicon Valley Bank (SVB), Signature Bank, and First Republic Bank. These banks weren't limited to one geographic area, and there wasn't one single reason behind their failures.

Who has the safest bank

Asset-heavy, diversified and regulated banks like JPMorgan Chase, Wells Fargo, PNC Bank and U.S. Bank are among the safest banks in the U.S. and should be considered if you are weighing your options.

What are the top 3 bank risks

Types of financial risks:Credit Risk. Credit risk, one of the biggest financial risks in banking, occurs when borrowers or counterparties fail to meet their obligations.Liquidity Risk.Model Risk.Environmental, Social and Governance (ESG) Risk.Operational Risk.Financial Crime.Supplier Risk.Conduct Risk.

Which bank collapsed in 2023

By the numbers: The three banks that failed this year — Silicon Valley Bank (SVB), First Republic Bank (FRB) and Signature Bank — accounted for 2.4% of all assets in the banking sector.

Which banks have failed 2023

About the FDIC:

| Bank NameBank | CityCity | Closing DateClosing |

|---|---|---|

| First Republic Bank | San Francisco | May 1, 2023 |

| Signature Bank | New York | March 12, 2023 |

| Silicon Valley Bank | Santa Clara | March 10, 2023 |

| Almena State Bank | Almena | October 23, 2020 |

Which banks are in trouble

List of Recent Failed Banks

| Bank Name | City | State |

|---|---|---|

| First Republic Bank | San Francisco | CA |

| Signature Bank | New York | NY |

| Silicon Valley Bank | Santa Clara | CA |

1 thg 7, 2023

Why doesn t Canada have bank failures

Bank failures haven't happened often in Canada. The Canada Deposit Insurance Corporation (CDIC), which insures deposits in Canadian banks, last handled one in the mid-1990s, and the Crown corporation has dealt with only 43 such incidents since it was established in 1967.

Is Barclays too big to fail

BOE Says UK's Biggest Banks Like HSBC and Barclays No Longer Too Big to Fail – Bloomberg.

Is Credit Suisse too big to fail

The failure of Credit Suisse was a serious test of the reforms of banking regulation made after the global financial crisis of 2007-09. It was the first failure of a large, interconnected bank that was considered 'too big to fail'.

Is my money safe in the bank 2023

While banks are insured by the FDIC, credit unions are insured by the NCUA. "Whether at a bank or a credit union, your money is safe. There's no need to worry about the safety or access to your money," McBride said.

What is safer than banks

However, because credit unions serve mostly individuals and small businesses (rather than large investors) and are known to take fewer risks, credit unions are generally viewed as safer than banks in the event of a collapse. Regardless, both types of financial institutions are equally protected.

How many banks failed in 2023

Over the course of five days in March 2023, three small- to mid-size U.S. banks failed, triggering a sharp decline in global bank stock prices and swift response by regulators to prevent potential global contagion.

Which banks collapsed 2023

Over the course of a few weeks in the spring of 2023, multiple high-profile regional banks suddenly collapsed: Silicon Valley Bank (SVB), Signature Bank, and First Republic Bank. These banks weren't limited to one geographic area, and there wasn't one single reason behind their failures.

Which banks just failed

List of Recent Failed Banks

| Bank Name | City | State |

|---|---|---|

| First Republic Bank | San Francisco | CA |

| Signature Bank | New York | NY |

| Silicon Valley Bank | Santa Clara | CA |

1 thg 7, 2023

Are Canadian banks too big to fail

Royal Bank of Canada (RBC) and TD Bank remain Canada's only members on the list of global systemically important banks (G-SIBs), which defines banks considered “too big to fail” by regulators. The Financial Stability Board (FSB) published its G-SIB list for 2020 on Nov. 11.

Why are Canadian banks so stable

The country's financial stability, and the high profitability of its banks at a time when those in the U.S. are in turmoil, comes from strong regulations. If inflation and rising interest rates weren't enough to cause anxiety about the global economy, bank failures, or near collapses, have been added to the mix.

Is HSBC a too big to fail bank

BOE Says UK's Biggest Banks Like HSBC and Barclays No Longer Too Big to Fail – Bloomberg.

Is Citi too big to fail

Citibank's history is inextricable from that of the United States. “Citi,” as it is known, has embodied the best and the worst of America's banking industry.

Is UBS better than Credit Suisse

UBS is the world leader in wealth management and generated nearly 15 percent of its $34.5 billion in turnover in 2022 through this global arm. At Credit Suisse — level with the United States' Morgan Stanley in second place — wealth management contributed 22 percent of the 22.4 billion Swiss francs in turnover.

Is your money 100% safe in the bank

Key Takeaways. Savings accounts are a safe place to keep your money because all deposits made by consumers are guaranteed by the FDIC for bank accounts or the NCUA for credit union accounts. Certificates of deposit (CDs) issued by banks and credit unions also carry deposit insurance.