What is the three-fund portfolio theory

A 3 fund portfolio is a diversified investment plan comprising three different kinds of assets, i.e., domestic stocks, domestic bonds, and international stocks. In this kind of investment, the investors can choose the asset allocation mix and the funds based on their financial objective.

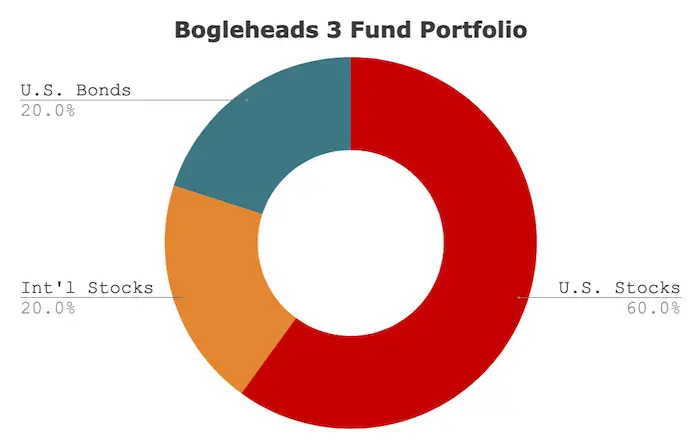

What is the Boglehead 3 fund portfolio

Boglehead 3 Fund Portfolio is a simple, low-cost investment strategy that consists of three index funds: a U.S. Total Stock Market Index Fund, an International Stock Market Index Fund, and a U.S. Total Bond Market Index Fund. Boglehead 4 Fund Portfolio adds Total International Bond Market Index Fund to the mix.

What are the 3 portfolios of equity investments

The three-fund portfolio consists of a total stock market index fund, a total international stock index fund, and a total bond market fund. Asset allocation between those three funds is up to the investor based on their age and risk tolerance.

What is the 3 ETF strategy

This strategy involves choosing three mutual funds or exchange-traded funds (ETFs) to create a diversified portfolio. The three-fund portfolio is often associated with the Bogleheads, named after Vanguard founder John Bogle. It's a lazy way to invest, but is it right for you

What are the 3 major types of investment styles

The major investment styles can be broken down into three dimensions: active vs. passive management, growth vs. value investing, and small cap vs. large cap companies.

What is Boglehead investment theory

Conclusion. In summary, a Bogleheads investor tends to (1) save a lot, (2) select an asset allocation containing both stock and bond asset classes, (3) buy low cost, widely diversified funds, (4) allocate funds tax-efficiently, and (5) stay the course.

What is the best 3 fund portfolio allocation

3 Fund portfolio asset allocation

The most common way to set up a three-fund portfolio is with: An 80/20 portfolio i.e. 64% U.S. stocks, 16% International stocks and 20% bonds (aggressive) An equal portfolio i.e. 33% U.S. stocks, 33% International stocks and 33% bonds (moderate)

What is BlackRock’s portfolio

BlackRock Inc.s top holdings are Apple Inc (US:AAPL) , Microsoft Corporation (US:MSFT) , Amazon.com Inc. ( US:AMZN) , NVIDIA Corp (US:NVDA) , and Alphabet Inc – Class A (US:GOOGL) . BlackRock Inc.s new positions include Dow Inc (US:DOW) , Liberty Broadband Corp – Series A (US:LBRDA) , GE HealthCare Technologies, Inc. (

What are the 3 common types of portfolios briefly describe

1) Showcase or Presentation Portfolio: A Collection of Best Work.2) Process or Learning Portfolio: A Work in Progress.3) Assessment Portfolio: Used For Accountability.4) A Hybrid Approach.

What is the oldest 3X ETF

Direxion

Direxion launched its first leveraged ETFs in 2008. In November 2008 the company was the first to offer ETFs with 3X leverage, a move that was copied some months later by its competitors ProShares and Rydex Investments.

What is a 3X ETF

An ETF that is leveraged 3x seeks to return three times the return of the index or other benchmark that it tracks. A 3x S&P 500 index ETF, for instance, would return +3% if the S&P rose by 1%.

What are the three 3 key elements of an investment strategy

There are three key factors that determine which investment strategy is right for you.Risk tolerance.Expected returns.Effort required to implement the strategy.

What are the 3 classifications for investment accounting

Such investments are therefore generally categorized under generally accepted accounting principles (GAAP) in three categories: investments in financial assets, investments in associates, and business combinations.

What is Edward Shapiro the profits theory of investment

Edward Shapiro has developed the profits theory of investment in which total profits vary directly with the income level. For each level of profits, there is an optimal capital stock. The optimal capital stock varies directly with the level of profits.

What is a Bogle portfolio

The Bogleheads Three Funds Portfolio is a Very High Risk portfolio and can be implemented with 3 ETFs. It's exposed for 80% on the Stock Market. In the last 30 Years, the Bogleheads Three Funds Portfolio obtained a 7.69% compound annual return, with a 12.30% standard deviation.

What are the three 3 categories of investment

There are three main types of investments:Stocks.Bonds.Cash equivalent.

What are the three fund categories

The generally accepted accounting principles (GAAP) basis classification divides funds into three broad fund categories: Governmental, Proprietary, and Fiduciary.

Who are the 7 owners of BlackRock

BlackRock was founded in 1988 by Larry Fink, Robert S. Kapito, Susan Wagner, Barbara Novick, Ben Golub, Hugh Frater, Ralph Schlosstein, and Keith Anderson to provide institutional clients with asset management services from a risk management perspective.

Does BlackRock own Pfizer

The three largest shareholders of Pfizer, J&J and Merck are Vanguard, SSGA and BlackRock, the multi-trillion dollar funds which make investments on behalf of their clients and keep a cut for their service.

What are the 3 parts of a portfolio

ESSENTIAL ELEMENTS OF THE PORTFOLIOCover Letter “About the author” and “What my portfolio shows about my progress as a learner” (written at the end, but put at the beginning).Table of Contents with numbered pages.Entries – both core (items students have to include) and optional (items of student's choice).

Is QQQ 3X leveraged

The TQQQ is a 3x leveraged ETF based on the QQQ (a Nasdaq-100 Index ETF). Because it is leveraged, it uses derivatives contracts to amplify its returns based on how the index performs.

Can you hold 3X ETF long term

Triple-leveraged ETFs also have very high expense ratios, which make them unattractive for long-term investors. All mutual funds and exchange-traded funds charge their shareholders an expense ratio to cover the fund's total annual operating expenses.

Is there a 5x ETF

The SP5Y Exchange Traded Fund (ETF) is provided by Leverage Shares PLC. This ETF provides leveraged exposure (5x) to Large Cap US Equities.

What is the rule of 3 investing

Wealth Building Using the Rule of Thirds: Invest Your Money: One-third in Stocks & Bonds; One-third in Real Estate & Commodities; One-third in Liquid Assets.

What are the three main categories of assets in the portfolio

Three of the main types of asset classes are equities, fixed income, and cash and equivalents. For individual investors, these are more commonly referred to as stocks, bonds and cash. An investor's asset allocation, or mix of asset types, is the foundation of portfolio construction.