Whose income is tax free in India

Agricultural Income

The government of India has made Agricultural Income free from tax liabilities for the benefit of our farmers and our agricultural industry ever since the Income Tax Act of 1961 was established and has been free from taxes ever since.

How can I be exempt from income tax in India

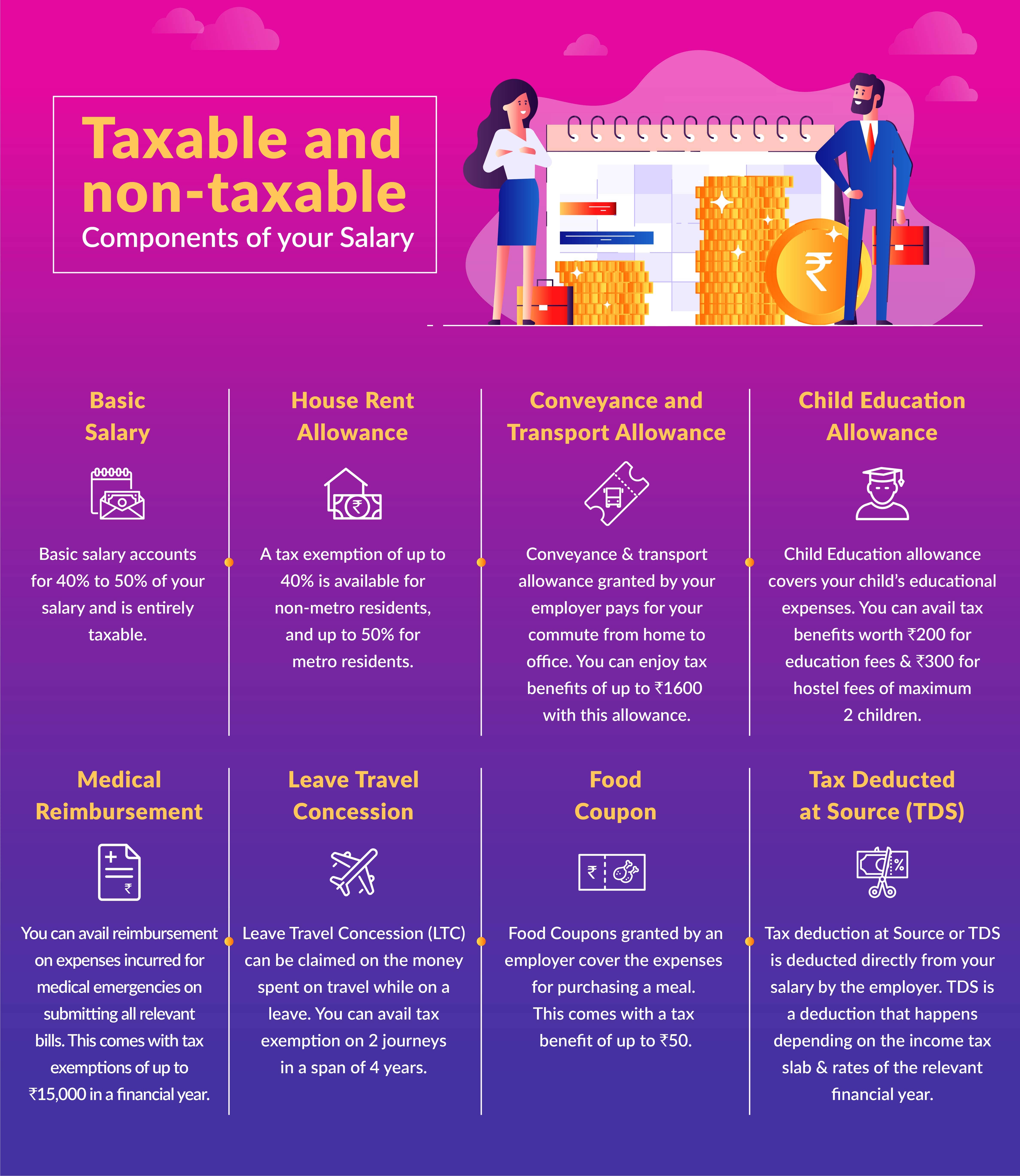

Here is the income tax exemption list 2022-23:House Rent Allowance.Leave Travel Allowance (LTA)Food coupons.Salary component.Reimbursements.Proof.House rent allowance (HRA)Rent amount for residential housing.

Who is eligible for income tax in India

It is mandatory to file ITR for individuals If the total Gross Income is over Rs.3,00,000 in a financial year (Including standard deduction). This limit exceeds Rs.3,00,000 for senior citizens and Rs.5,00,000 for super senior citizens. The entities listed below must pay taxes and file their income tax returns.

What is the taxable salary in India

For individuals who are under 60 years of age (Existing Tax Regime)

| Net Income | Income Tax Rate |

|---|---|

| Up to Rs.2.5 lakhs | Nil |

| Rs.2.5 lakhs to Rs.5 lakhs | 5% of (Total income – Rs.2.5 lakhs) |

| Rs.5 lakhs to Rs.10 lakhs | Rs.25,000 + 20% of (Total income – Rs.5 lakhs) |

| Above Rs.10 lakhs | Rs.1,12,500 + 30% of (Total income – Rs.10 lakhs) |

Do all people in India pay taxes

2.5 Lakhs annually (which cover the overwhelming majority of the country) are exempt for paying any income tax. Those earning between Rs. 2.5 Lakhs and 5 Lakhs are subject to 5 per cent tax; those earning between 5 Lakhs and 10 lakhs rupees, 20 percent tax; and those above 10 lakhs, a 30 percent rate.

Does everyone pay tax in India

Every individual, who has a source of income, regular or irregular, are legally required to file their income tax returns. Even if your income is below the taxable bracket, you should file your income tax returns.

How can I save tax in India if my income is above 20 lakhs

There are various ways to save tax for those earning above ₹20 lakhs, including investing in tax-saving mutual funds, PPF, NPS, health insurance, donations to charity, home loan, rent paid, education loan, and offsetting expenses incurred on generating income from investments.

What is the tax rate for 24 lakhs salary in India

What are the income tax rates

| Tax Slabs | Tax Rates |

|---|---|

| Income up to Rs.3 lakhs | NIL |

| Income between Rs.3 lakhs and Rs.5 lakhs | 10% of amount exceeding Rs.3 lakhs |

| Income between Rs.5 lakhs to Rs.10 lakhs | 20% of amount exceeding Rs.5 lakhs |

| Income above Rs.10 lakhs | 30% of amount exceeding Rs.10 lakhs |

How to pay tax in India for foreign income

The income from foreign sources gets taxed at the same rate applicable to earnings in India. If the taxpayer receives his foreign income in India, he/she must pay taxes in the same fiscal year. If the income is not received in India, it gets taxed in the financial year in which it is realised or accrued.

Is personal allowance taxable in India

Allowances, which are part of salary are taxable if no specific exemption is provided under the Income Tax Act/Rules. Certain allowances have been exempted from Income tax as per section 10(14) of the Income Tax Act.

How much monthly salary is taxable in India

Components for Calculating Income Tax

| Tax slab | Tax rate as per new regime |

|---|---|

| 0 – 3,00,000 | Nil |

| 3,00,001 – 6,00,000 | 5 % |

| 6,00,001 – 9,00,000 | 10 % |

| 9,00,001 – 12,00,000 | 15 % |

How much tax do I have to pay in India for 1 crore

| Range of Income | ||

|---|---|---|

| Rs. 50 Lakhs to Rs. 1 Crore | Rs. 1 Crore to Rs. 2 Crores | Exceeding Rs. 2 crores |

| 10% | 15% | 25% |

How many people in India don’t pay taxes

So if you tally all that, you'll see that a measly 5% of Indians actually pay tax. A maximum of around 8 crore people out of 130 crore Indians. It does sound quite odd, doesn't it

Do Indian citizens pay taxes in both countries

If you are a resident Indian, your global income is taxable in India. This income may have been earned or received outside – but it shall be taxed in India. If this income is also taxable in another country, you can take benefit of DTAA (Double Tax Avoidance Agreement).

Can you avoid tax in India

People utilize various methods to avoid paying taxes, including filing fraudulent tax returns, smuggling, falsifying documents, and bribery. Tax evasion is important because it is considered illegal in India and leads to severe penalties.

How can I save 100% tax in India

Here are some examples of tax-saving instruments.Public Provident Fund.National Pension Scheme.Premium Paid for Life Insurance policy.National Savings Certificate.Equity Linked Savings Scheme.Home loan's principal amount.Fixed deposit for five years.Sukanya Samariddhi account.

How much tax for 24 lakhs in india

What are the income tax rates

| Tax Slabs | Tax Rates |

|---|---|

| Income up to Rs.3 lakhs | NIL |

| Income between Rs.3 lakhs and Rs.5 lakhs | 10% of amount exceeding Rs.3 lakhs |

| Income between Rs.5 lakhs to Rs.10 lakhs | 20% of amount exceeding Rs.5 lakhs |

| Income above Rs.10 lakhs | 30% of amount exceeding Rs.10 lakhs |

How much tax will I pay if my salary is 1000000 in India

If you make ₹ 1,000,000 a year living in India, you will be taxed ₹ 238,335. That means that your net pay will be ₹ 761,665 per year, or ₹ 63,472 per month. Your average tax rate is 23.8% and your marginal tax rate is 36.8%.

What is the tax for 60 lakhs in India

What are the income tax rates

| Tax Slabs | Tax Rates |

|---|---|

| Income up to Rs.2.5 lakhs | NIL |

| Income between Rs.2.5 lakhs and Rs.5 lakhs | 10% of amount exceeding Rs.2.5 lakhs |

| Income between Rs.5 lakhs to Rs.10 lakhs | 20% of amount exceeding Rs.5 lakhs |

| Income above Rs.10 lakhs | 30% of amount exceeding Rs.10 lakhs |

Do I have to pay tax in India if I earn abroad

Income which is earned outside India is not taxable in India. Interest earned on an NRE account and FCNR account is tax-free. Interest on NRO accounts is taxable in the hands of an NRI.

Is foreign income taxable in India for NRI

In case of resident taxpayer all his income would be taxable in India, irrespective of the fact that income is earned or has accrued to taxpayer outside India. However, in case of non-resident all income which accrues or arises outside India would not be taxable in India.

Is foreign allowance taxable in India

The tribunal held that the foreign assignment allowance that was topped up to the TCC of the assessee, though it was transferred by the employer from their bank account in India to the nostro accounts, is not taxable in India.

Is transfer allowance taxable in India

Tax on Transport Allowance

Transport allowance is taxable under the head salaries in the hands of the employee. It is added to your gross salary. You can claim tax exemption for each transport allowance as per the exemption limit.

How much tax will I pay if my salary is 100000 in India

If you make ₹ 100,000 a year living in India, you will be taxed ₹ 12,000. That means that your net pay will be ₹ 88,000 per year, or ₹ 7,333 per month. Your average tax rate is 12.0% and your marginal tax rate is 12.0%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

How much tax for 50 lakh rupees in India

How to calculate income tax on salary above 50 lakhs Tax calculation example

| Gross Salary | 50,00,000 |

|---|---|

| Net Taxable Income | 42,47,600 |

| Tax on the above income | 10,86,780 |

| Rebate u/s 87A | NA |

| Total Tax | 10,86,780 + 4% cess |