What Alibaba does

Its primary business is to offer a digital marketplace where consumers and merchants can connect and buy and sell from each other. But the company has expanded its operations to include cloud computing, digital media and entertainment, and other business offerings.

What is the future of Alibaba

Stock Price Forecast

The 51 analysts offering 12-month price forecasts for Alibaba Group Holding Ltd have a median target of 138.63, with a high estimate of 184.44 and a low estimate of 72.07. The median estimate represents a +50.42% increase from the last price of 92.16.

Why is Alibaba so successful

Alibaba gathers scattered customers with similar needs to form a powerful purchasing group that can buy single products at a wholesale price. Furthermore, Alibaba also takes advantage of its massive online customer behavior data to develop products suited to particular customer habits.

Can Alibaba reach $1000

Drawing a straightforward trend line price chart, BABA shares could reach $1,000 sometime in the first quarter of 2027 if it crawls along with the support level. Alibaba's P/E ratio would compress to a mere 11 times on a forward basis (FY2026) and this is based on the current depressed environment.

How big will Alibaba get

If Alibaba meets those analysts' expectations and continues to grow its revenue and net income at a relatively modest CAGR of 10% from fiscal 2025 to fiscal 2028, it could potentially generate about 1.37 trillion yuan ($190 billion) in revenue and 165 billion yuan ($23 billion) in net income by the final year.

Why Alibaba will beat Amazon

Alibaba has both a cheaper valuation and faster revenue growth than Amazon, which would theoretically make it a better buy. However, Amazon faces less political risk than Alibaba does, which justifies some sort of a premium.

What will Alibaba be worth 2025

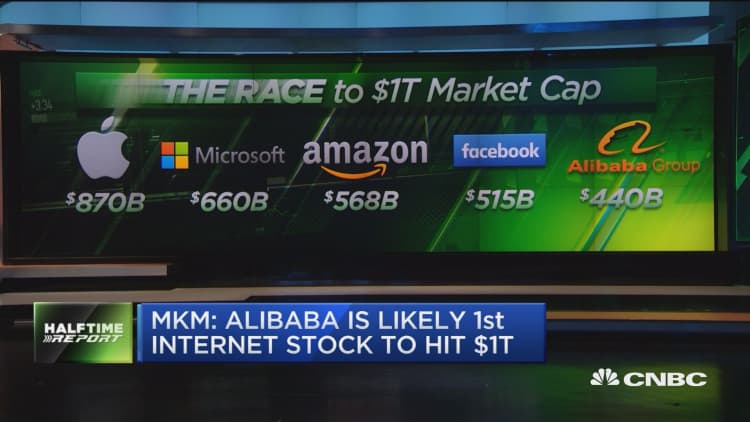

If its price-to-sales ratio holds steady, it could be worth about $750 billion by the beginning of 2025. But if the regulatory headwinds fade and Alibaba commands higher valuations again, its market cap could exceed $1 trillion by 2025.

How high can Alibaba go

Average Price Target

Based on 15 Wall Street analysts offering 12 month price targets for Alibaba in the last 3 months. The average price target is $141.87 with a high forecast of $183.00 and a low forecast of $98.00. The average price target represents a 69.22% change from the last price of $83.84.

Could BABA reach $1,000

Drawing a straightforward trend line price chart, BABA shares could reach $1,000 sometime in the first quarter of 2027 if it crawls along with the support level. Alibaba's P/E ratio would compress to a mere 11 times on a forward basis (FY2026) and this is based on the current depressed environment.

Does Alibaba have a future

Analysts believe Alibaba's revenue and adjusted EBITDA will grow 10% and 9%, respectively, in fiscal 2024.

Can BABA reach $1,000

Drawing a straightforward trend line price chart, BABA shares could reach $1,000 sometime in the first quarter of 2027 if it crawls along with the support level. Alibaba's P/E ratio would compress to a mere 11 times on a forward basis (FY2026) and this is based on the current depressed environment.

What will BABA be worth in 2030

According to the Traders Union long-term price forecast Alibaba (BABA) can reach $117.14 by 2025, $164.85 by 2030, $216.67 by 2034.

Can Baba reach $1,000

Drawing a straightforward trend line price chart, BABA shares could reach $1,000 sometime in the first quarter of 2027 if it crawls along with the support level. Alibaba's P/E ratio would compress to a mere 11 times on a forward basis (FY2026) and this is based on the current depressed environment.

Will Alibaba recover in 2023

Analysts expect Alibaba's revenue to grow at a CAGR of 9% from fiscal 2023 to 2025, and for its net income to increase at a CAGR of 30% as it spins off more of its subsidiaries and reins in its spending.

How high can Alibaba stock go

Alibaba Group Holding Ltd (NYSE:BABA)

The 51 analysts offering 12-month price forecasts for Alibaba Group Holding Ltd have a median target of 138.82, with a high estimate of 184.69 and a low estimate of 72.17. The median estimate represents a +51.05% increase from the last price of 91.90.