How can I transfer money from Icici to international bank

Online channel for Non-Resident Indians (NRIs) holding an ICICI Bank AccountLogin to Internet Banking with your user ID and Password.Click on 'Funds Transfer' on 'Payments & Transfer' tab.Click on 'An overseas account from NRE/FCNR account'Add your beneficiary's Bank Account.Specify the amount to initiate transfer.

Does Icici allow international transfer

Fund Transfer Abroad is a unique online service offered exclusively by ICICI Bank, for its resident individual customers. With ICICIBank.com, now transfer funds abroad to your dear ones by placing a request from any part of the world accessible to ICICI Bank Internet Banking.

Can I transfer money from my bank account to a foreign bank account

You can use the bank where you have a checking or savings account to conduct your international money transfer or open an account with various companies that specialize in sending money, such as Western Union, MoneyGram, PayPal, Xoom, Wise (formerly TransferWise) or Paysend.

How much does Icici charge for international transfer

Key Facts About ICICI Bank International Transfers

| 🏦 ICICI int'l charges | 3%+ |

|---|---|

| 💸 Int'l fees via Monito | 0.5% – 3% |

| ⏱ ICICI int'l transfer time | 1-3 business days |

| ⚡Transfer time via Monito | 1-2 business days |

| 💵 ICICI payment method | SWIFT transfer |

How can I transfer money from India to foreign bank account

You can send money overseas via a:bank.post office.money transfer service.digital payment platform.money exchanger.

How can I transfer money to an international account

It can be easily done via a bank, an international money transfer service, individual agents or online platforms. Generally, money transfers can take days and are exchanged in multiple currencies offline and digitally through online banking applications.

How much ICICI charges for international money transfer from India

ICICI international transfer fees

| Transfer type | ICICI international transfer fee |

|---|---|

| Standard telegraphic transfer online | 750 INR + exchange rate markup + agent or intermediary bank charges |

| Standard telegraphic transfer in branch | 1,000 INR + exchange rate markup + agent or intermediary bank charges |

How can I send money from India to abroad

You can transfer your money using:foreign currency bank draft (or cashier cheque)demand draft (DD)debit card or credit card.money order.wire transfer.online (bank) transfer.

How do I send money directly to a foreign bank account

Method #1: Making an International Wire Transfer Online Through the BankFind the wire transfer page.Check your online transfer limit.Provide bank details.Enter the amount and currency type.Pay the processing fee.Find out how long it will take to arrive.

How can I transfer money from my account to foreign account

You can send money overseas via a:bank.post office.money transfer service.digital payment platform.money exchanger.

How long does Icici international transfer take

How much time does it take to send money with ICICI. The beneficiary abroad will receive the funds in their overseas bank account within 1 international working day, where the transaction requests are received before 15:00 PM on weekdays¹². It can take a few more days if intermediary banks are involved.

Is there a fee for international bank transfer

Wire transfer fees generally range from $0 to about $50. The median wire transfer fee for the institutions we surveyed is $15 for incoming domestic wire transfers, $25 for outgoing domestic wire transfers, $15 for incoming international wire transfers and $45 for outgoing international wire transfers.

How much money can NRI transfer from India to abroad

As of the financial year 2021-2022, the LRS limit for NRIs is INR 2,50,00,000 per financial year. This limit applies to the total amount of funds transferred by an NRI during the financial year, and includes all transfers made for any purpose, including investments, gifts, and personal expenses.

How to transfer money from Indian bank account to foreign account

You can transfer your money using:foreign currency bank draft (or cashier cheque)demand draft (DD)debit card or credit card.money order.wire transfer.online (bank) transfer.

Can I transfer money internationally through online banking

Making an international payment using the mobile app or Online Banking is just as secure as it is to make one in branch.

How can I send money from India to another country online

You can transfer your money using:foreign currency bank draft (or cashier cheque)demand draft (DD)debit card or credit card.money order.wire transfer.online (bank) transfer.

How do I send money to an international bank account

Method #1: Making an International Wire Transfer Online Through the BankFind the wire transfer page.Check your online transfer limit.Provide bank details.Enter the amount and currency type.Pay the processing fee.Find out how long it will take to arrive.Bring all banking data to the branch with you.

How to transfer money from Indian bank to international bank account

How to transfer money to a foreign bank account from IndiaSWIFT/ Wire transfer with banks.Online money transfer with providers.Western Union.Bank drafts and cashier's checks.International Money Order.

How do I transfer money to an overseas account

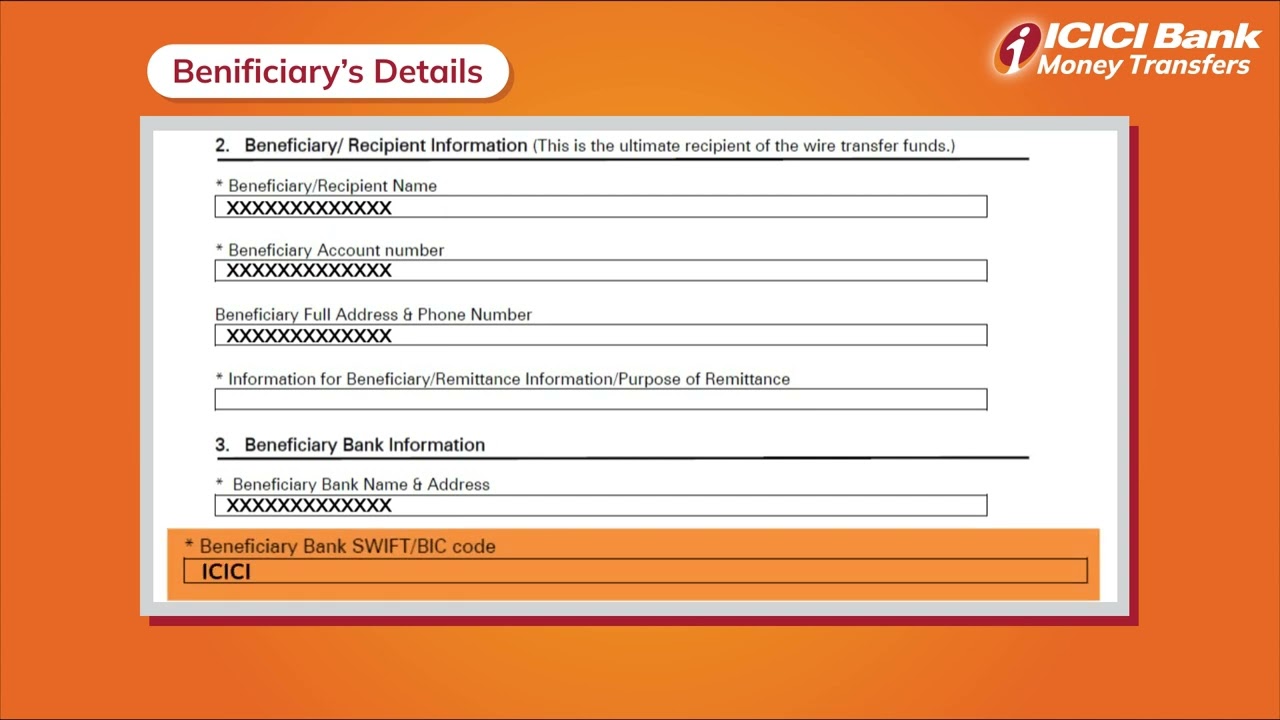

You'll need the following information from your recipient:Their full name and street address (not a PO Box).The IBAN or bank account number.A SWIFT code or BIC (this identifies their bank) or, if not available, the full bank address.Any other information they have like sort codes or routing code.

How do I avoid bank charges on international transfers

Here's a look at some of the most effective ways to keep your costs low as you send money internationally.Ask the Bank to Waive the Fee.Use Multi-Currency Accounts.Make Cross-Border Payments.There's No Reason to Pay Wire Transfer Fees.

What is the cheapest way to transfer international funds

The cheapest way to send money internationally is to transfer funds directly from your bank account to a recipient's bank account. Most transfer services charge additional fees for debit card or credit card payments and cash pickups. Credit card payments will incur additional charges from your credit card provider.

Can I transfer money from Indian bank account to international bank account

Transferring money to an international bank account

The Reserve Bank of India (RBI) allows Indian citizens to make international remittances of up to USD250,000 per financial year through the Liberalised Remittance Scheme. You can send money overseas via a: bank.

Can I transfer money from my NRE account to abroad

Interest earned and account balance in NRE and FCNR accounts can be freely repatriated abroad.

What is the best way to transfer money internationally between banks

Our Top Picks for the Best Ways to Send Money InternationallyWise — Best for Low Fees.PayPal — Best for Peer-to-peer Money Transfers.Western Union — Best for Availability.MoneyGram — Best for Cash Transfers.OFX — Best for Large Amounts of Money.WorldRemit — Best Mobile Option.XE — Best for Business Transfers.

How can I transfer money from India to overseas bank account

You can transfer your money using:foreign currency bank draft (or cashier cheque)demand draft (DD)debit card or credit card.money order.wire transfer.online (bank) transfer.