What is the difference between FCNR NRE and NRO account

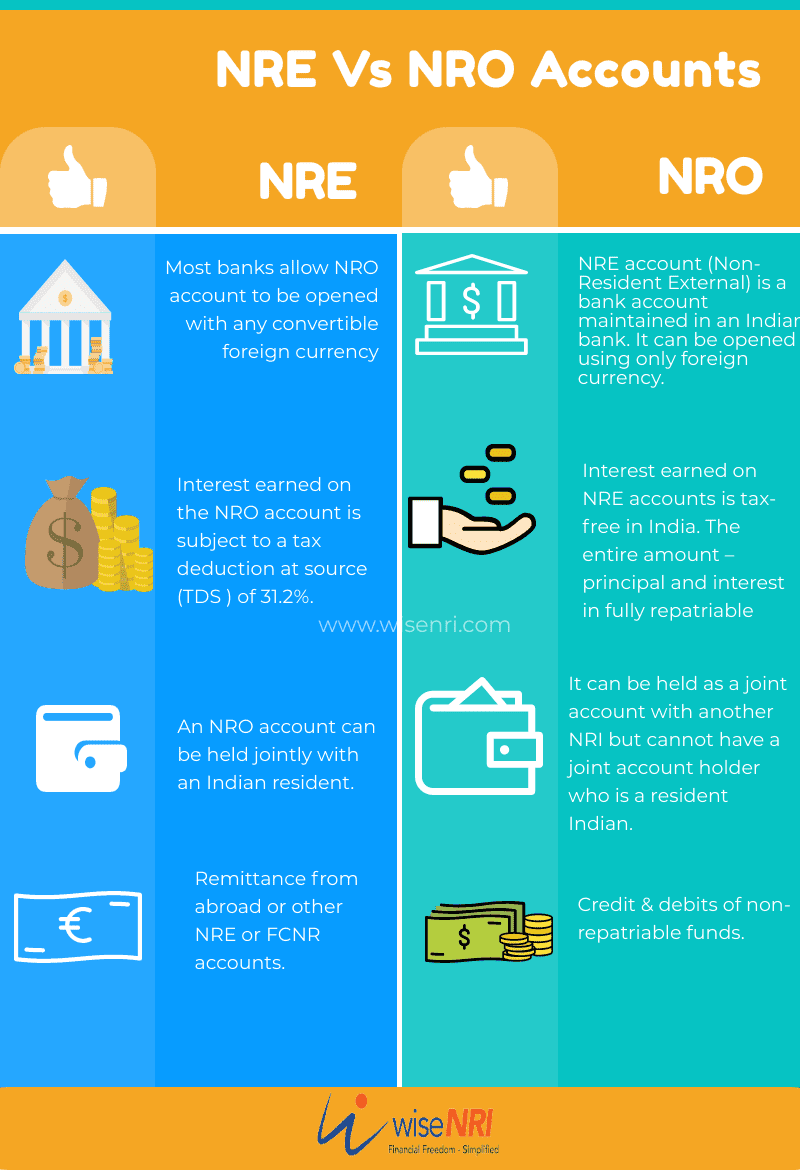

NRO Account is for depositing income that one earns in India. NRE account is for depositing income earned outside India in India. FCNR account is for depositing earnings in foreign currency in an Indian account. Deposits made in this account are repatriable to the NRI's country of residence with certain limits.

Do I need to have both NRE and NRO account

Yes, an individual can open both NRE and NRO accounts to meet his needs. If you have any income arising in India, you can receive it in NRO account, and if you want to park your earnings abroad in India, you can open an NRE account.

Is NRO account taxable in India

In India, the interest earned on deposits in NRO accounts is fully taxable. The interest income on funds in an NRO account is subject to tax deducted at source (TDS). A 30% tax on the NRO account, in addition to the applicable cess and surcharge, is levied on the interest income from these accounts.

What is the disadvantage of NRO account

Limitations of NRO Accounts

One of the major disadvantages of an NRO account is the cap of USD 1 million on the repatriation of funds. Moreover, the interest income of an NRO account is also subject to taxes.

What are the disadvantages of NRE account

Deposits made in foreign currencies in an NRE account are subject to conversion into Indian rupees. Hence, such deposits might fluctuate in value due to appreciation of domestic currency (or depreciation of foreign currency), thereby incurring losses during repatriation.

Can a foreign citizen hold NRO account in India

Q5. What are the accounts that a tourist visiting India can open Answer: An NRO (current/ savings) account can be opened by a foreign national of non-Indian origin visiting India, with funds remitted from outside India through banking channel or by sale of foreign exchange brought by him to India.

What is the disadvantage of NRE

Limitations of NRE accounts

All transactions made through an NRE Account must be between India and a foreign country, meaning domestic transactions are prohibited. As the currency of the account is usually based on Indian Rupees, there is the risk of currency fluctuations when transferring funds.

Do I need to pay tax on NRO account in India

In India, the interest earned on deposits in NRO accounts is fully taxable. The interest income on funds in an NRO account is subject to tax deducted at source (TDS). A 30% tax on the NRO account, in addition to the applicable cess and surcharge, is levied on the interest income from these accounts.

What is the disadvantage of NRO

Limitations of NRO Accounts

But the NRE and NRO full form is not the only difference between the two types of accounts. One of the major disadvantages of an NRO account is the cap of USD 1 million on the repatriation of funds. Moreover, the interest income of an NRO account is also subject to taxes.

What is the disadvantages of NRO account

An NRO account restricts you from remitting more than USD 1 million inclusive of taxes during an assessment year. You can repatriate the interest amount freely, but the principal amount can be repatriated only within set limits. It also requires an undertaking along with a certificate from a Chartered Accountant.

What happens if you don’t convert to NRO account

Penalties for not converting to NRO account

Under the Act, any individual who fails to adhere to the guidelines is liable to pay a penalty of up to 3 times the amount involved in the existing resident savings account or Rs 2 lakh when the sum is not quantifiable.

Do I need both NRE and NRO

Yes, an individual can open both NRE and NRO accounts to meet his needs. If you have any income arising in India, you can receive it in NRO account, and if you want to park your earnings abroad in India, you can open an NRE account.