What is taxation of foreign income in India

The income from foreign sources gets taxed at the same rate applicable to earnings in India. If the taxpayer receives his foreign income in India, he/she must pay taxes in the same fiscal year. If the income is not received in India, it gets taxed in the financial year in which it is realised or accrued.

Is foreign company income taxable in India

Taxation of Non-Resident Companies:

While resident companies (including foreign companies with POEM in India) will be taxed according to the residence rule, non-residence companies will only be taxed on income which arises in India. This is known as the 'source' rule of taxation.

How are foreign investors taxed in India

Section 115AD of the Income Tax Act, 1961, deals with Tax on income of Foreign Institutional Investors from securities [excluding income from units of mutual fund which are taxed u/s 115AB] or capital gains arising from the transfer of such securities.

Is foreign direct investment taxable in India

Tax on Foreign Companies

A foreign company is only taxed on the income earned within India from any source, i.e. being accrued or received in India, at 40% (excluding surcharge). Some other income on pure investments in India, such as royalty, interest, and capital gains, is taxed at a different rate.

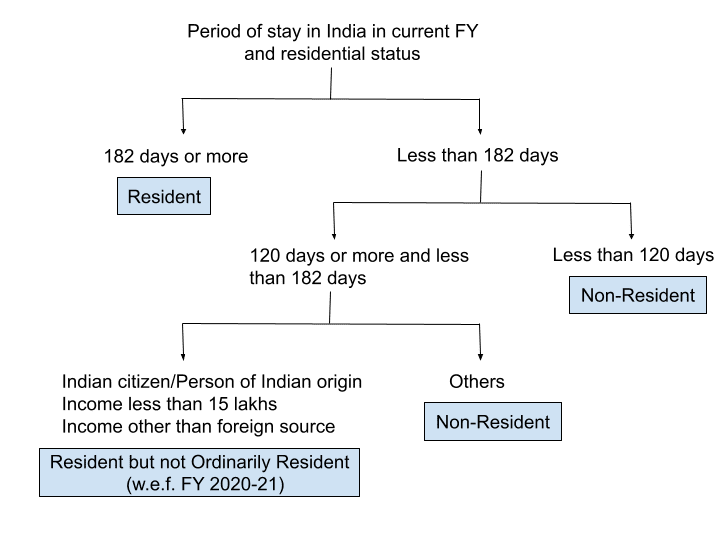

Is foreign income taxable in India for NRI

In case of resident taxpayer all his income would be taxable in India, irrespective of the fact that income is earned or has accrued to taxpayer outside India. However, in case of non-resident all income which accrues or arises outside India would not be taxable in India.

Do I need to pay tax in India if I work in Dubai

As an NRIs in UAE, you are exempted from paying income tax in UAE. You do not have to pay any tased on your UAE Income in India too, under the UAE-India Double Taxation Avoidance Agreement. However, you must pay taxes on any income earned form investments in India.

How can I avoid tax on foreign income in India

Form 67 should be filed along with the income tax return for the relevant assessment year, and the foreign tax credit claimed can be set off against the tax liability of the individual in India.

How are US investments taxed in India

Indian investors are subject to a flat tax rate of 25% on dividends from US stocks, with the tax withheld by US companies. Reinvested dividends are added to the investor's income and taxed accordingly. Capital gains from selling stocks are taxed as either long-term or short-term gains.

Do traders have to pay tax in India

Their profits are taxed as per the applicable slab rates, which can go up to 30% depending on their income level. In short, investors are taxed on their capital gains, while traders are taxed on their business income. A detailed explanation of this is available here.

Is NRI investment taxable in India

When NRIs invest in certain Indian assets, they are taxed at 20% on the income earned. If the special investment income is the only income the NRI has during the financial year and TDS has been deducted, then such an NRI is not required to file an income tax return.

In which case foreign income received in India is taxable

In case of resident taxpayer all his income would be taxable in India, irrespective of the fact that income is earned or has accrued to taxpayer outside India. However, in case of non-resident all income which accrues or arises outside India would not be taxable in India.

How much NRI is tax free in India

As a Non-resident, you still get the benefit of the basic exemption limit of Rs. 2,50,000 from your total income. However, If your total income in India consists of only short-term capital gains or long-term capital gains, then the benefit of the basic exemption limit is not available in respect of such gains.

How much NRI salary is taxed in India

Tax Slabs for AY 2023-24

| Old Tax Regime | New Tax Regime u/s 115BAC | |

|---|---|---|

| Income Tax Slab | Income Tax Rate | Income Tax Rate |

| Up to ₹ 2,50,000 | Nil | Nil |

| ₹ 2,50,001 – ₹ 5,00,000 | 5% above ₹ 2,50,000 | 5% above ₹ 2,50,000 |

| ₹ 5,00,001 – ₹ 10,00,000 | ₹ 12,500 + 20% above ₹ 5,00,000 | ₹ 12,500 + 10% above ₹ 5,00,000 |

Is salary income from Dubai taxable in India

As an NRIs in UAE, you are exempted from paying income tax in UAE. You do not have to pay any tased on your UAE Income in India too, under the UAE-India Double Taxation Avoidance Agreement. However, you must pay taxes on any income earned form investments in India.

Is salary earned in Qatar taxable in India

1 Salary income earned in Qatar is not taxable in India as he is non resident. 2 Not required but can be shown in exempted income. 3 That person is right in suggesting to file return as non resident. If you file the return as resident, Qatar income is taxable.

Do I need to pay tax on US income in India

income tax in India. The foreign income i.e. income accruing or arising outside India in any financial year is liable to income-tax in that year even if it is not received or brought into India. There is no escape from liability to income-tax even if the remittance of income is restricted by the foreign country.

Do I have to pay tax in USA if I earn in India

Article 16 of the DTAA states that salaries earned by a person who resides and works in country A (country A in this case being the US), shall be taxed 'only' in the country of residence, that is, the US. So if you are a resident in the US and are working in the US, you will pay tax on your India salary in the US.

How to show forex income in India

A: Forex trading income in India can be classified as either business income or capital gains. Business income is taxed at the individual's applicable income tax slab rates, while capital gains are subject to specific tax rates, depending on the holding period and the type of gain (short-term or long-term).

What happens if you don’t pay taxes in India

Prosecution Under Section 276CC:

The whole liability shifts on the tax payer to give a valid reason for not filing tax on time. Under the section, an individual would be liable to pay penal interest and could be prosecuted for imprisonment of three months to seven years along with a fine.

Do NRI need to declare foreign income in India

By default, income earned by an NRI abroad is not taxable in India. But if the income in India through aspects like capital gains from investments in shares, mutual funds, property rental and term deposits exceed the basic exemption limit as defined in the Income Tax Act, an NRI would have to file a tax return.

Is money sent to India taxable if NRI

However, if an NRI sends money to somebody who is not related by blood, then there is a tax implication. An amount over Rs 50,000 per year is subject to taxation in the hands of the receiver. For an NRI who is sending money from the US, then blood relation does not make a difference.

How can NRI avoid tax in India

Submitting Form 15G or Form 15H: NRIs can submit Form 15G or Form 15H to the Indian income tax department to avoid TDS on their income if their total income is below the taxable limit. Form 15G is for individuals and HUFs, while Form 15H is for senior citizens.

Is money received from NRI taxable in India

Any income you receive in India is taxable, with a few exceptions. You may be liable to pay taxes if you receive money from an NRI, except for marriage or inheritance reasons. Ensure you check the tax laws before you send or receive NRI gifts.

What salary is not taxable in India

Income Exempt from Tax as Per Section 10

| Section | Exemptions |

|---|---|

| Section 10(24) | Income earned by authorised trade unions |

| Section 10(25) | Income earned via provident funds and superannuation funds |

| Section 10(25A) | Income earned via Employee's State Insurance Fund |

| Section 10(26), 10(26A) | Income earned by Schedule Tribe Members |

How to report foreign salary income in India

If the income is a payment for your services rendered abroad, include it under 'Income from salary. Always select relevant income head based on the nature of income and list the foreign income under that particular head. 👉 After clubbing the foreign income, it would be a part of your income earned in India.