Can I bring gold out of Vietnam

When leaving Vietnam: A quantity over 300g of gold must be declared and be permitted by the State Bank. You are not allowed to bring out weapons, munitions, explosives, drugs, antiques, live wild animals, rare plants, and documents relating to the national security.

How much gold can you carry out of India

Rules when carrying gold out of India

Though there is no upper limit on the amount of gold that can be taken out of the country, if you plan to bring it back later, then you will have to pay customs duty.

How much gold jewellery can I carry from India to USA

Generally, travelers are allowed to bring up to $10,000 worth of gold into the US without having to declare it or pay duty on it. However, if you're carrying more than that amount then you'll need a special license and will have to declare your gold at customs upon arrival in the US.

How much gold jewellery can I carry to UK from India

How much jewellery can I take to the UK under Indian laws Under Indian laws, i.e. the baggage import export rules of the ministry of external affairs, there is no value limit on the export of gold jewellery by a passenger through the medium of baggage so long as it constitutes the bonafide baggage of the passenger.

How much gold we can bring from Vietnam

Anyone entering or leaving the country can bring jewelry but must declare if they have over 300 grams. The ban will take effect starting May 15. The old regulation permitted anyone to travel with gold bars freely. They only needed a customs clearance if the jewelry volume is higher than 300 grams.

How much gold can I carry from Vietnam to India

How much gold is allowed on international flights to India The duty-free gold allowance for male passengers is 20 grams (maximum Rs 50,000) and for female passengers is 40 grams (maximum Rs 100,000).

How much jewellery can I carry in international flight in India

The duty-free allowance is up to fifty thousand rupees for men and one lakh rupees for women. Indians who have lived abroad for six months or more can carry up to 1kg of gold to India, after paying 10% gold duty and the applicable customs duty.

How much gold can I bring to India on tourist visa

As per rules, the gold should not weight more than 1 kg per person. Going by the rules, if you don't want to pay extra charges, your gold value should remain under the duty-free limit.

How much gold can I carry to India without duty

It must be in the form of jewellery only. Gold coins, gold biscuits or gold bars cannot be part of the duty-free allowance. The maximum duty-free allowance is Rs 50,000 (for men) and Rs 100,000 (for women). Gold above this limit will be subject for customs duty.

What are the new gold rules in India 2023

The Press Information Bureau's release of 4 March 2023 said that hallmarked gold jewellery and artefacts without the 6-digit HUID would be prohibited from 1 April 2023. The release further said that it would safeguard the consumer interests and increase their confidence, traceability and quality of the sold items.

Can I bring 24k gold to India

A male passenger is allowed to carry up to 20 grams of gold costing no more than Rs. 50,000 and a female traveler can bring a maximum of 40 grams of gold that does not cost more than Rs. 1 lakh. How much custom duty is charged on gold in India 2022

How much gold can I fly with

Generally speaking, airlines allow passengers to bring up to 500 grams of gold jewellery in their carry-on luggage without any special paperwork or declarations. Anything over 500 grams must be declared as part of your checked baggage and will incur additional fees per the airline's policy.

How much jewellery can I bring to India customs

Each passenger can carry up to 1 kg (kilogram) of gold jewelry upon payment of customs duty, provided the passenger has stayed abroad for atleast a year or more. Also, Indian customs will not allow more than 1 kg of gold jewelry even if the passenger is willing to pay the customs duty for it.

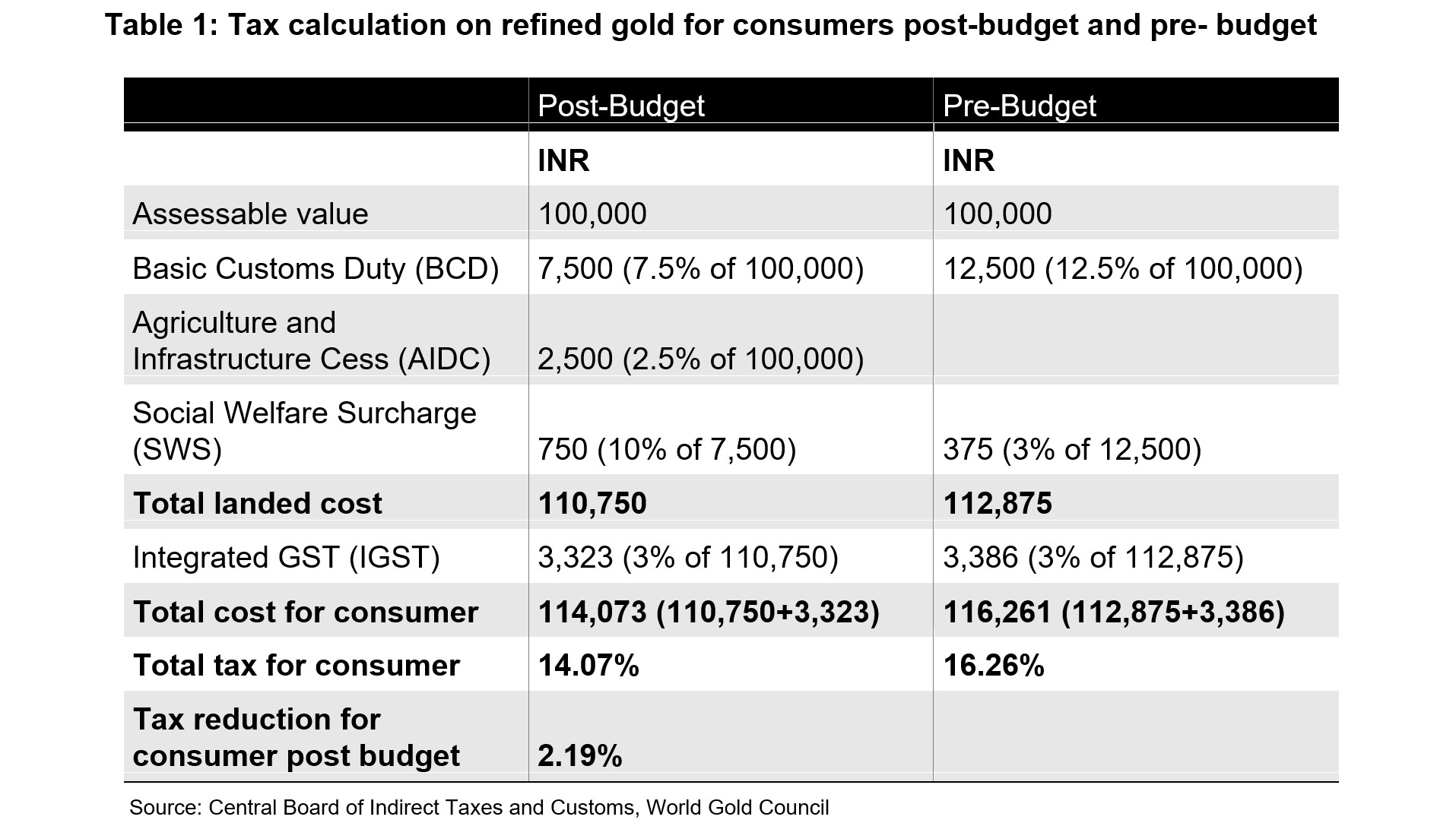

How much customs duty charges in India for gold

The effective duty on gold is currently 18.45%, which includes 12.5% import duty, 2.5% agriculture infrastructure development cess and other taxes. Grey market operators, who smuggle gold and sell it for cash to avoid duties, got a boost when government raised the basic import duty on gold to 12.5% from 7.5% in July.

What is the new rule in India for gold

Gold is often an emotional purchase for Indians. But come April 1, 2023, gold jewellery will mandatorily have a 6-digit HUID or Hallmark Unique Identification Number.

What is the new law on gold in India

April 1, 2023 onwards all gold jewellery and artifacts will need to mandatorily carry a 6-digit alphanumeric HUID or Hallmark Unique Identification. This number will help consumers trace the gold jewellery back to its jeweller and also help check its purity.

Can you travel with gold bars to India

A person can carry bars or coins of gold weighing below 1kg from the USA to India. This is allowed with customs duty taxes charged. The limit is applicable only if you are a resident of India and are carrying a valid passport issued by the Indian government authorities. You can easily carry gold as baggage.

Do I have to declare jewelry at Indian customs

For those who carry a lot of gold/jewelry and deliberately fail to declare the items on arrival, their gold/jewelry items can be confiscated and they can face fines and prosecution under the customs laws of India.

Can NRI bring gold to India

The weight of gold being imported into the country should not exceed 1Kg per passenger, which is about 2.2 pounds. The said passenger must be a Person of Indian origin OR person holding valid passport under the Passport Act, 1967. Imported gold can be in the form of bars, coins or jewellery.

Why is gold illegal in India

The Gold Control act which was in force between 1968-1990 banned Indians from owning gold bars or coins and this led to a huge black market. In the 1990s economic reforms repealed this act and put a cap of 450 rupees per 10g of gold, bringing smuggling to a halt.

How much gold a person can keep at home in India

Gold Storage Limit

According to the Central Board of Direct Taxes (CBDT), the limits for holding gold jewellery and ornaments without showing any proof are: Married woman: Up to 500 grams of gold. Unmarried woman: 250 grams of gold. Men: Only 100 grams of gold.

Is gold import banned in India

The government on Wednesday imposed restrictions on imports of certain gold jewellery and articles. In a notification, the directorate general of foreign trade (DGFT) amended the import policy for unstudded jewellery made of gold, and other articles made of gold to “restricted” from “free”.

Can I bring gold from abroad to India

The weight of gold being imported into the country should not exceed 1Kg per passenger, which is about 2.2 pounds. The said passenger must be a Person of Indian origin OR person holding valid passport under the Passport Act, 1967. Imported gold can be in the form of bars, coins or jewellery.

Is it OK to travel with gold

Coins. Call the number on your screen or click on the link.

Which gold is banned in India

KDM gold is one of the most searched for types of Gold in the world. It has its benefits but has also been considered controversial in the recent past and was banned by the Indian government due to certain side effects.