What is the limit of NRI fund transfer to India

As of the financial year 2021-2022, the LRS limit for NRIs is INR 2,50,00,000 per financial year. This limit applies to the total amount of funds transferred by an NRI during the financial year, and includes all transfers made for any purpose, including investments, gifts, and personal expenses.

How much is the transfer fee for Shinhan Bank

Shinhan had been charging customers 500 won ($0.40) for online or mobile money transfers to other banks and 300 won when using automated transfers, and waived fees only for customers who met certain criteria. These were all waived completely from 2023.

How much money can be sent from UK to India

There is no limit on the amount you can transfer to India from the UK. Do I have to mention the reason for transferring funds Yes, as per the RBI guidelines, whenever you remit money from abroad, you are required to mention the reason for transferring the funds on the remittance form.

How can I transfer money from India to Germany through SBI

Transfer money from SBI to Foreign Bank OnlineSelect Payments/Transfer option.Select the option International Fund Transfer and click on it.Click on Foreign Currency Transfer/ Remittance New.Accept the Terms and Conditions.Select the beneficiary.Enter the amount.Provide the required details and click on proceed.

How much money can be transferred to NRE account from abroad

The Reserve Bank of India allows the transfer of funds up to USD 1 million a year from an NRO to an NRE account. Here is a list of documents you will require if you are planning transfer funds from an NRO account to an NRE account, according to the IDFC FIRST Bank. Form 15CB – It is a form certified by the CA.

Can we deposit dollars in NRE account in India

A Non-Resident External (NRE) account helps an NRI store their foreign currency savings in an Indian bank. Using an NRE account, an account holder can deposit money in any foreign denomination and withdraw it in INR (Indian Rupees).

Is there a fee for international bank transfer

Wire transfer fees generally range from $0 to about $50. The median wire transfer fee for the institutions we surveyed is $15 for incoming domestic wire transfers, $25 for outgoing domestic wire transfers, $15 for incoming international wire transfers and $45 for outgoing international wire transfers.

Is there a charge for international bank transfer

Every bank is different, but in general you can expect them to take as much as 3-4% of your total transfer as a fee when you send money internationally. Thankfully, despite that, a lot of banks will try to cap the amount they charge their customers. This will vary depending on the institution.

How much money can I send to India from UK without tax

Tax on Money Transfer to India

If you are looking to send money from the UK to India, you can send up to 3,000 GBP as gifts during the fiscal year under the annual exemption.

What is the maximum money transfer without tax in the UK

Currently, there are no legal limits on the amount of money you can transfer to the United Kingdom. However, if you're bringing in £10,000 or more in physical cash you will need to declare it.

What are the charges for Swift transfer

SWIFT money transfer charges and fees

| Bank | SWIFT transfer fee |

|---|---|

| HDFC Bank | ₹500 |

| ICICI Bank | ₹750 |

| SBI | $11.25 |

| Axis Bank | ₹500 |

How much do banks charge for international money transfer

Every bank is different, but in general you can expect them to take as much as 3-4% of your total transfer as a fee when you send money internationally. Thankfully, despite that, a lot of banks will try to cap the amount they charge their customers. This will vary depending on the institution.

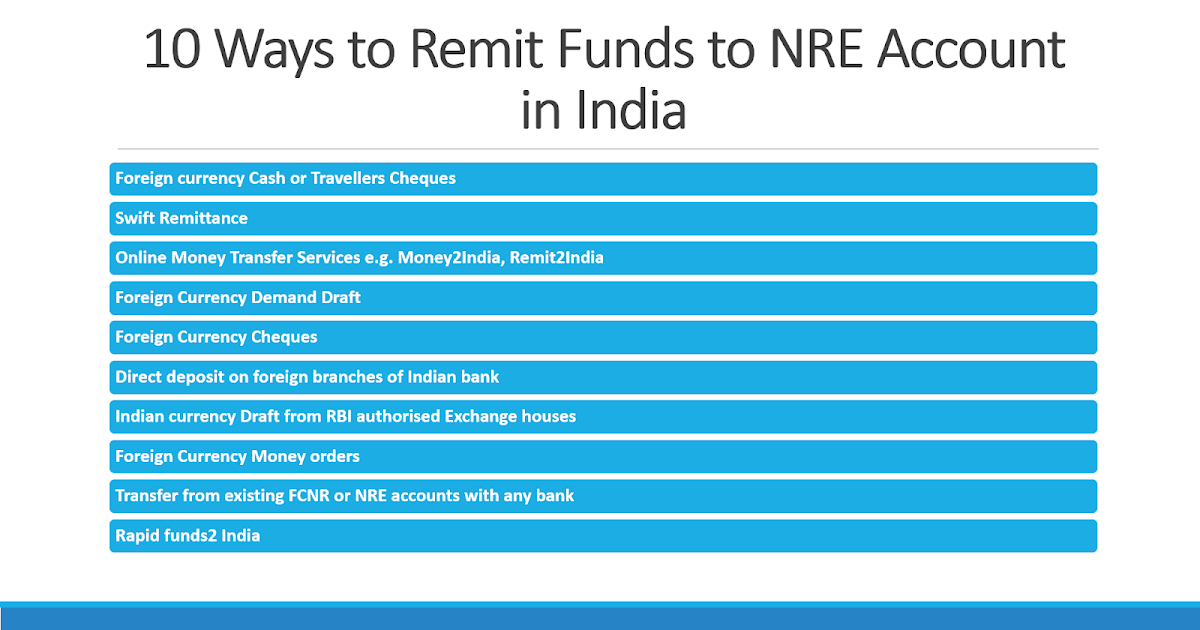

Can someone transfer money to my NRE account

You cannot transfer money to a NRE account from a savings account in India. However, you can transfer money from NRO to NRE account. You can also transfer money from one NRE account to another.

What is the penalty for not converting to NRE account

What happens if an account is not converted into NRI account If you continue operating a resident account after change in your residential status, it carries a penalty of up to 3 times the amount in your savings bank account or Rs. 2 lakh.

Can cash be deposited in a NRE account

You cannot deposit cash into an NRE account. You can transfer funds from one account to another. You cannot transfer money into a NRE account from a savings account in India.

What is the cheapest way to transfer international funds

The cheapest way to send money internationally is to transfer funds directly from your bank account to a recipient's bank account. Most transfer services charge additional fees for debit card or credit card payments and cash pickups. Credit card payments will incur additional charges from your credit card provider.

How do I avoid bank charges on international transfers

Here's a look at some of the most effective ways to keep your costs low as you send money internationally.Ask the Bank to Waive the Fee.Use Multi-Currency Accounts.Make Cross-Border Payments.There's No Reason to Pay Wire Transfer Fees.

Do I need to pay tax if I transfer money to India

There is no recipient tax on money being transferred from abroad to India when it's being sent to blood relatives. In general, “blood relatives” — including spouses, children and grandchildren, siblings or in-laws — don't pay tax on any amount you send.

How much money transfer is tax free in India

According to the latest notification, any individual making payments using their international Debit or Credit cards up to INR 700,000 per financial year will be exempt from the Liberalized Remittance Scheme (LRS) limits. As a result, these transactions will not be subject to any Tax Collected at Source (TCS).

Do I have to pay tax on money transferred from overseas to UK

Tax implications of transferring money to the UK. UK residence and tax: Your residence status in the UK is the deciding factor in whether your foreign income is taxable or not. Non-residents' overseas income is not taxable; they only pay tax on their income in the UK.

How much money can be transferred tax free

Annual exemption

You can give gifts or money up to £3,000 to one person or split the £3,000 between several people. You can carry any unused annual exemption forward to the next tax year – but only for one tax year. The tax year runs from 6 April to 5 April the following year.

How can I avoid SWIFT fees

Also, if you want to speed up your payment, some of the banks also charge a priority payment fee. The only real way to avoid these fees is to bypass your bank altogether. Some money transfer companies, such as Key Currency, don't charge any fees for SWIFT transactions.

Is SWIFT better than wire transfer

SWIFT transfers use a global network of secure banks for electronic payments, while local transfers use a national network to send money to a recipient's local account. SWIFT transfers are more secure and suitable for larger transactions but have higher fees and longer processing times.

Can my friend in India transfer money to my NRE account

Another question you may have is- can I deposit money in NRE account from India You cannot transfer money to a NRE account from a savings account in India. However, you can transfer money from NRO to NRE account. You can also transfer money from one NRE account to another.

How can I send money to India without tax

Tax for sending money from the USA to India

There is no recipient tax on money being transferred from abroad to India when it's being sent to blood relatives. In general, “blood relatives” — including spouses, children and grandchildren, siblings or in-laws — don't pay tax on any amount you send.