What is the limit of international money transfer in India

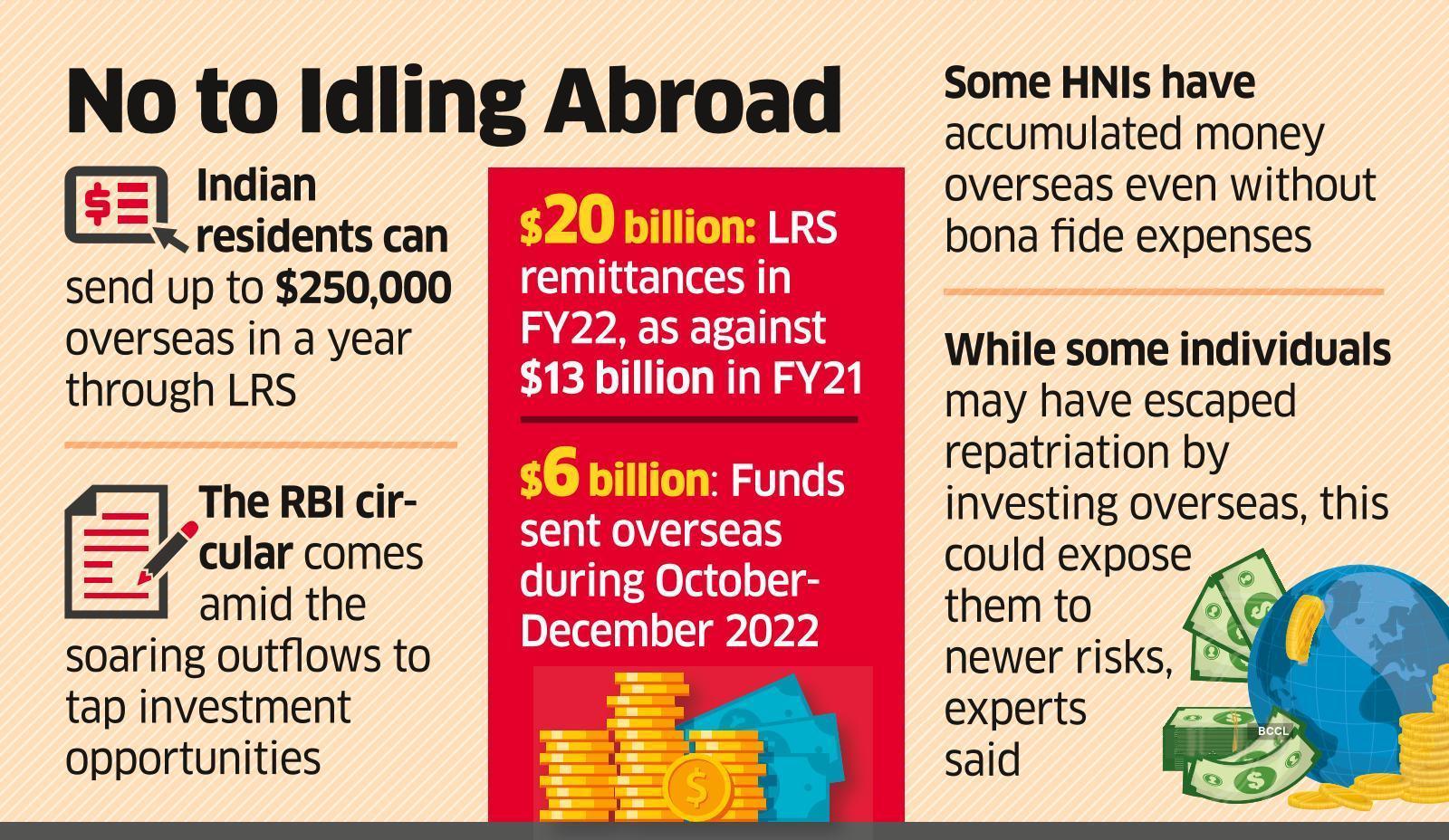

Liberalised Remittance Scheme (LRS) was brought into effect by the Reserve Bank of India in 2004. According to it, residents of India can remit a maximum of $250,000 within a given financial year to individuals living overseas. This includes both capital and current account transactions.

What is the maximum amount for international transfer

How much money can you wire without being reported Financial institutions and money transfer providers are obligated to report international transfers that exceed $10,000. You can learn more about the Bank Secrecy Act from the Office of the Comptroller of the Currency.

How can I transfer money from abroad to India

Bank or Wire Transfer:

It is one of the most common, efficient and rapid means of money transfer to India. Wire transfer is through your bank. The bank levies a fee depending on the amount. The bank offers exchange rates.

How much money can NRI transfer from India to abroad

As of the financial year 2021-2022, the LRS limit for NRIs is INR 2,50,00,000 per financial year. This limit applies to the total amount of funds transferred by an NRI during the financial year, and includes all transfers made for any purpose, including investments, gifts, and personal expenses.

Can I send 100000 USD to India

The IRS has no limit on how much money you can send to India. However, above $11.7 million USD, you'll be liable for taxes.

Is foreign remittance taxable in India

Every overseas remittance made under the liberalised remittance scheme (LRS) would be subject to a 20% tax collected at source (TCS) starting 1 July 2023, with the exception of those sent for medical and educational expenses, for which a 5% TCS will be imposed after the threshold of ₹7 lakh is exceeded annually.

What happens if you transfer more than $10000

Financial institutions must file a Currency Transaction Report (CTR) for any transaction over $10,000. The CTR includes information about the person initiating the transaction, the recipient, and the nature of the transaction.

Can you transfer more than 50000

You would need to visit a bank that is a part of the NEFT network and proceed with transfers. The only issue is that such remittance is restricted at RS. 50,000 per transaction. People using netbanking or mobile banking can do NEFT fund transfer online as well.

How can I transfer money from abroad to India without tax

If someone transferring money (any sum of money) to his family or relative to India from abroad then, he doesn't need to pay any kind of tax on that money. He must inform only the income tax return officials at his country wherever he is living and also at the recipient's country.

Are foreign remittances taxed in India

From 1 July 2023, all overseas remittances under India's liberalised remittance scheme, except for medical and educational expenses, will be subject to 20% tax collected at source (TCS).

How much money can NRI transfer to India without tax

From October 1, 2020, remittances of up to Rs700,000 (Dh33,103) in a financial year are free from tax liability. Amount exceeding Rs700,000 is liable to TCS (Tax Collected at Source) in the hands of the individual at 5 per cent. (TCS is collected by the receiver at the time of receipt of payment.)

How much money NRI can send to relatives in India

There is no ceiling on the money an NRI can send to India. This money, however, needs to be earned through legit means. You also have to pay the required taxes on this money in the country it was earned. There is also an aspect of taxation to the money being sent to India.

How much money can I send to India without tax

There is no limit on sending money from USA to India. But, there is a limit of US $14,000 per person per year for tax free transactions. Any amount sent above US $14,000 per person per year, the sender is responsible for paying the taxes. How India's currency ban will affect NRIs

How can I send large money to India

You can always check the best exchange rates, fees, and transfer time using CompareRemit, featuring the best money transfer providers offering services to India.Online Bank Account Transfer (ACH Transfer)Online Transfers.Wire Transfers.Cashier's Checks, Money Orders, and Bank Drafts.Money Transfer Companies.

How much remittance is tax free in India

If the inward remittance is sent to anyone other than these mentioned relatives, it will be taxed by the government as income if it goes above 50,000 rupees annually. Further, there are inward remittances under Business payments received in India.

Can I transfer $100000 from one bank to another

Wire transfers also have limits, but in general they are higher than ACH transfers. As with an ACH transfer, many major banks impose a per-day or per-transaction wire transfer limit. For example, Chase Bank sets the limit at $100,000 for individuals, but offers higher limits to businesses on request.

Is it OK to transfer large amounts of money

Use a wire transfer

It's a good way to send money quickly and securely, especially large amounts of money or overseas transfers. It's safe for the sender as long as you know the recipient. And it's safe for the recipient because the funds are guaranteed (unlike a personal check, which can bounce).

How can I transfer large amount of money in India

RTGS (Real Time Gross Settlement

If you want to transfer more than 2 then you can use this. There is no upper cap on the amount. An RTGS money transfer happens on a real-time basis. The bank of the person to whom the money is transferred gets 30 minutes to credit it to his/her account.

Can I transfer more than 2 lakh online

Transfers greater than Rs 2 lakhs and up to Rs 10 lakhs to Other Bank Accounts are done through NEFT (National Electronic Funds Transfer). The Receiving Bank can take up to 2 hours to credit the money in receiver's account.

How much income tax on foreign remittance received in India

Budget 2023 raised the Tax Collection at Source (TCS) rate for foreign remittances under the Liberalised Remittance Scheme (LRS) from 5 per cent to 20 per cent for select transactions. The new rates of TCS will kick in from July 1, 2023.

Do I need to pay tax if I send money to India

Tax for sending money from the USA to India

There is no recipient tax on money being transferred from abroad to India when it's being sent to blood relatives. In general, “blood relatives” — including spouses, children and grandchildren, siblings or in-laws — don't pay tax on any amount you send.

How much money can I transfer to a family member in India

50,000, the transfer will not be considered a taxable gift. 3) Gifts from specified relatives are exempted, regardless of the amount received. These relatives are spouse, father, mother, brother and sister.

Can I send more than 10000 USD to India

The IRS has no limit on how much money you can send to India. However, above $11.7 million USD, you'll be liable for taxes.

Is remittances from abroad taxable in India

From 1 July 2023, all overseas remittances under India's liberalised remittance scheme, except for medical and educational expenses, will be subject to 20% tax collected at source (TCS).

Can I transfer $50000 from one bank to another

If you're sending a large amount of money, you may want to use a wire transfer at your bank. You'll need the recipient's account and routing numbers. You and the recipient will likely incur fees. Wire transfers take place in less than 24 hours but do not occur on weekends or on bank holidays.