What are the Big 4 banks in Vietnam

The Big4 banks include BIDV, VietinBank, Vietcombank and Agribank.

What are the big 5 banks in Vietnam

Largest banksVietinBank $1.56 billion (32,661 billion VND)Agribank $1.39 billion (29,154 billion VND)Vietcombank $1.10 billion (23,174 billion VND)BIDV $1.10 billion (23,011 billion VND)Eximbank $0.59 billion (12,355 billion VND)

Which is the largest public sector bank

SBI

SBI is the largest public sector bank in India and Asia and one of the largest in the world.

Which is the biggest bank in Vietnam

BIDV

BIDV has reported a 58 per cent on-year increase in pre-tax profit to over ($288.7 million) for the first quarter of 2023, according to the AGM on April 28.

What are the 4 state owned banks in Vietnam

As of December 01, 2022, the State's ownership ratios in 4 largest state-owned commercial banks are as follows: (i) 80.9% in BIDV, (ii) 74.8% in Vietcombank, (iii) 64.46% in Vietinbank, and (iv) 100% in Agribank.

What are the 4 money center banks

Four examples of large money center banks in the United States include Bank of America, Citi, JP Morgan, and Wells Fargo, among others. Most money center banks raise funds from domestic and international money marks (as opposed to relying on depositors, like traditional banks).

What is Big 6 bank

Royal Bank of Canada, Bank of Montreal, The Bank of Nova Scotia, The Toronto-Dominion Bank, National Bank of Canada and Canadian Imperial Bank of Commerce. – Financial Services.

Which is the 3rd largest public sector bank

Bank of Baroda

Bank of Baroda is an Indian multinational bank. It is the third-largest public sector bank in the country established in 1908.

Which is the 4th largest private sector bank

Kotak Mahindra Bank Ltd

Kotak is the Fourth-Largest Private Banks in India.

What are the 4 state-owned banks in Vietnam

As of December 01, 2022, the State's ownership ratios in 4 largest state-owned commercial banks are as follows: (i) 80.9% in BIDV, (ii) 74.8% in Vietcombank, (iii) 64.46% in Vietinbank, and (iv) 100% in Agribank.

What are the top 10 banks in Vietnam by assets

Top 10 banks with the largest total assets in Vietnam by the end of the first quarter of 2022 are BIDV, VietinBank, Vietcombank, MB, Techcombank, VPBank, ACB, Sacombank, SHB and HDBank.

What are the 4 state-owned banks in China

The Big Four and others

In 1995, the Chinese Government introduced the Commercial Bank Law to commercialize the operations of the four state-owned banks, the Bank of China (BOC), the China Construction Bank (CCB), the Agricultural Bank of China (ABC), and the Industrial and Commercial Bank of China (ICBC).

What are the top banks in Vietnam

The ten banks honoured this year are Vietcombank, VietinBank, Techcombank, BIDV, MBBank, VPBank, Asia Commercial Joint Stock Bank (ACB), AgriBank, TPBank, and Vietnam International Commercial Joint Stock Bank (VIB). It also listed the ten most prestigious private joint-stock banks.

What is a top 4 bank

The “big four banks” in the United States are JPMorgan Chase, Bank of America, Wells Fargo, and Citibank. These banks are not only the largest in the United States, but also rank among the top banks worldwide by market capitalization, with JPMorgan Chase being the most valuable bank in the world.

What is the meaning of Big 4 bank

The term 'Big Four Banks' alludes to the Commonwealth Bank of Australia (ASX:CBA), Westpac Banking Corporation (ASX:WBC), Australia and New Zealand Banking Group – or ANZ Bank for short – (ASX:ANZ) and National Australia Bank (ASX:NAB).

What are the big 3 core banking

This aggressive move is particularly remarkable considering that Jack Henry, together with FIS and Fiserv — the other two members of the Big Three bank technology companies — provides the processing power for most of the U.S. banking industry and a large portion of credit unions.

What are the big 3 banks

The “big four banks” in the United States are JPMorgan Chase, Bank of America, Wells Fargo, and Citibank.

Which is the 7th largest public sector bank

Indian Bank

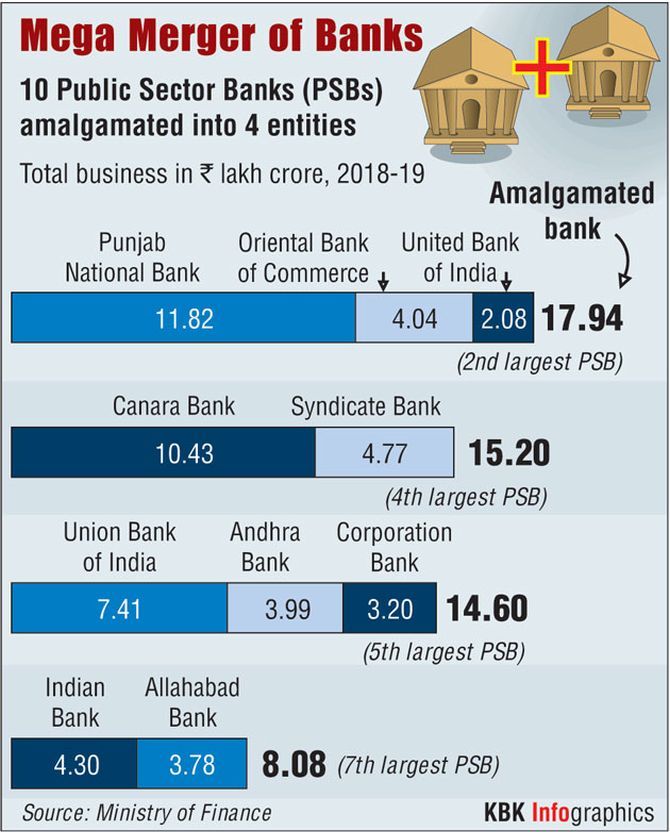

| List of Government Banks in India After Merger | |

|---|---|

| Punjab National Bank, Oriental Bank of Commerce, and United Bank | 2nd largest Public Sector Bank |

| Union Bank, Andhra Bank, and Corporation bank | 5th largest Public Sector Bank |

| Indian Bank and Allahabad Bank | 7th largest Public sector Bank |

What is the second largest bank in Vietnam

Topping the list of 10 largest banks in Vietnam in 2021 is Vietcombank. Coming out second is VietinBank, which is followed by Techcombank, BIDV, MBBank, VPBank…

What are the top 4 Chinese bank

In fact, the biggest four banks in the world (by asset size) are Chinese, according to the 2021 annual rankings by S&P Global Market Intelligence: the Industrial & Commercial Bank of China, the China Construction Bank, the Bank of China, and the Agricultural Bank of China.

What are the 5 biggest bank in China

These are the Industrial & Commercial Bank of China (ICBC), the China Construction Bank (CCB), the Bank of China (BoC), the Bank of Communications (BoCom), and the Agricultural Bank of China (ABC). Specific lending purpose banks that specialize in loans for specific sectors or purposes.

What are the 4 top banks

The “big four banks” in the United States are JPMorgan Chase, Bank of America, Wells Fargo, and Citibank. These banks are not only the largest in the United States, but also rank among the top banks worldwide by market capitalization, with JPMorgan Chase being the most valuable bank in the world.

What is the 4th largest bank in the US by assets

Wells Fargo

List of largest banks in the United States

| Rank | Bank name | Headquarters location |

|---|---|---|

| 1 | JPMorgan Chase | New York City |

| 2 | Bank of America | Charlotte |

| 3 | Citigroup | New York City |

| 4 | Wells Fargo | San Francisco |

What are the big 4 banks by market cap

The market cap of the five banks are now:CBA: $174 billion.Macquarie: $164 billion.NAB: $96.33 billion.Westpac: $79.68 billion.ANZ: $78.99 billion.

What is a Category 4 bank

(1) A banking organization with average total consolidated assets of $100 billion or more is a Category IV banking organization if the banking organization: (i) Is not a Category II banking organization; and. (ii) Is not a Category III banking organization.