How much duty-free are you allowed in India

Rs 50,000

ALLOWANCE WHEN YOU ARE ARRIVING TO INDIA :

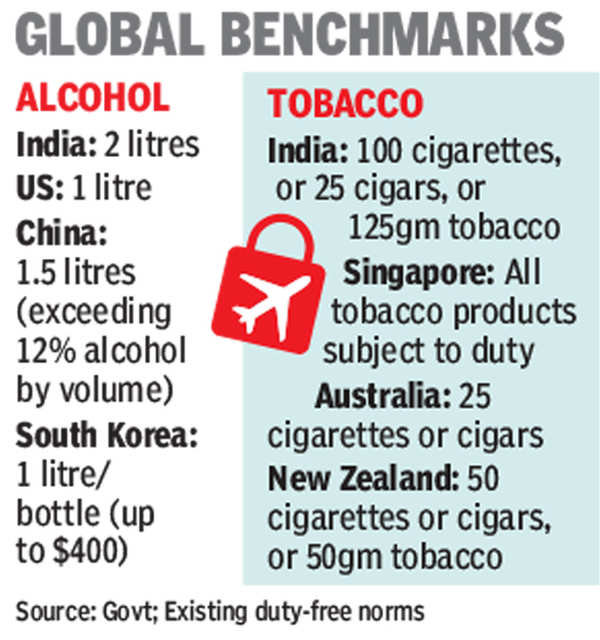

100 cigarettes or 25 cigars or 125g of tobacco. 2 liter of alcoholic liquor or wine. Total Value Duty Free Purchases cannot exceed Rs 50,000.

What is the minimum amount for customs duty in India

Types of custom duty in India

| Type of custom duty | Rate |

|---|---|

| Basic Customs Duty (BCD) | BCD is decided according to the HS code of the product and its origin. It can be from 0% to 100%. |

| Countervailing Duty (CVD) | 0% to 12% depending on the product |

| Special Additional Duty (SAD) | 4% where applied |

What is the duty-free allowance for Vietnam

400 cigarettes or 100 cigars or 50g of tobacco. 1,5L of spirits or 2L of alcohol containing up to 22% volume of alcohol or 3L of beer (or similar light alcoholic beverages) 3Kg of coffee. 5Kg of tea.

How much alcohol can I bring into India

Ans. Following quantities of Alcoholic drinks and Tobacco products may be included for import within the duty free allowances admissible to various categories of incoming passengers: – Alcoholic liquor or Wine or beer up to 2 litres. – 100 Cigarettes or 25 Cigars or 125 gms of Tobacco.

Can I carry alcohol in checked baggage to India

Read More… Passengers may carry upto 5 Liters of alcoholic beverages as part of their checked-in baggage, provided the following conditions are met: The alcoholic beverage is in retail packaging and is packed appropriately (to prevent damage / leakage). Alcohol content in the beverage is not more than 70%.

Can I bring 2 laptops from USA to India

Number of Devices, Duty-Free Limit, and Gadget Import Limit

One can bring two laptops to India and for more laptops, they have to pay customs duty. There are some exemptions like if the laptop is a used one and you can prove that with its original receipt.

How duty is calculated in Indian customs

This duty is calculated as a percentage of the assessable value of the imported goods. The assessable value of the goods is determined by adding the cost of the goods, insurance charges, and freight charges incurred in transporting the goods to India.

What is exemption from customs duty in India

The Central Government has given full exemption from basic customs duty on all drugs and Food for Special Medical Purposes imported for personal use for treatment of all Rare Diseases listed under the National Policy for Rare Diseases 2021 through a general exemption notification.

How much money can I carry from India to Vietnam

Currently, there is no legal limit on the amount of cash you can bring to Vietnam (either for Vietnamese Dong or any other foreign currency).

How much dollars can I carry from India to Vietnam

Basing on Vietnam customs regulation, foreign currency (including cash, coin and travelers' cheques) in excess of US$7,000 must be declared at customs upon arrival with supported appropriate documentation.

Can I carry duty-free alcohol in hand luggage in India

Can we carry alcohol in domestic flights in India Yes you are allowed to carry liquor in domestic flights but it should be packed only in your check-in luggage. Alcohol is strictly prohibited in carry-on luggage.

Can I take duty free alcohol to India

Non-resident travellers over 18 may import the following items into India without incurring customs duty: 100 cigarettes or 25 cigars or 125g of tobacco. 2L of spirits or wine.

Can we carry alcohol in international flight in India

Transporting Alcoholic Beverages

Up to 5 litres of alcohol with alcoholic content between 24% and 70% are allowed per person as carry-on or checked luggage if packaged in its retail container. Alcoholic beverages with less than 24% alcoholic content are not subject to hazardous materials regulations.

Can I carry 3 used laptops to India

Number of Devices, Duty-Free Limit, and Gadget Import Limit

One can bring two laptops to India and for more laptops, they have to pay customs duty. There are some exemptions like if the laptop is a used one and you can prove that with its original receipt.

How much shopping is allowed from USA to India

In addition to personal items, items up to a value of ₹15,000-50,000 depending on your origin. Indian residents coming in after more than 1 year abroad can bring ₹1,00,000 worth of jewelry for women, and ₹50,000 worth of jewelry for men. Approved plants and seeds. Laptop or a computer within the free allowance amount.

Why is Indian custom duty so high

Tax on imports in India are high because of India's policy of encouraging local/homegrown industries. This is called import substitution industrialisation (ISI), a trade policy that is all about substituting imports with domestic manufacturing and production.

How can I save custom duty in India

Avoid unwanted fees arising from incorrect declarations

Shipping used products as gifts is not allowed. Customs duty will be charged with additional fines and penalties if you do. When moving back to India, shipping used items is only permitted with accompanied baggage.

Is there custom duty on personal items in India

All dutiable articles, intended for personal use,imported by post or air , and exempted from any pro of India Custom Duty and Import Tariff and Tax. Important Information: Duty Calculation with SAARC Member Countries.

What items are restricted by Indian customs

Prohibited GoodsHuman skeleton.Specified sea-shells.Beef, tallow, fat/oil of animal origin.Exotic birds except for a few specified ones.Wild animals, their parts and products.Specified Live birds and animals.

Is Vietnam duty free to India

falling under Chapter 85 of Harmonised System of Nomenclature [HSN] are major export item from Vietnam. Many of these products attract zero custom duty when imported from Vietnam into India. Thus, India can be good trade destination for such export goods from Vietnam.

How much money can I carry on a plane to India

There is no limit on the foreign currency that you can carry to India. However, you need to file a declaration if the currency value exceeds USD 5,000 or the total foreign exchange exceeds USD 10,000.

Can I carry 10000 USD to India

There's no limit, however, to how much foreign currency you can bring into India. Although, you will have to declare it if the amount exceeds US$5,000 in notes and coins, or US$10,000 in notes, coins, and traveller's cheques².

How many dollars can a foreigner carry from India

The legal limit to carry cash currency in US Dollars from India to USA is USD 3000 per person per trip. However, you can carry up to US $10,000 in form of currency notes, Travelers check, etc. without declaring it at the customs. How India's currency ban will affect NRIs

How many liquor bottles allowed to carry in flight in India

Read More… Passengers may carry upto 5 Liters of alcoholic beverages as part of their checked-in baggage, provided the following conditions are met: The alcoholic beverage is in retail packaging and is packed appropriately (to prevent damage / leakage). Alcohol content in the beverage is not more than 70%.

How many bottles I can carry to India

India allows a duty-free allowance of 2 litres of liquor per passenger. If you bring more than 2 litres of liquor into India, you will have to pay customs duty on the additional amount. The duty will be calculated based on the entire amount of liquor that exceeds the 2-litre allowance.