What is the advantage of activity-based costing over the traditional costing system

Activity based costing systems are more accurate than traditional costing systems. This is because they provide a more precise breakdown of indirect costs. However, ABC systems are more complex and more costly to implement. The leap from traditional costing to activity based costing is difficult.

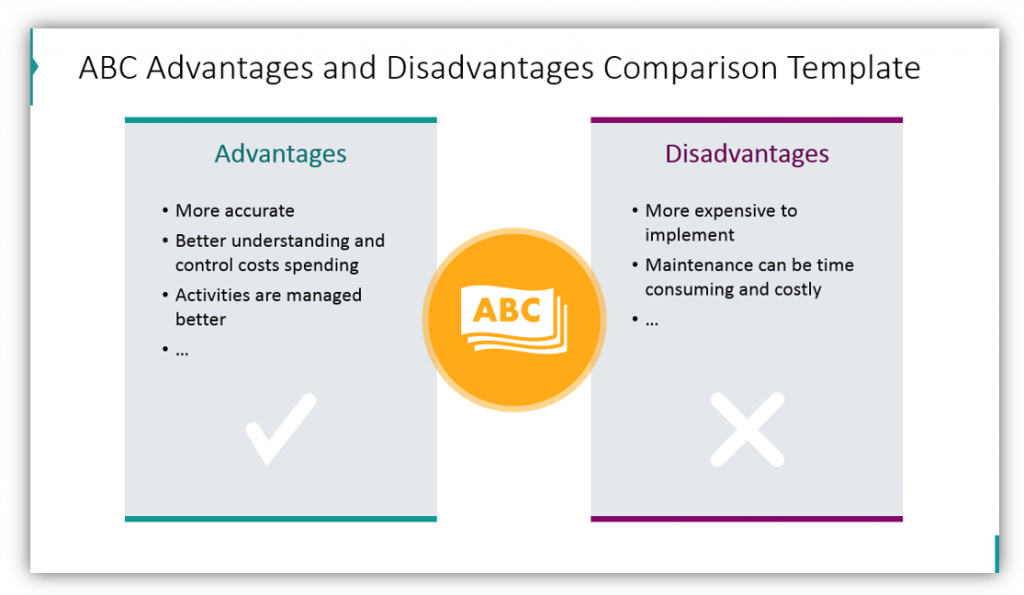

What are the advantages and disadvantages of activity-based costing method

While using ABC has benefits, such as more precise cost allocation, improved process efficiency, and better decision-making, it also has drawbacks, such as the potential for increased complexity and costs.

What are three advantages of activity-based costing over traditional volume based

What are three advantages of activity-based costing over traditional volume-based allocation methods More accurate product costing, more effective cost control, and better focus on the relevant factors for decision making.

What are the advantages of activity-based costing ABC compared to traditional costing method quizlet

For example, the benefits of activity based costing include the increased number of cost pools that can be used to assign overhead, the better control over costs associated with overhead, and better management decisions.

What is the difference between traditional based costing and activity-based costing

Emphasis: Traditional costing emphasizes direct costs, such as direct labor and direct materials. ABC emphasizes indirect costs, such as overhead expenses and support costs.

What is the difference between traditional costing system and activity-based costing system

Traditional costing adds an average overhead rate to the direct costs of manufacturing products and is best used when the overhead of a company is low compared to the direct costs of production. Activity-based costing identifies all of the specific overhead operations related to the manufacture of each product.

What are the disadvantages of activity-based costing

Some of the limitations of activity-based costing include the following:Expensive to implement: The ABC method is costly to fit within a business and maintain it.Internal reporting only: The activity-based costing method is created only for internal use.

What is the advantage of activity-based costing

ABC improves management's understanding of the cost drivers behind their products. With ABC, managers may have an accurate view of costs associated with activities, which can lead to misallocating resources. With ABC, managers can see what components in their product lines drive up costs and which do not.

What is the difference between activity-based costing and traditional costing

Traditional costing adds an average overhead rate to the direct costs of manufacturing products and is best used when the overhead of a company is low compared to the direct costs of production. Activity-based costing identifies all of the specific overhead operations related to the manufacture of each product.

What is the major difference between ABC and traditional costing

Cost drivers: Traditional costing uses a single cost driver, such as direct labor or machine hours, to allocate indirect costs to products. ABC uses multiple cost drivers, such as several setups, inspections, or orders, to give indirect costs to products.

What are the differences between activity-based costing ABC and traditional absorption costing

The key difference between absorption costing and activity based costing is that while absorption costing is a way of allocating all costs to individual production units, activity based costing is a way of using multiple cost drivers to allocate costs.

What are the differences between traditional methods and activity-based costing methods

Traditional costing will have one rate for allocation of overhead for the entire business operation, while activity-based absorption costing creates multiple cost pools. The ABC system can be extremely complicated and difficult to implement.

What are the disadvantages of ABC

Demerits of Activity Based Costing (ABC):Expensive and Complex: ADVERTISEMENTS:Selection of Drivers: Some difficulties emerge in the implementation of ABC system, such as selection of cost drivers, assignment of common costs, varying cost driver rates etc.Disadvantages to Smaller Firms:Measurement Difficulties:

What is the biggest disadvantage of activity-based costing

One of the main challenges of using ABC for cost classification is that it can be complex and costly to implement and maintain. ABC requires identifying and measuring the activities and cost drivers that consume resources, and collecting and analyzing data on the usage of those resources by the products or services.

What are the advantages of activity-based costing

Benefits of Activity-Based Costing System

Streamline production processes: Companies can streamline their processes by implementing the ABC method in their accounting procedures. A better understanding of manufacturing overhead provides more accuracy on the actual costs incurred in production.

What is the difference between traditional costing and activity-based costing

Traditional costing can only be used for the absorption of manufacturing overheads but activity based costing can effectively be used to allocate manufacturing as well as non-manufacturing overheads like selling, administration etc.

What is the difference between traditional and activity-based costing

While traditional costing methods enable firms to allocate indirect costs at a single overhead rate, this method is subpar at best. Activity-based costing (ABC) resolves this issue by precisely assigning specific indirect costs to several products produced by the company.

What is the difference between traditional based costing & activity-based costing

While traditional costing methods enable firms to allocate indirect costs at a single overhead rate, this method is subpar at best. Activity-based costing (ABC) resolves this issue by precisely assigning specific indirect costs to several products produced by the company.

What are the disadvantages of ABC costing

Limitations of Activity-Based Costing System

Expensive to implement: The ABC method is costly to fit within a business and maintain it. Because of the additional data that must be collected and analyzed, the process is longer and more expensive than others.

What is a disadvantage of using activity-based costing

Activity-based costing can be a more time-consuming process. Instead of calculating total costs and dividing them equally over all products, team members have to evaluate the costs of each product manually.

What are the disadvantages of activity-based costing system

Disadvantages of ABC:

ABC can be more complex to explain to the stakeholders of the costing exercise. The benefits obtained from ABC might not justify the costs. Other systems may need to be changed – for example, how variances are calculated.

What is the difference between ABC and traditional costing

Cost drivers: Traditional costing uses a single cost driver, such as direct labor or machine hours, to allocate indirect costs to products. ABC uses multiple cost drivers, such as several setups, inspections, or orders, to give indirect costs to products.

What is the main difference between activity-based costing and traditional quizlet

Tradition costing only uses one base to determine the amount of overhead to be assigned to a product (such as direct labor hours or machine hours), ABC costing uses multiple bases to determine the amount of overhead to allocate. Products consume activities, and activities consume resources.

What are the advantages and disadvantages of ABC analysis

What are the advantages and disadvantages of ABC Analysis

| Advantages | Disadvantages |

|---|---|

| Better inventory management | Over-simplification |

| Efficient use of resources | Time-consuming |

| Improved decision-making | Maintenance |

| Better forecasting | Lack of flexibility |

What is the advantage of using activity-based costing

It gives you more accurate data for profit margins

It can also help reduce or transfer production costs, allowing management to improve their profit margins even further with effective pricing strategies. Managers can easily identify products of little to no value when using activity-based costing.