What is Category 2 banks

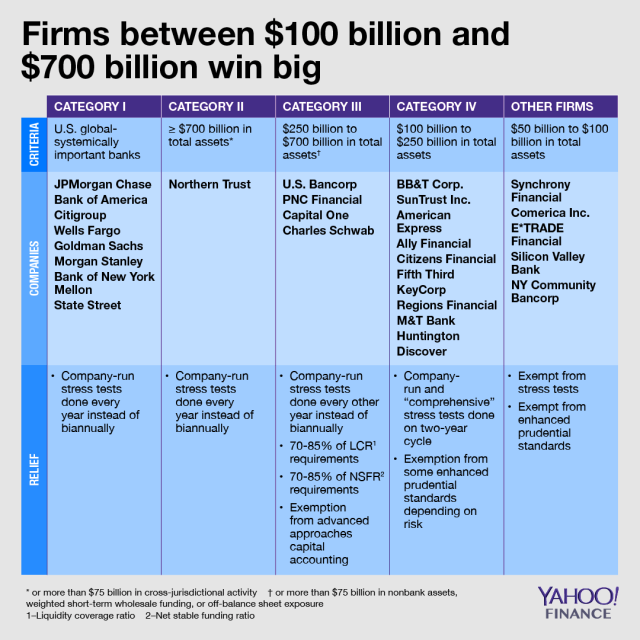

(1) A banking organization is a Category II banking organization if the banking organization has: (i) $700 billion or more in average total consolidated assets; or. (ii) (A) $75 billion or more in average cross-jurisdictional activity; and. (B) $100 billion or more in average total consolidated assets.

What is the classification of a bank

According to the Banking Regulation Act 1949, the banks in India have classified into two types. These are Scheduled Banks and Non-Scheduled Banks. All the banks listed in the 2nd schedule of the RBI Act of 1934 are Scheduled Banks and the rest are Non-Scheduled Banks.

What is a Category I bank

AD Category-I Bank means a Bank( commercial, State or urban cooperative) which is an Authorized Dealer and allowed to deal in all current and capital account transactions by RBI from time to time.

What is the largest foreign bank in Vietnam

HSBC –

In Vietnam, HSBC first opened an office in Saigon (now Ho Chi Minh City) in 1870. In August 1995, HSBC opened a full-service branch in Ho Chi Minh City. In 2005, HSBC also opened its second branch in Hanoi and established a representative office in Cantho.

What is the size of a Category 2 bank

Category II standards apply to U.S. banking organizations and U.S. IHCs with total consolidated assets of $700 billion or more or cross-jurisdictional activity of $75 billion or more that do not qualify as U.S GSIBs.

What is Tier 1 vs Tier 2 banks

Tier 1 and tier 2 capital are two types of assets held by banks. Tier 1 capital is a bank's core capital, which it uses to function on a daily basis. Tier 2 capital is a bank's supplementary capital, which is held in reserve. Banks must hold certain percentages of different types of capital on hand.

How many categories are there in a bank

What are the different bank types There are Retail banks, Commercial banks, Investment banks, Credit unions, Private banks, Savings and Loan Associations, Challenger banks, and Neobanks.

What are the three levels of banks

There are three major types of depository institutions in the United States. They are commercial banks, thrifts (which include savings and loan associations and savings banks) and credit unions.

What is a Category 3 bank in the US

Category III: Firms with $250 billion or more in assets, or with at least $100 billion in assets having “specified risk-based indicators,” would be subject to enhanced standards less stringent than those imposed under Category I or Category II, but more stringent than those imposed under Category I or Category II, but …

What are the top 5 banks in Vietnam

The ten banks honoured this year are Vietcombank, VietinBank, Techcombank, BIDV, MBBank, VPBank, Asia Commercial Joint Stock Bank (ACB), AgriBank, TPBank, and Vietnam International Commercial Joint Stock Bank (VIB).

What is the richest bank in Vietnam

BIDV

BIDV has reported a 58 per cent on-year increase in pre-tax profit to over ($288.7 million) for the first quarter of 2023, according to the AGM on April 28.

Which banks are Category 3 banks

5 Based on current asset levels alone, Category III would include U.S. Bancorp, The PNC Financial Services Group, Inc., Capital One Financial Corporation, and The Charles Schwab Corporation.

What is a 2nd level bank account

With a 2nd Level current account, there are no fees for maintaining the account and no individual charges for a range of current account transactions and services.

What does Tier 1 and 2 mean

Tier 1 Suppliers: These are direct suppliers of the final product. Tier 2 suppliers: These are suppliers or subcontractors for your tier 1 suppliers. Tier 3 suppliers: These are suppliers or subcontractors for your tier 2 suppliers. These tiers can extend longer than three.

What are the Tier 2 banks in the world

Tier two would be Goldman Sachs, Barclays Capital, Credit Suisse, Deutsche Bank, and Citigroup. Examples of tier three would be UBS, BNP Paribas, and SocGen. Being a bulge bracket bank does not necessarily mean it is rock solid.

What are Category 3 banks

Category III: applies to organizations to which categories I-II do not apply and that have more than $250 billion in total consolidated assets or more than $75 billion in one of the following three categories: weighted short-term wholesale funding, nonbank assets, and off-balance sheet exposure.

What are some Category 3 banks

5 Based on current asset levels alone, Category III would include U.S. Bancorp, The PNC Financial Services Group, Inc., Capital One Financial Corporation, and The Charles Schwab Corporation.

What are scope 3 categories for banks

In general terms, Scope 3 emissions include a corporate's upstream and downstream value chain (e.g. suppliers and distributors), as well as business travel, leased assets, and even bank lending exposure.

What is Stage 3 in banking

As NBFC follow Indian Accounting Standards (Ind AS), they have to classify bad loans in three categories or stages. Stage 1 which consists of loans overdue by up to 30 days, stage 2 where loans are overdue by 31-89 days, and stage 3 for loans overdue by more than 90 days.

What are the types of bank 4

The 4 different types of banks are Central Bank, Commercial Bank, Cooperative Banks, Regional Rural Banks. You can read about the Types of Banks in India – Category and Functions of Banks in India in the given link.

Which is the safest bank in Vietnam

Here, data revealed that Techcombank is the most trusted bank with a 'Recommend' score of 81.2. MBB (74.6) and TPBank (74.4) came in as the second and third 'most recommended' respectively.

What is the strongest bank in Vietnam

BIDV

BIDV has reported a 58 per cent on-year increase in pre-tax profit to over ($288.7 million) for the first quarter of 2023, according to the AGM on April 28.

Does Vietnam have any billionaires

The founder and chairman of the giant conglomerate Vingroup, Pham Nhat Vuong is Vietnam's first and richest billionaire. In 2013, Forbes named Vuong the first Vietnamese billionaire with a net worth of US$1.5 billion. His current net worth, according to Forbes, is a whopping US$4.2 billion.

What is ad category 1 bank

Authorized dealer Category 1 Banks, popularly known as AD Cat I Banks, are the banks with an RBI license to buy and sell foreign exchange for specified purposes. Such banks aim to ease the foreign exchange facilities for NRI.

What are the 4 types of bank account

Here is a list of some of the types of bank accounts in India.Current account. A current account is a deposit account for traders, business owners, and entrepreneurs, who need to make and receive payments more often than others.Savings account.Salary account.Fixed deposit account.Recurring deposit account.NRI accounts.