What is the difference between a bank and a private bank

What is the difference between commercial and private banking Commercial banking provides financial services to corporations, municipalities, nonprofit organizations and other institutions. Private banking offers personal services to individuals or families.

What makes a bank a private bank

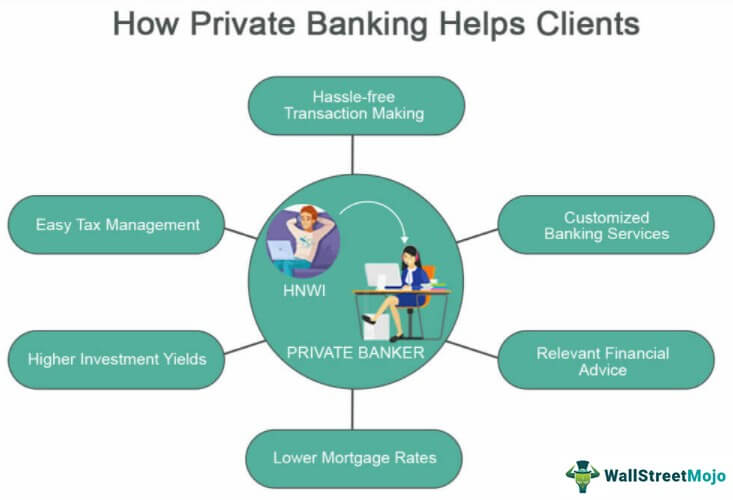

Private banking consists of personalized financial services and products offered to the high-net-worth individual (HNWI) clients of a retail bank or other financial institution. It includes a wide range of wealth management services, and all provided under one roof.

What are the advantages of a private bank

Advantages of Private BankingSpecialized loans.Mortgages.Lines of credit.Higher APYs on checking, savings, and money market accounts.Reduced or waived fees.

What is the disadvantage of private bank

Disadvantages of Private Sector Bank

Here are some common disadvantages of private sector banks. Private Sector Banks charge extra on every financial service. These banks only operate in cities and out of reach for the rural population. Private Sector Banks offer no job security to the employees.

Is it worth using a private bank

Private banks may be worth the cost for the increased yields on the deposit accounts, the decreased interest rates on the loans and the relationship you can have with a private banker.

What is difference between private and commercial bank

Commercial banking is a type of banking that provides services to businesses, corporations, and other commercial entities, while private banking provides services to high-net-worth individuals, families, and trusts.

Is JP Morgan private bank worth it

There are very few genuinely global wealth managers. One of them is JPMorgan Private Bank, and this year our panel of international experts name it the world's best private bank. JPMorgan also takes the awards for the world's best private bank for ultra-high-net-worth individuals, and for investment research.

What is advantages and disadvantages of private banking

Advantages and Disadvantages of Private Banking

| Advantage | Disadvantage |

|---|---|

| Personal finance as well as business finances can be taken care of by a private banker who can help you maintain a balance between the two. | There might be a conflict of interest as the private bankers might prioritise their interest before yours. |

Is private banking better

"Though expensive, private banking is often worth the price for individuals who demand a high degree of service, want ongoing professional advice for no extra charge and have their assets held in sophisticated structures that require professional management,” Frederick says. Dedicated help.

What are the pros and cons of a private bank

Private banking allows access to personalized service, all-in-one financial solutions, attractive interest rates, reduced fees, and exclusive perks. Its drawbacks include low expertise, limited product offerings, high employee turnover, and potential conflicts of interest.

Are private banks trustworthy

Since all scheduled banks are covered under DICGC, whether it's a private, public sector or a co-operative bank, all banks are equally safe for amounts of up to Rs. 5 lakh. This includes both the principal as well the interest held with the bank.

Is private banking high risk

Although most private banking activities are normally profitable for the client and the bank, they do not come without a high level of reputation risk to the bank should they fail to perform as expected.

What is an example of a private bank

Private banks include institutions like HDFC Bank, ICICI Bank, AXIS Bank, etc. Regional rural banks, Foreign banks – Foreign banks are those with their corporate headquarters located outside of India. Standard Chartered, American Express, Citibank, and other institutions are examples of foreign sector banks.

What banks do millionaires use

7 banks that millionaires useBank of America Private Bank.J.P. Morgan Private Bank.Wells Fargo Private Bank.UBS Wealth Management.Goldman Sachs Private Wealth Management.Citi Private Bank.HSBC Global Private Banking.

How much money do you need to be in JP Morgan Private Bank

J.P. Morgan Private Bank – $10 million

However, this service requires $10 million in assets to become a member. If you qualify as an individual or business, you can expect the following privileges: Personal and business banking.

What is the difference between private and foreign banks

Private sector Banks – A bank where the majority stakes are owned by a private organization or an individual or a group of people. Foreign Banks – The banks with their headquarters in foreign countries and branches in our country, fall under this type of bank.

What are 2 disadvantages of private business

Five Top Disadvantages of Private Limited Company OwnershipYou must be incorporated with Companies House.Complicated accounts.Shared ownership.Your company must be in compliance with strict administrative requirements.Limited stock exchange access.

What are the disadvantages of public bank

Public Sector Banks – DisadvantagesAt the management level, there is a large bureaucratic system.Inability to make a major financial decision in a timely manner.Customers receive less personalized service.There have been far too many complaints about the employees' poor service.

What is the advantage of a public bank

One of the key benefits of public banks is their ability to keep public money invested locally. Because they are not driven by profit, public banks can prioritize returning banking profit and interest to local communities.

Is private banking for the rich

Private banking is a general description for banking, investment and other financial services provided by banks and financial institutions primarily serving high-net-worth individuals (HNWIs) – those with very high income and/or substantial assets.

Which bank is known as private bank

Private-sector banks

| Bank Name | Established | Branches |

|---|---|---|

| HDFC Bank | 1994 | 5,608 |

| ICICI Bank | 1994 | 5,266 |

| IDBI Bank | 1964 | 1,884 |

| IDFC First Bank | 2015 | 707 |

What banks are private banks

The Private Banking Top 10 List.UBS.Morgan Stanley.Bank of America.J.P. Morgan Private Bank.Citigroup.BNP Paribas.Goldman Sachs.

What bank do millionaires use the most

7 banks that millionaires useBank of America Private Bank.J.P. Morgan Private Bank.Wells Fargo Private Bank.UBS Wealth Management.Goldman Sachs Private Wealth Management.Citi Private Bank.HSBC Global Private Banking.

Do rich people put their money in the bank

High net worth investors typically keep millions of dollars or even tens of millions in cash in their bank accounts to cover bills and unexpected expenses. Their balances are often way above the $250,000 FDIC insured limit.

Who is eligible for JP Morgan Private Bank

Clients with at least $10 million in assets can become J.P. Morgan private bank customers. 3 Its wealthy clients enjoy custom financial planning, goals-based investing and advice, cross-border wealth advisory, and more.