What is custom clearance charges in India

Customs Clearance Charges

In addition to the import duties, India charges a 1% customs handling fee on all the imports. This cost is charged on the entire/total value of the goods+the freight costs and Insurance. Here is a simple example to understand the calculation of the import duty.

Which goods are exempted from customs duty in India

The Central Government has given full exemption from basic customs duty on all drugs and Food for Special Medical Purposes imported for personal use for treatment of all Rare Diseases listed under the National Policy for Rare Diseases 2021 through a general exemption notification.

What is the duty-free allowance for Vietnam

400 cigarettes or 100 cigars or 50g of tobacco. 1,5L of spirits or 2L of alcohol containing up to 22% volume of alcohol or 3L of beer (or similar light alcoholic beverages) 3Kg of coffee. 5Kg of tea.

How much gold can I bring to Vietnam

– Vietnamese and foreign individuals who carry jewelry gold and fine-art gold articles in a total amount of 300 (three hundred) grams or more when leaving or entering Vietnam with passports shall declare such with customs offices.

Do I need to pay customs duty in India

All goods imported into India are subject to duty. The duty is levied at the time of import and is paid by the importer of the goods. The main purpose of import duty is to protect Indian industries from cheaper foreign goods.

How much is duty free allowance in India

Rs 50,000

ALLOWANCE WHEN YOU ARE ARRIVING TO INDIA :

100 cigarettes or 25 cigars or 125g of tobacco. 2 liter of alcoholic liquor or wine. Total Value Duty Free Purchases cannot exceed Rs 50,000.

What is the duty free limit for import in India

a) The 'Duty Free Allowance' for an Indian resident / foreigner residing in India / a tourist of Indian origin, not being an infant and arriving from any country other than Nepal, Bhutan and Myanmar is Rs. 50,000/- including two litres of alcoholic liquor/wine and 100 Cigarettes or 25 Cigars or 125 gms of tobacco.

What is duty free limit in India

Rs 50,000

ALLOWANCE WHEN YOU ARE ARRIVING TO INDIA :

Total Value Duty Free Purchases cannot exceed Rs 50,000.

How much dollars can I carry from India to Vietnam

Lawfully and legally speaking, under the provisions of Article 2 of Circular 15/2011/TT-NHNN: If you bring over $5,000 US Dollars, other foreign currencies of the same value (or 15,000,000 Vietnamese Dong, you're going to have to declare it at customs when you get here.

Can I bring 2 phones to Vietnam

Passengers arriving in Vietnam are allowed to freely carry a second mobile phone for personal use. They, however, must pay a tax if it is worth more than VND10 million ($429).

Can we bring gold from Vietnam to India

Each passenger can carry up to 1 kg (kilogram) of gold jewelry upon payment of customs duty, provided the passenger has stayed abroad for atleast a year or more. Also, Indian customs will not allow more than 1 kg of gold jewelry even if the passenger is willing to pay the customs duty for it.

How much gold can you take to India from Vietnam

2. How much gold can I carry to India without paying customs duty An Indian passenger who has lived abroad for over one year can bring jewellery free of duty in his bonafide baggage up to an aggregate weight of: 20 grams, subject to a maximum value of Rs. 50,000/- (in the case of a male passenger)

How much can I import without paying duty in India

There are no taxes on importing books and you may import goods up to the value of INR 10,000 duty free provided they are sent as gifts to you.

How can I avoid customs duty in India

Unfortunately, there's no legal way to avoid import duty—if the duty is owed, someone has to pay it.

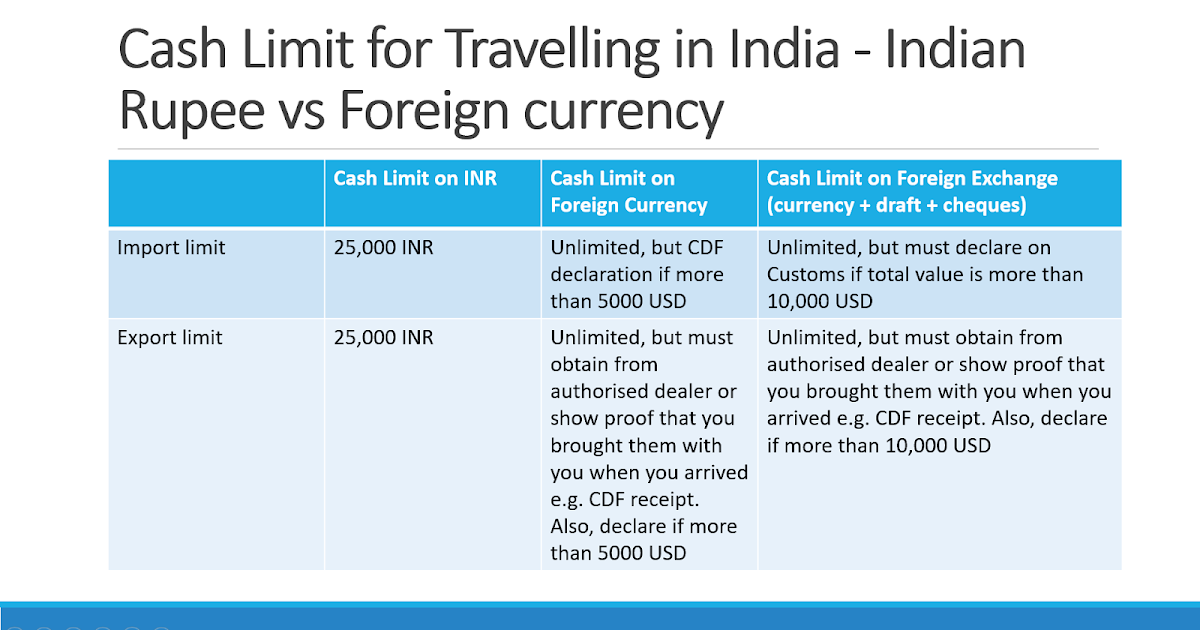

What is the cash limit in India customs 2023

Non-Residents, tourists including foreign citizens (except citizens of Pakistan or Bangladesh), may take outside India currency notes up to an amount not exceeding Rs. 25,000 per person * may bring into India currency notes up to an amount not exceeding Rs. 25,000 per person *

What is the max import in India

India's top import products contain Mineral fuels including oil, Gems, precious metals, Electrical machinery, equipment, Machinery including computers and Organic chemicals. Several foreign trade markets are majority dependent on India for importing specific goods from several growing countries.

How much liquor I can carry to India

A passenger flying to India can enjoy a duty-free allowance on alcoholic beverages and tobacco products based on quantity. The maximum limit on Indian Customs Alcohol Allowance is 2 litres.

Can I bring food into India

What types of food can be carried from USA to India Non-perishable and commercially packaged food items are generally allowed for personal consumption. This includes items like packaged snacks, candies, canned goods, dry fruits, spices, and condiments.

Can I carry 10000 USD to India

There's no limit, however, to how much foreign currency you can bring into India. Although, you will have to declare it if the amount exceeds US$5,000 in notes and coins, or US$10,000 in notes, coins, and traveller's cheques².

How many dollars can a foreigner carry from India

The legal limit to carry cash currency in US Dollars from India to USA is USD 3000 per person per trip. However, you can carry up to US $10,000 in form of currency notes, Travelers check, etc. without declaring it at the customs. How India's currency ban will affect NRIs

Can I take 3 phones to India

Carrying one sealed box of iPhone might not be an issue but if you are carrying 3-4 devices, you will have to show the receipts of your purchases and might even have to pay a customs duty. So, it's better that you avoid carrying more than two phones on your flight from USA to India.

Can I take 2 iphones to India

There is no special allowance for bringing mobile phones to India. Normally Customs Officers do not mind if you are carrying one used mobile phone for your personal use. If you are carrying extra mobile phones in your baggage, they may be considered under the Rs 50,000 duty-free allowance.

How much gold can I carry to India as a foreigner

Each passenger can carry up to 1 kg (kilogram) of gold jewelry upon payment of customs duty, provided the passenger has stayed abroad for atleast a year or more. Also, Indian customs will not allow more than 1 kg of gold jewelry even if the passenger is willing to pay the customs duty for it.

Is Vietnam duty free to India

falling under Chapter 85 of Harmonised System of Nomenclature [HSN] are major export item from Vietnam. Many of these products attract zero custom duty when imported from Vietnam into India. Thus, India can be good trade destination for such export goods from Vietnam.

How much gold can a tourist bring to India

As per CBIC, a male passenger residing abroad for over a year can bring up to 20 grams of gold jewellery with a maximum value of Rs 50,000.