Can NRI send money from India to USA

It can be done through your banking channel only either using online services or via demand drafts or cheques. You cannot use the services of money transfer agents. NRIs will not have a resident Indian bank account.

How NRI can transfer money from India

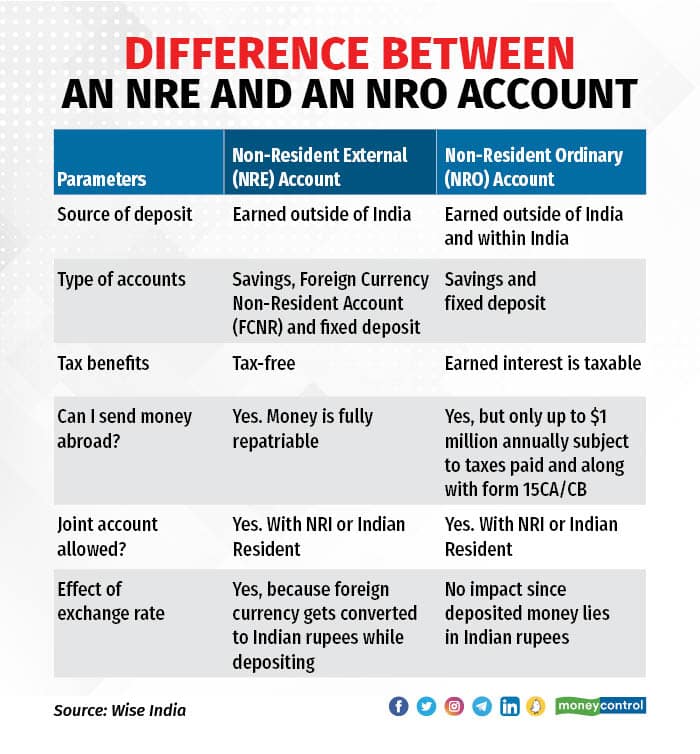

There are several ways in which NRIs can transfer funds to or from India:Wire Transfer. NRIs can use wire transfer to transfer funds between their bank accounts in India and abroad.Demand Draft.Online Money Transfer Services.NRE and NRO Accounts.

How much money can be remitted out of India

Liberalised Remittance Scheme (LRS) was brought into effect by the Reserve Bank of India in 2004. According to it, residents of India can remit a maximum of $250,000 within a given financial year to individuals living overseas. This includes both capital and current account transactions.

How much money can be transferred from India to USA

How much money can resident Indians send to the U.S As per RBI's guidelines under the liberalized remittance scheme (LRS), a resident Indian can send up to $250,000 in a financial year.

Is it legal to send money abroad from India

If you want to make a transaction, you must follow the rules established by the Reserve Bank of India: According to RBI regulations, remittances of up to USD 25,000 (INR 20,42,200) are allowed per calendar year.

Can I transfer money from NRO to US account

RBI allows the NRIs to remit up to USD 1 million per financial year from the NRO account, provided you follow specific procedures. The funds in NRO accounts are usually from income earned locally, like certain capital amount transactions or the rent on a property acquired in India.

What is the transfer limit for NRE

The Reserve Bank of India allows the transfer of funds up to USD 1 million a year from an NRO to an NRE account.

How much money can NRI remit out of India

Repatriation from an NRO account is possible after taxes have been deducted from the income. The current income in NRO accounts is from earnings in India and is liable to be taxed. There is a repatriation limit of USD 1 million in a financial year on income from the sale of any moveable or immovable assets in India.

What is the maximum amount of money I can transfer overseas

The most amount of money that can be sent abroad

An individual is allowed to send up to USD 2,50,000 (INR 20,420,774) abroad per fiscal year under the Liberalised Remittance Scheme (LRS). This spending limit can be applied to a single purchase or a series of purchases.

How much money can I transfer without being flagged India

The income tax department will be looking at high-value transactions, i.e., transactions above Rs 2.5 lakh by an individual, and may investigate these. The taxmen or bank officials may question anyone receiving high-value funds in his account, even if it is through an electronic transaction.

Can I transfer 100k to India from USA

The IRS has no limit on how much money you can send to India. However, above $11.7 million USD, you'll be liable for taxes.

Is there a limit to how much money I can transfer to the USA

Is there a limit on International Wire Transfers There isn't a law that limits the amount of money you can send or receive. However, financial institutions and money transfer providers often have daily transaction limits. This depends entirely on the establishment.

Can I transfer money from Indian bank account to international bank account

Transferring money to an international bank account

The Reserve Bank of India (RBI) allows Indian citizens to make international remittances of up to USD250,000 per financial year through the Liberalised Remittance Scheme. You can send money overseas via a: bank.

Can we transfer money from NRE account to USA

The NRE funds can be repatriated only to customers' own/self-account abroad. The beneficiary's name should be same as per name of the account holder. Repatriation of funds to third party is not allowed under this option.

How much can I transfer from NRO to foreign account

The Reserve Bank of India allows the transfer of funds up to USD 1 million a year from an NRO to an NRE account.

How much money can you transfer to someone overseas

There is no limit to the amount of money that you can travel with, receive and send overseas. You also don't need to declare money that you transfer overseas or receive from overseas through a bank or a remittance service provider (money transfer business).

How much money NRI can send to India without tax

As an NRI, there will be no tax applicable on your remittance since the remittance is not being made under LRS. How is tax cut currently on remittances and since when did it apply From October 1, 2020, remittances of up to Rs700,000 (Dh33,103) in a financial year are free from tax liability.

What is the limit for outward remittance from NRE account

There is no limit to repatriate funds from NRE accounts as it is fully and freely repatriable from India. NRE Deposits are tax-free in India as NRE Accounts are meant to maintain the income earned outside India.

What happens if you transfer more than $10000

Financial institutions must file a Currency Transaction Report (CTR) for any transaction over $10,000. The CTR includes information about the person initiating the transaction, the recipient, and the nature of the transaction.

How can I transfer large amounts of money internationally

Both Western Union and PayPal are popular choices for sending large sums of money overseas.

What happens if we transfer more than 50000

The required details are account number, account name, IFSC Code, branch name, bank name, and account type of both persons. If the transaction exceeds Rs. 50,000, the remitter will have to provide his/her PAN card at the time of commencing the transaction.

What happens if you transfer $10000

Financial institutions must file a Currency Transaction Report (CTR) for any transaction over $10,000. The CTR includes information about the person initiating the transaction, the recipient, and the nature of the transaction.

Is there a limit on how much money you can transfer overseas

Is there a limit on International Wire Transfers There isn't a law that limits the amount of money you can send or receive. However, financial institutions and money transfer providers often have daily transaction limits. This depends entirely on the establishment.

How much money can I transfer to my account overseas

Earlier, in 2007, RBI had fixed the maximum limit of sending money to an overseas bank account to USD 2,00,000 per year. After the rupee weakened, RBI reduced this limit in 2013 to USD 75,000 per year. With a stronger value of rupee, RBI has now increased the maximum limit to USD 2, 50,000 (as of May 26, 2015).

Can I send money directly to an international bank account

An international wire transfer is an electronic transfer of funds from one bank account to another. Your money will be sent directly from your account to the recipient, and deposited in the currency they need for convenience.