What is the risk assessment formula

Risk is the combination of the probability of an event and its consequence. In general, this can be explained as: Risk = Likelihood × Impact.

What is the risk assessment formula in audit

Audit risk (AR)= Inherent risk (IR) x Control risk (CR) x Detection risk (DR) This equation must always be in balance. The higher the auditor assesses the level of inherent and/or control risk to be, the lower the detection risk must be.

How to calculate risk in Excel

And I get the variance of the market portfolio.

How do you calculate total risk

Total risk = Systematic risk + Unsystematic risk

In a large portfolio: Some stocks will go up in value because of positive company-specific events, while. Others will go down in value because of negative company-specific events.

How do you calculate risk assessment matrix

How do you calculate risk in a risk matrixStep 1: Identify the risks related to your project.Step 2: Define and determine risk criteria for your project.Step 3: Analyze the risks you've identified.Step 4: Prioritize the risks and make an action plan.

What is the formula for total risk

Total risk = Systematic risk + Unsystematic risk

In a large portfolio: Some stocks will go up in value because of positive company-specific events, while. Others will go down in value because of negative company-specific events.

How to do a risk assessment table

Let's consider the truck now in the scenario where trucks are infrequent. The likelihood of a crash is low but the consequence is high the overall risk is medium.

How do you calculate total risk and market risk

Total Risk = Market Risk + Diversifiable Risk. The total risk of a security portfolio can be divided into systematic and unsystematic risk; systematic risk is the risk that cannot be avoided by any means; it is the inherent risk of the portfolio, and also known as market risk.

How to do a risk assessment example

Step 1: Identify the hazards/risky activities; Step 2: Decide who might be harmed and how; Step 3: Evaluate the risks and decide on precautions; Step 4: Record your findings in a Risk Assessment and management plan, and implement them; Step 5: Review your assessment and update if necessary.

What is a 3×3 risk matrix

A risk assessment matrix contains a set of values for a hazard's probability and severity. A 3×3 risk matrix has 3 levels of probability and 3 levels of severity.

How to calculate market risk

The market risk premium can be calculated by subtracting the risk-free rate from the expected equity market return, providing a quantitative measure of the extra return demanded by market participants for the increased risk. Once calculated, the equity risk premium can be used in important calculations such as CAPM.

What are the 4 types of risk assessment

Including qualitative, quantitative, generic, site-specific and dynamic risk assessments. Not all risk assessments are the same. You can use each different type of risk assessment for different situations. And we will cover each one in this post.

How is risk assessment done

A risk assessment is a thorough look at your workplace to identify those things, situations, processes, etc. that may cause harm, particularly to people. After identification is made, you analyze and evaluate how likely and severe the risk is.

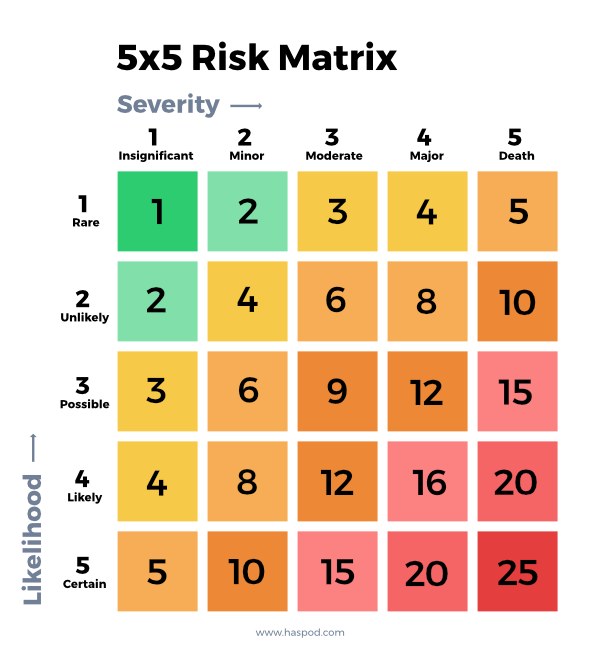

How do you calculate a 5×5 risk matrix

Using the 5×5 matrix grid, risk can be given a numerical figure calculated as Likelihood x Consequence. Existing Control Measures – These are the measures already in place to control any identified hazard and the risk presented. These may be sufficient and no further work will need to be done.

Why use a 5×5 risk matrix

As a comprehensive tool used by organizations during the risk assessment stage of project planning, operations management, or job hazard analysis, a 5×5 risk matrix aims to identify the probability and impact levels of injury and risk exposure to a worker in relation to workplace hazards.

How do you calculate risk in CAPM

In CAPM the risk premium is measured as beta times the expected return on the market minus the risk-free rate. The risk premium of a security is a function of the risk premium on the market, Rm – Rf, and varies directly with the level of beta.

What are the 6 methods of risk assessment

Each methodology can evaluate an organization's risk posture, but they all require tradeoffs.Quantitative. Quantitative methods bring analytical rigor to the process.Qualitative.Semi-Quantitative.Asset-Based.Vulnerability-Based.Threat-Based.

What are the 5 levels of risk

Levels of RiskMild Risk: Disruptive or concerning behavior. Individual may or may not show signs of distress.Moderate Risk: More involved or repeated disruption; behavior is more concerning.Elevated Risk: Seriously disruptive incidents.Severe Risk: Disturbed behavior; not one's normal self.Extreme Risk:

Which scores are used to calculate risk

The risk assessment score for an individual risk is the average of the Likelihood, Impact, and Current® Impact values.

What is a 3×3 matrix risk assessment

A risk assessment matrix contains a set of values for a hazard's probability and severity. A 3×3 risk matrix has 3 levels of probability and 3 levels of severity.

How do you use a 3×3 risk matrix

For example, you can use a 3×3 matrix for less granularity. In this example, you see risk categories ranging from low to high and likelihood ranging from very likely to very unlikely. Using it is as simple as any other matrix: You look for where both of your criteria meet to get your risk rating.

How do you calculate risk percentage

We used the (appropriately transformed) risk formula to get this answer: probability of failure = risk/loss . Plugging in the numbers, we get 100 / 1000 = 0.10 = 10% .

What are the 7 steps of a risk assessment

Seven Steps for Risk AssessmentPreparation of the risk assessment,Determination of the hazards,Assessment of the hazards,Determination of specific occupational safety and health measures,Performance of the measures,Review of the performance and efficiency of the measures, and.Updating of the risk assessment.

What are Level 1 Level 2 and Level 3 risks

For that reason, it is important for public managers to be aware of three levels of risk and how to manage them. Level 1, the lowest category, encompasses routine operational and compliance risks. Level 2, the middle category, represents strategy risks. Level 3 represents unknown, unknown risks.

What is a 5×5 risk matrix

The 5×5 risk matrix is a tool used to help people think about and communicate risk. It does this by breaking down risk into two components: likelihood and severity. It also uses a 5-point scale for each of these components, hence why it's called the 5×5 risk matrix.