Does Icici allow international transfer

Fund Transfer Abroad is a unique online service offered exclusively by ICICI Bank, for its resident individual customers. With ICICIBank.com, now transfer funds abroad to your dear ones by placing a request from any part of the world accessible to ICICI Bank Internet Banking.

Can we transfer money from Indian account to international account

Transferring money to an international bank account

The Reserve Bank of India (RBI) allows Indian citizens to make international remittances of up to USD250,000 per financial year through the Liberalised Remittance Scheme. You can send money overseas via a: bank. post office.

How much ICICI charges for international money transfer from India

ICICI international transfer fees

| Transfer type | ICICI international transfer fee |

|---|---|

| Standard telegraphic transfer online | 750 INR + exchange rate markup + agent or intermediary bank charges |

| Standard telegraphic transfer in branch | 1,000 INR + exchange rate markup + agent or intermediary bank charges |

How can I transfer money from Icici Bank to another bank

On the quick fund transfer. Page select to other bank.

How much does Icici charge for international transfer

Key Facts About ICICI Bank International Transfers

| 🏦 ICICI int'l charges | 3%+ |

|---|---|

| 💸 Int'l fees via Monito | 0.5% – 3% |

| ⏱ ICICI int'l transfer time | 1-3 business days |

| ⚡Transfer time via Monito | 1-2 business days |

| 💵 ICICI payment method | SWIFT transfer |

How much does Icici charge for international transaction

The applicable foreign transaction fee on ICICI Credit Cards is 3.5% of the transaction value.

Can I send money directly to an international bank account

An international wire transfer is an electronic transfer of funds from one bank account to another. Your money will be sent directly from your account to the recipient, and deposited in the currency they need for convenience.

How much money can NRI transfer from India to abroad

As of the financial year 2021-2022, the LRS limit for NRIs is INR 2,50,00,000 per financial year. This limit applies to the total amount of funds transferred by an NRI during the financial year, and includes all transfers made for any purpose, including investments, gifts, and personal expenses.

What is the limit of Icici overseas transfer

Limit of USD 2,50,000* or its equivalent per financial year is applicable for the below mentioned purposes of travel.

What is Icici foreign transaction fee

a 3.5%

However, almost all credit cards by ICICI Bank charge a 3.5% forex markup fee which you will have to pay on all foreign currency spends with the card.

How much can I transfer from Icici to other bank account

2 lakh while the maximum value is Rs. 10 lakh for RTGS transfer. IMPS: To transfer money via IMPS using the iMobile Pay app, Rs. 2 lakh is the transaction limit if the transfer is made using account number and IFSC per transaction.

How long does Icici international transfer take

How much time does it take to send money with ICICI. The beneficiary abroad will receive the funds in their overseas bank account within 1 international working day, where the transaction requests are received before 15:00 PM on weekdays¹². It can take a few more days if intermediary banks are involved.

What is the transfer limit for Icici NRI

Limits for per day transfers for NRI Customer: The per day limit will be 5,00,000 for each applicable transaction mentioned above. Transfers to third party ICICI Bank accounts is 5,00,000 per day.

How can I transfer money to someone internationally

Our Top Picks for the Best Ways to Send Money InternationallyWise — Best for Low Fees.PayPal — Best for Peer-to-peer Money Transfers.Western Union — Best for Availability.MoneyGram — Best for Cash Transfers.OFX — Best for Large Amounts of Money.WorldRemit — Best Mobile Option.XE — Best for Business Transfers.

How do I send an international money transfer

Log into your online or mobile banking app and select the account. Select “Send Money” > International and then select the recipient's destination and banking information. Your request is sent to the recipient and you will receive a notification via email when the funds have been sent.

How to transfer 100000 from India to USA

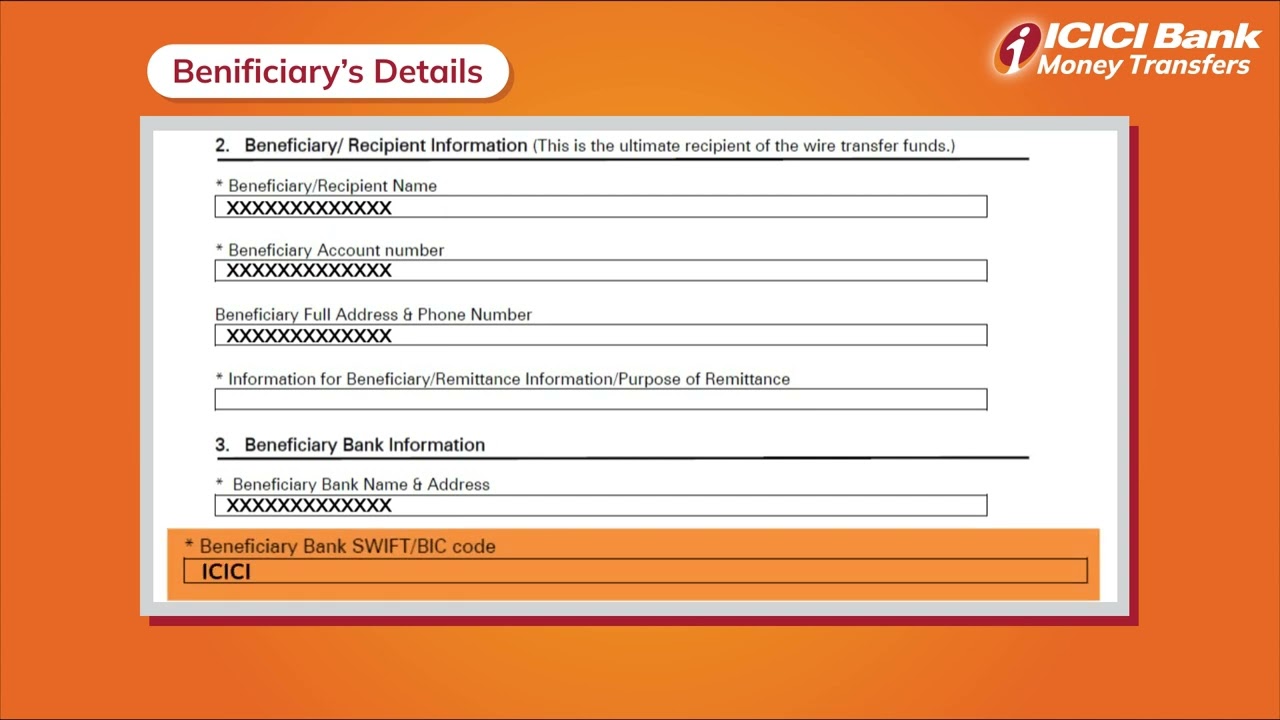

Best Ways To Send Money to the U.S.Bank Transfer/Wire Service.Online Money Transfer Services.Cryptocurrency Transfer.Beneficiary Details.Country.Routing Number.Note: Some service providers may ask for additional documents, or information on the purpose of transfer, to complete the transfer.

How much money can NRI repatriate from India

How much money can an NRI repatriate out of India An NRI can freely transfer without any upper transaction limit from NRE and FCNR accounts. On the other hand, an NRI can remit only up to 1 USD million out of the balances of an NRO account, provided they meet the eligibility criteria. 2.

How much money can you transfer internationally per day

Is there a limit on International Wire Transfers There isn't a law that limits the amount of money you can send or receive.

How can I activate international transaction in Icici app

How to enable ICICI Credit Card international transactions by iMobileLogin into the iMobile by MPIN or Fingerprint, Biomatric Authentication.Go the Credit Card and Select 'Manage Card' from the main menu.Select the credit card for which international transactions are desired.

What is the limit of Icici transfer per day

1 lakh. For NEFT transactions, the limit is set according to hours of the day: From 01:00 am to 07:00 pm: The maximum you can transfer is Rs. 10 lakh or Rs. 25 lakh depending on the customer segment you belong to at ICICI Bank.

Can I transfer 100000 from my bank to another

Wire transfers also have limits, but in general they are higher than ACH transfers. As with an ACH transfer, many major banks impose a per-day or per-transaction wire transfer limit. For example, Chase Bank sets the limit at $100,000 for individuals, but offers higher limits to businesses on request.

What is the foreign transaction fee for Icici Bank

3.5%

The forex markup fees charged by almost all ICICI Bank credit cards is 3.5% of the total transaction amount.

How much international transfer is allowed

If you want to make a transaction, you must follow the rules established by the Reserve Bank of India: According to RBI regulations, remittances of up to USD 25,000 (INR 20,42,200) are allowed per calendar year.

What happens if you transfer more than $10000

Financial institutions must file a Currency Transaction Report (CTR) for any transaction over $10,000. The CTR includes information about the person initiating the transaction, the recipient, and the nature of the transaction.

Can I transfer money internationally through online banking

Making an international payment using the mobile app or Online Banking is just as secure as it is to make one in branch.