What is the difference between FCNR NRE and NRO account

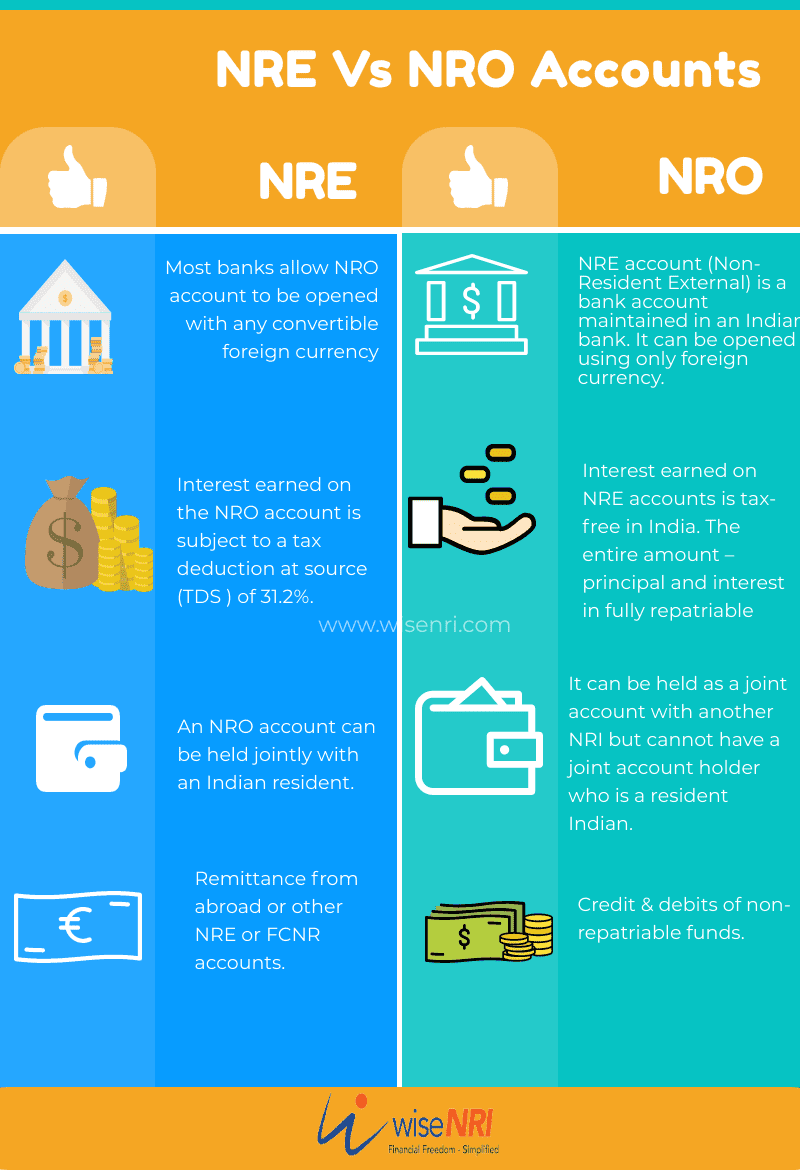

NRO Account is for depositing income that one earns in India. NRE account is for depositing income earned outside India in India. FCNR account is for depositing earnings in foreign currency in an Indian account. Deposits made in this account are repatriable to the NRI's country of residence with certain limits.

Which is better NRE or NRI

Tax benefits- NRE exempts the entire fund from any Income Tax. In FCNR accounts, only the interest is tax exempted. Purpose- NRE accounts take the deposit of earnings from the country where the NRI is currently residing but denominated in INR.

Should I open NRE or NRI account

You should opt for NRE Accounts if you want to hold or maintain your overseas earnings in Indian currency. NRE Accounts are also suitable if you wish to keep your savings liquid. You should opt for NRO Accounts if you want to save your earnings from India in Indian currency itself.

What is the disadvantage of NRE

Limitations of NRE accounts

All transactions made through an NRE Account must be between India and a foreign country, meaning domestic transactions are prohibited. As the currency of the account is usually based on Indian Rupees, there is the risk of currency fluctuations when transferring funds.

What is the disadvantage of NRI

Disadvantages of being an NRI

Some of the drawbacks of being an NRI are listed below: Even though NRIs do not pay income tax to the Indian government, they have to pay taxes to the government of the country of residence. The rate of taxes on income is much higher than India in most first world countries.

What are the disadvantages of NRE account in India

Deposits made in foreign currencies in an NRE account are subject to conversion into Indian rupees. Hence, such deposits might fluctuate in value due to appreciation of domestic currency (or depreciation of foreign currency), thereby incurring losses during repatriation.

Is it better to have NRE or NRO account

The difference between NRE & NRO accounts

NRE accounts are exempt from tax. Neither the balance, nor the interest earned on these accounts is taxable. The interest earned on an NRO account is however taxable at 30% according to the Income Tax Act 1961.

How long can I keep my NRE account

You cannot maintain your NRE account and NRE FDs when you are an RNOR. You need to convert your NRE account to resident account immediately upon returning to India. You need to convert these accounts to resident accounts within a reasonable period of time. The reasonable period can be assumed as 3 months.

How can NRI avoid tax in India

Submitting Form 15G or Form 15H: NRIs can submit Form 15G or Form 15H to the Indian income tax department to avoid TDS on their income if their total income is below the taxable limit. Form 15G is for individuals and HUFs, while Form 15H is for senior citizens.

What are the risks of NRE account

All transactions made through an NRE Account must be between India and a foreign country, meaning domestic transactions are prohibited. As the currency of the account is usually based on Indian Rupees, there is the risk of currency fluctuations when transferring funds.

Do NRE accounts need to pay tax in India

The interest earned on an NRE account is tax-free in India, while the interest earned on an NRO account is subject to income tax. Therefore, the NRE account is tax-free in terms of interest income.

Do the NRE have to pay tax in India

Interest in an NRE account is not taxable in India. However, Interest on the NRO account is taxable in India and will be liable for TDS. As per FEMA rules, the penalty for not converting a resident account to an NRO account is up to 3 times the amount in the account or INR 2 lakh when the sum is not quantifiable.

What are the disadvantages of NRE account

Deposits made in foreign currencies in an NRE account are subject to conversion into Indian rupees. Hence, such deposits might fluctuate in value due to appreciation of domestic currency (or depreciation of foreign currency), thereby incurring losses during repatriation.

Do NRIs pay taxes when they transfer money to India

If you are an NRI, you also need a declaration to the effect that the total remittances being made by you have not exceeded the limit under the foreign exchange laws. As an NRI, there will be no tax applicable on your remittance since the remittance is not being made under LRS.

How much NRI is tax free in India

As a Non-resident, you still get the benefit of the basic exemption limit of Rs. 2,50,000 from your total income. However, If your total income in India consists of only short-term capital gains or long-term capital gains, then the benefit of the basic exemption limit is not available in respect of such gains.

Do I have to pay tax in India for NRE account

The interest earned on an NRE account is tax-free in India, while the interest earned on an NRO account is subject to income tax. Therefore, the NRE account is tax-free in terms of interest income.

How much money can I keep in my NRE account in India

NRE accounts do not have a limit on repatriation and the interest earned is tax-free in India. An NRO account, in contrast, has a limit of $1 million on remittances outside India in a financial year. Are you interested in opening NRI accounts remotely

How much money can NRI transfer to India without tax

From October 1, 2020, remittances of up to Rs700,000 (Dh33,103) in a financial year are free from tax liability. Amount exceeding Rs700,000 is liable to TCS (Tax Collected at Source) in the hands of the individual at 5 per cent. (TCS is collected by the receiver at the time of receipt of payment.)

How can I avoid NRI tax in India

NRIs can avoid double taxation (meaning: getting taxed on the same income twice in the country of residence and India) by seeking relief from the Double Taxation Avoidance Agreement (DTAA) between the two countries. Under DTAA, there are two methods to claim tax relief – exemption method and tax credit method.

Does NRI account need to pay tax in India

By default, income earned by an NRI abroad is not taxable in India. But if the income in India through aspects like capital gains from investments in shares, mutual funds, property rental and term deposits exceed the basic exemption limit as defined in the Income Tax Act, an NRI would have to file a tax return.

Which is better NRI or NRE

Though there are several differences between an NRE and NRI account, you will need both to manage your funds. An NRE account proves useful for your foreign earnings and you can even send money back to your country of residence freely. An NRI account helps keep your income earned in India safe and within India.

What is the maximum amount NRI can send in India

As of the financial year 2021-2022, the LRS limit for NRIs is INR 2,50,00,000 per financial year. This limit applies to the total amount of funds transferred by an NRI during the financial year, and includes all transfers made for any purpose, including investments, gifts, and personal expenses.

Do I need to file tax return in India if I am NRI

An NRI, like any other individual taxpayer, must file his return of income in India if his gross total income received in India exceeds Rs 2.5 lakh for any given financial year. Further, the due date for filing a return for an NRI is also 31 July of the assessment year or extended by the government.

How much money can NRI transfer to India in one year

As of the financial year 2021-2022, the LRS limit for NRIs is INR 2,50,00,000 per financial year. This limit applies to the total amount of funds transferred by an NRI during the financial year, and includes all transfers made for any purpose, including investments, gifts, and personal expenses.

Do NRI need to declare foreign income in India

By default, income earned by an NRI abroad is not taxable in India. But if the income in India through aspects like capital gains from investments in shares, mutual funds, property rental and term deposits exceed the basic exemption limit as defined in the Income Tax Act, an NRI would have to file a tax return.