Is there a limit to how much money I can transfer to the USA

Is there a limit on International Wire Transfers There isn't a law that limits the amount of money you can send or receive. However, financial institutions and money transfer providers often have daily transaction limits. This depends entirely on the establishment.

What happens if you transfer more than $10000

Financial institutions must file a Currency Transaction Report (CTR) for any transaction over $10,000. The CTR includes information about the person initiating the transaction, the recipient, and the nature of the transaction.

Do I have to pay tax on money transferred from overseas to us

Personal Bank Accounts

If you decide to move back to America after time spent overseas, you may transfer the funds from your foreign bank account to your American bank account. Since this isn't income and is simply moving around your money, you won't have to pay taxes on the transfer.

Can I transfer $100000 from one bank to another

Wire transfers also have limits, but in general they are higher than ACH transfers. As with an ACH transfer, many major banks impose a per-day or per-transaction wire transfer limit. For example, Chase Bank sets the limit at $100,000 for individuals, but offers higher limits to businesses on request.

How can I transfer large amounts of money internationally

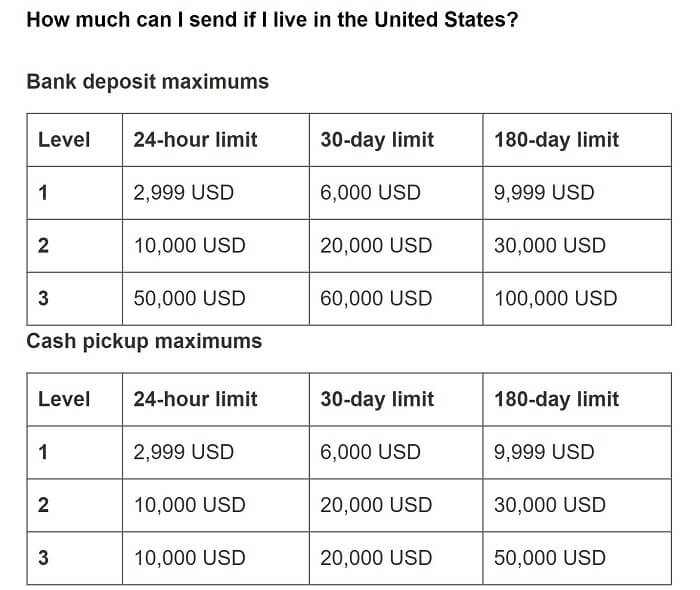

Both Western Union and PayPal are popular choices for sending large sums of money overseas.