What is the name of bad bank in India

National Asset Reconstruction Ltd (NARC)

The bad bank in India will be called National Asset Reconstruction Ltd (NARC).

Which are risky banks in India

India's Worst Performing Banks on this All-Important Ratio#1 IDBI Bank. Leading with a 5-year-average gross NPA ratio of 26.2 is IDBI Bank.#2 Indian Overseas Bank (IOB)#3 Central Bank of India.#4 UCO Bank.#5 Punjab National Bank.PSU Banks vs Private Banks – Asset Quality.

What is an example of a bad bank

A well-known example of a bad bank was Grant Street National Bank. This institution was created in 1988 to house the bad assets of Mellon Bank.

What bad bank means

What is a Bad Bank A bad bank is a financial entity set up to buy Non-Performing Assets (NPAs), or Bad Loans, from banks. The aim of setting up a bad bank is to help ease the burden on banks by taking bad loans off their balance sheets and get them to lend again to customers without constraints.

Which banks are blacklisted in India

The blacklisted banks include Punjab National Bank, ICICI Bank, Andhra Bank, Bank of Maharashtra, Punjab and Sindh bank, Vijaya bank, Federal bank, Jammu Kashmir Bank, South Indian bank, ING Vysa Bank, Kotak Mahindra Bank, Bombay Mercantile Cooperative bank and Tapeshwar Urban Cooperative Bank.

Which is the No 1 trusted bank in India

1. State Bank of India (SBI) State Bank of India, the largest public sector no. 1 bank in India, offers a comprehensive range of banking services.

Which is India’s safest bank

Top Banks for FDs in India

| Sr No | List Of Banks | Score |

|---|---|---|

| 1. | State Bank of India | AAA |

| 2. | HDFC Bank | AAA |

| 3. | Bank of Baroda | AAA |

| 4, | ICICI Bank | AAA |

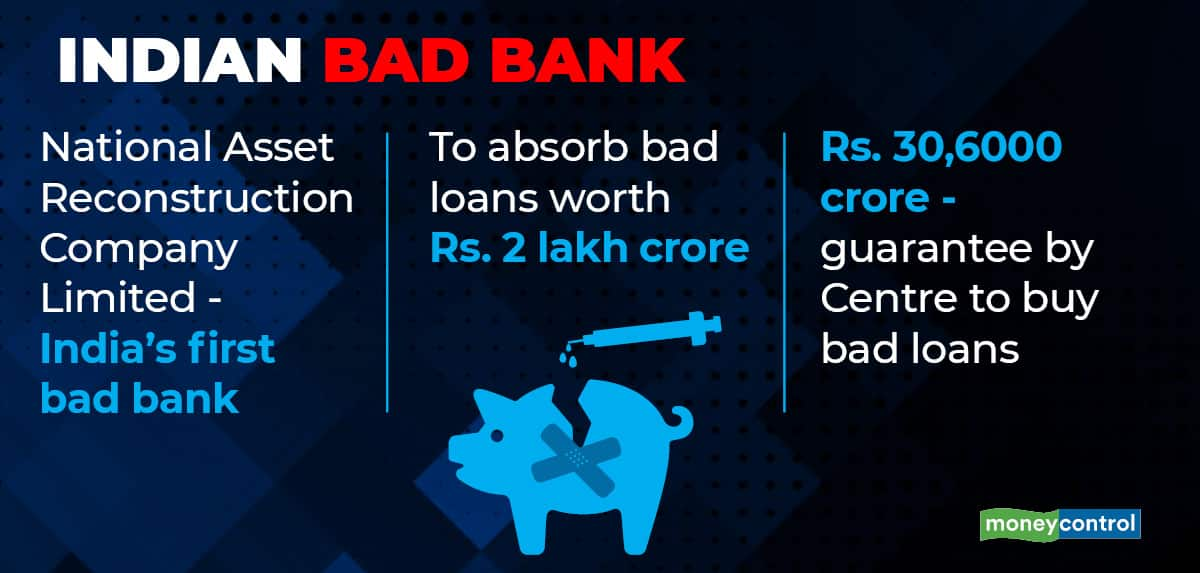

Which is the first bad bank in India

National Asset Reconstruction Company Limited (NARCL) is India's first ever bad bank. A bad bank is a corporate structure that isolates risky assets held by banks in a separate entity. Bad bank is established to buy the non-performing assets from banks at a price determined by them.

What is the most famous bank failure

Here are the seven largest bank failures

| Bank name | Bank failure date | Assets* |

|---|---|---|

| Washington Mutual Bank | Sept. 25, 2008 | $307 billion |

| First Republic Bank | May 1, 2023 | $212 billion** |

| Silicon Valley Bank | March 10, 2023 | $209 billion** |

| Signature Bank | March 12, 2023 | $110 billion** |

How do bad banks work in India

A Bad Bank does not function as a standard bank. It does not take deposits or lend loans. Its purpose is to buy the NPAs of commercial banks. The taken-over NPAs are then managed in a way that a part or all of the loan outstandings are recovered.

How do you tell if a bank is good or bad

The Bottom Line

A good bank is one that gives you easy access to your money, doesn't charge exorbitant fees, offers good interest rates, have online and app-based banking services, provides excellent customer service, and is trustworthy with your money.

Which bank has highest frauds in India

The Punjab National Bank scam was touted as India's biggest at Rs 11,400 crore and the main accused were jeweller Nirav Modi, Mehul Choksi, Nishant Modi, Ami Modi and others, including some PNB staff.

Which bank has highest number of frauds in India

Recently, in a written reply to the Lok Sabha, MoS Bhagwat Karad said that Kotak Mahindra Bank has the highest number of bank frauds, at 642, in the first nine months of FY22, followed by ICICI Bank at 518 and IndusInd Bank at 377. Here's a list of the major bank frauds in FY22.

What bank should I use in India

Best Private Sector Banks in India 2023

| List of Private Banks | Number of Branches | Headquarter |

|---|---|---|

| HDFC Bank | 4787 | Mumbai, Maharashtra |

| ICICI Bank | 4882 | Mumbai, Maharashtra |

| IDBI Bank | 1892 | Mumbai, Maharashtra |

| IDFC First Bank | 301 | Mumbai, Maharashtra |

Which is the richest bank in India

Top ten Indian banks (in terms of market capitalisation)HDFC Bank (post merger) 14,12,055.5.ICICI Bank Ltd. 6,53,704.04.State Bank of India. 5,11,201.77.Kotak Mahindra Bank Ltd. 3,66,967.55.Axis Bank Ltd. 304211.88.Indusind Bank Ltd. 106707.03.Bank of Baroda. 98436.88.

Which bank is No 1 in India

HDFC is the largest private sector bank in India at present and also ranked as Number 1 Bank in India according to as per Forbes World's Best Bank survey.

Which bank will never fail in India

RBI continues to classify SBI, ICICI Bank and HDFC Bank in the category of D-SIBs. But, what are D-SIBs These are the banks which are so important for the country's economy that the government cannot afford their collapse. Hence, D-SIBs are thought of as “Too Big to Fail" (TBTF) organisations.

Which is No 1 bank in India

1. State Bank of India. State Bank of India (SBI) is among the Fortune 500 companies. It is an Indian multinational and Public Sector Banking and Financial services firm.

Which banks of India are too big to fail

RBI continues to classify SBI, ICICI Bank and HDFC Bank in the category of D-SIBs. But, what are D-SIBs These are the banks which are so important for the country's economy that the government cannot afford their collapse. Hence, D-SIBs are thought of as “Too Big to Fail" (TBTF) organisations.

What are the 3 bank failures

Here are the seven largest bank failures

| Bank name | Bank failure date | Assets* |

|---|---|---|

| Silicon Valley Bank | March 10, 2023 | $209 billion** |

| Signature Bank | March 12, 2023 | $110 billion** |

| IndyMac Bank, F.S.B. | July 11, 2008 | $31 billion |

| Colonial Bank | Aug. 14, 2009 | $26 billion |

Which banks are in trouble

List of Recent Failed Banks

| Bank Name | City | State |

|---|---|---|

| First Republic Bank | San Francisco | CA |

| Signature Bank | New York | NY |

| Silicon Valley Bank | Santa Clara | CA |

1 thg 7, 2023

How safe are banks in India

Indian banks on safe ground

The RBI too has hiked policy rates steeply since May 2022, but Indian banks are not as vulnerable to market shocks from higher interest rates. Local banks deploy their assets mainly in advances, with investments comprising only a quarter of the assets.

Which banks are at risk

These Banks Are the Most VulnerableFirst Republic Bank (FRC) – Get Free Report.Huntington Bancshares (HBAN) – Get Free Report.KeyCorp (KEY) – Get Free Report.Comerica (CMA) – Get Free Report.Truist Financial (TFC) – Get Free Report.Cullen/Frost Bankers (CFR) – Get Free Report.

What is the safest bank to bank with

This is true whether the bank or credit union is national, regional or local. Asset-heavy, diversified and regulated banks like JPMorgan Chase, Wells Fargo, PNC Bank and U.S. Bank are among the safest banks in the U.S. and should be considered if you are weighing your options.

Which is the most trusted and secure bank in India

State Bank of India (SBI)

Having 23% of shares of the total market assets in India, this bank is the largest public sector bank of India and tops the list of best bank in India. It also holds 1/4th of the total loans and deposits in the current financial market.